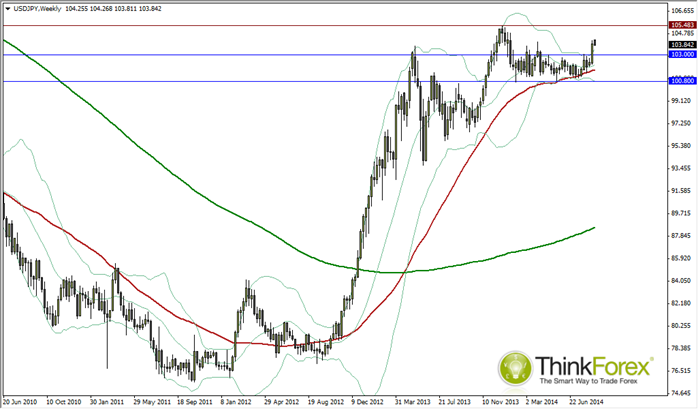

After remaining contained between 100.80 - 103 for nearly 6 months, the recent breakout could be just the beginning of a much larger move.

The breakout of the range will be welcomed by traders who have been anticipating a return to the dominant bullish trend following the 2011 all-time lows. Last week closed at its most bullish in 60 weeks and outside of the Bollinger Band. The preceding 3 times we have seen a close outside the weekly Bollinger Band provided heads-up to continued gains, so this signal should not be ignored this time around.

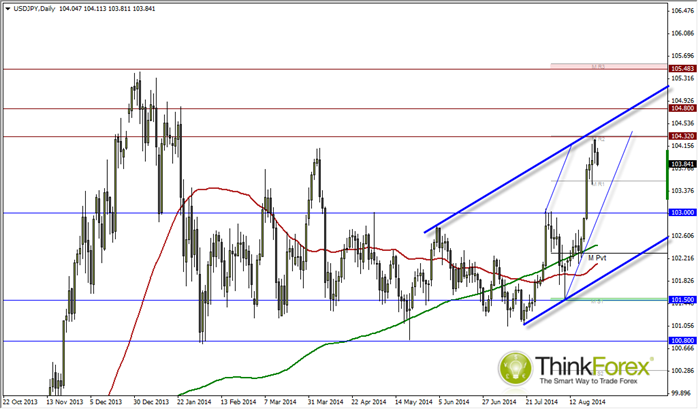

Price has already respected 104.32 resistance zone and trades within a suspected wide-ranged, bullish channel. However due to the velocity of the breakout I am not convinced this wide bullish channel will see complete pullbacks. At this stage I suspect retracement may be shallow and a break below 103 will deem the bullish advance as a 'fakeout'.

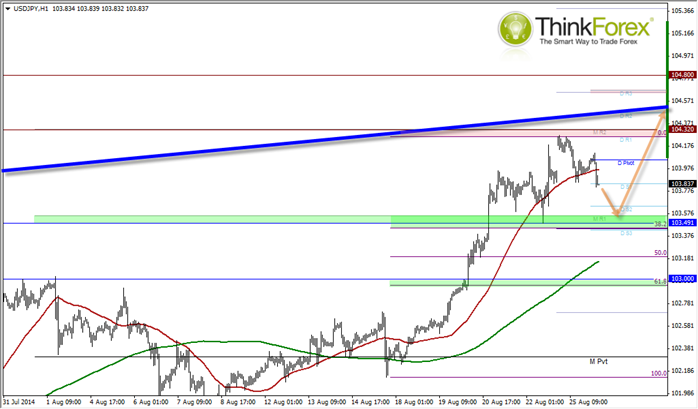

Intraday price action has already witnessed the weekend gap close with a 'higher low' forming. We also appear set to break to fresh new weekly lows which suggest a deeper pullback before the bullish trend continues. At this stage I favour 103.50 holding so any retracements towards here could be considered for bullish setups.

A break above 104.32 targets 104.80 and 105.48

A break below 103.50 opens up 103.20 and 103

Below 103 invalidates the bullish breakout and we return to sideways trading

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD holds positive ground above 0.6500 on weaker US Dollar

The AUD/USD pair extends recovery around 0.6525 during the early Asian session on Thursday. The Federal Reserve held its interest rates steady at 5.25–5.50% at its meeting on Wednesday, citing a “lack of further progress” in getting inflation back down to its 2% target.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.