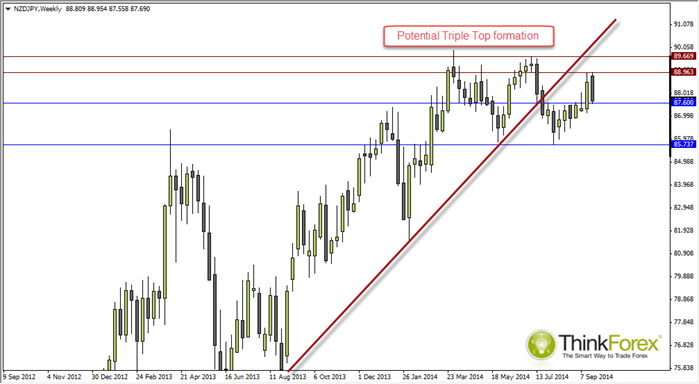

A break below 85.73 confirms a Triple Top on W1, however there may be opportunities on D1 to trade the short side prior to reaching this level.

The advance form the 85.73 swing low (in August) has seen a firm rejection of 88.96 resistance. A Weekly close around current levels would confirm a Dark Cloud Cover reversal, or a higher (but bearish) close would present a Hanging Man Reversal below resistance, to suggest losses ahead on D1.

Also note that 88.86 high has failed to get near the May high, which saw very small wicks prior to a heavy sell-off, which itself was below the Mar '14 highs. There is clearly weakness up near these levels to suggest we have seen a major top.

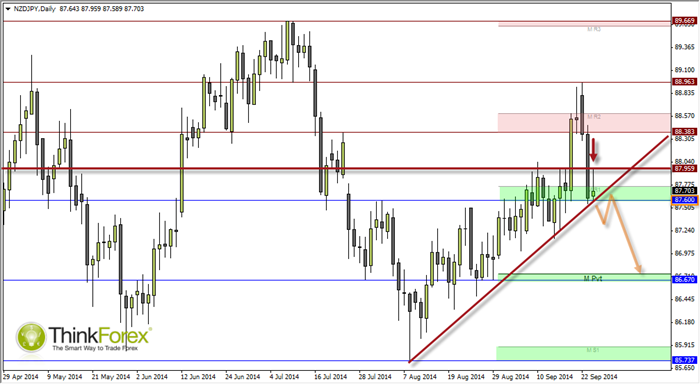

There may be an opportunity to trade a short breakout within the suspected Triple Top. 87.60 is a pivotal S/R level which houses today’s high. If we close around current levels it will present a Shooting Star However if Europe and US till to open the potential for a downside break below this key level is apparent, which would suit either a sell-stop order if you are not around to monitor price. Alternatively we can wait for a break of the inner-trendline and set a sell-limit to catch any retracements towards the broken trendline, or the assumed 87.60 resistance level.

I favour the downside break because price action from the August low appears to be corrective (lots of overlaps on the swings) and the higher timeframes are also suggesting a longer-term topping pattern.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD climbs to daily highs near 1.0770 on Dollar selling

EUR/USD manages to regain extra upside traction on the back of the renewed sell-off in the Greenback, reaching fresh daily highs in the 1.0770 region, or. two-day peaks.

GBP/USD hovers around 1.2500 post-BoE

GBP/USD alternates gains with losses around the 1.2500 neighbourhood amidst extra weakness in the Dollar, while market participants continue to digest the BoE event.

Gold improves to multi-day highs past $2,330

XAU/USD now gathers fresh steam and advances to the highest level in many sessions north of the $2,330 mark per troy ounce on the back of further selling pressure hurting the Greenback as well as mixed US yields.

Solana meme coins TREMP, BODEN rise after Donald Trump’s pro-crypto stance

Solana-based meme coins TREMP and BODEN post nearly 125% and 7% gains on Thursday. Former US President Donald Trump says his campaign will likely accept crypto donations.

Bank of England inches one step closer to a summer rate cut

The Bank of England is undoubtedly turning more optimistic, but it’s keeping its options open amid some uncertainty surrounding the near-term inflation numbers. We still narrowly expect the first rate cut in August.