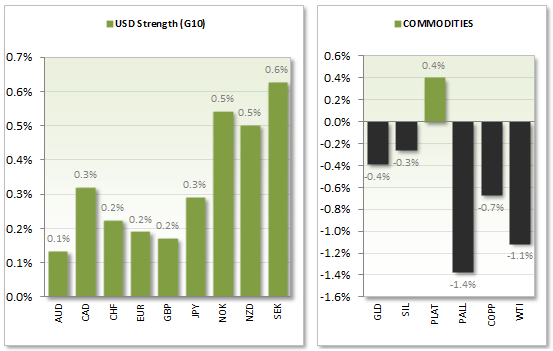

With the USD the best performing G10 currency this week the markets await important US data from G2 GDP, FOMC meetings and Nonfarm payroll to see if it can extend its bullish reach.

The Greenback has continued the bullish sentiment of the previous 2 weeks, breaking to 6-month highs as consumer sentiment came in its highest since October 2007. With the USD the best performing G10 currency this week the markets await important US data from G2 GDP, FOMC meetings and Nonfarm payroll to see if it can extend its bullish reach.

If tonight's GDP comes in at 3% or above then this would more than erase Q1 contraction of -2.9%, and help the Greenback remain support at the highs. Whether it will extend its bullish reach further is up for debate, as I do not think this will put pressure on the FED to raise rates sooner. Traders would do well to remember that the FED's preferred measurement of inflation is PCE (personal consumption expenditure) which is 1.8% y/y. below the FED's 2% target, and released this Friday along with employment data.

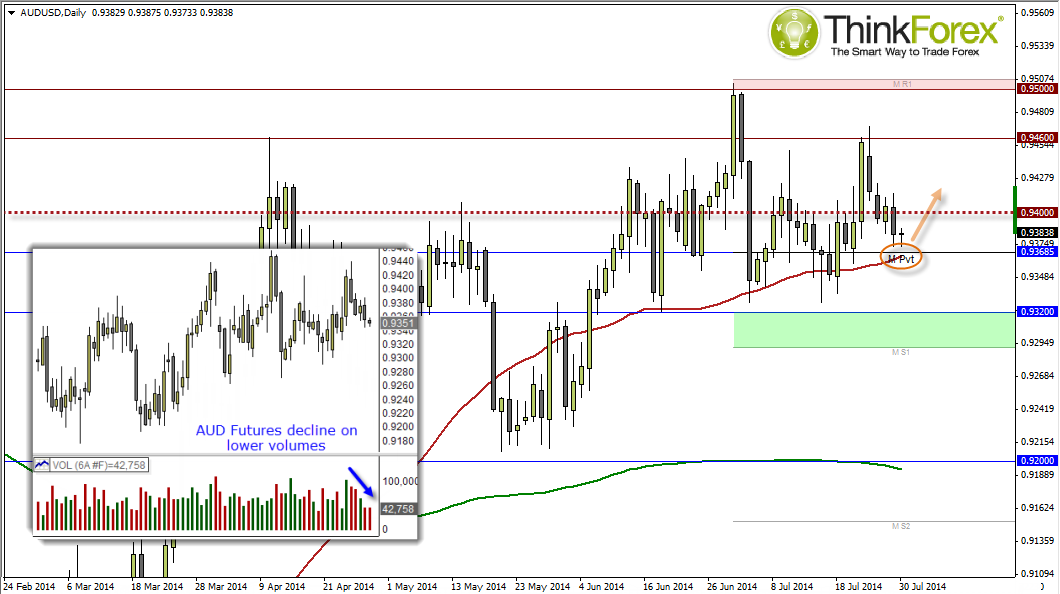

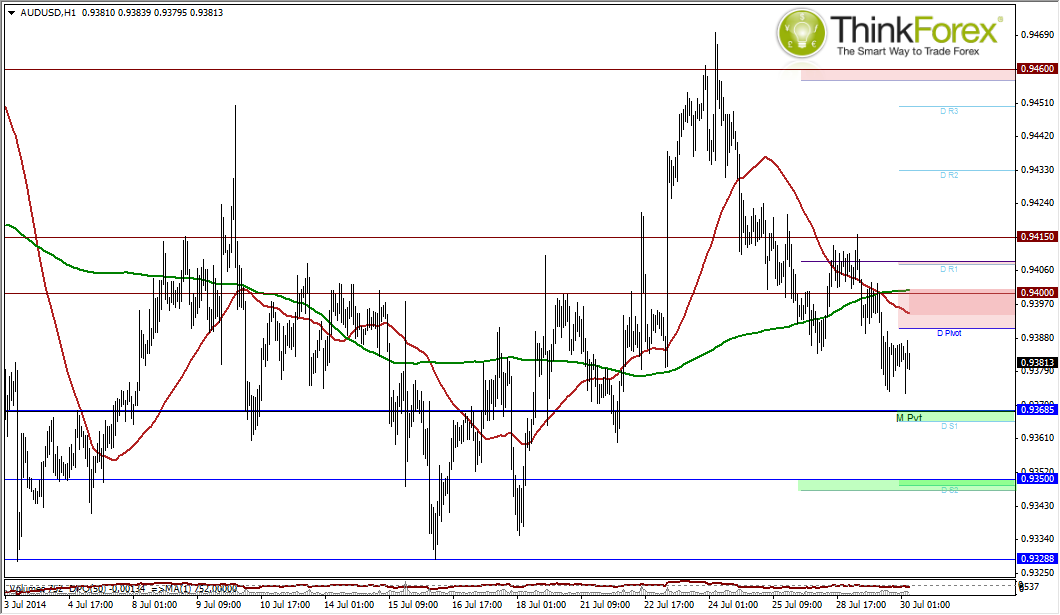

Whilst A$ continues to meander around 94c the fact it is managing to hold ground whilst the Greenback is a testament to A$ strength. Whilst we now trade back below 94c it should be noted that the decline has been achieved on declining volume (which suggests a lack of sellers) and price has now stalled above the 50-day MA (moving average) and monthly pivot support.

I expect to remain around current levels as the markets quietly await tonight's GDP data.

Technical support is around 0.9365 and holding above its 50-day average. If US GDP falls below target and this is accompanied by further hesitancy from the FED in regards to interest rates then this should help A$ stay above 0.9365 support and break above 94c again. Then the question becomes "can it stay above this level" for more than a couple of sessions.

However if GDP comes in or above 3% and we see a Hawkish statement from FOMC then we could see A$ break below key support of 0.9368 and target 0.935

After tonight the markets will then focus on China PMI, Australian Commodity prices and of course the data-dump from the US on Friday. With Nonfarm payroll and PCE being released together if the data combined all leans towards a more bullish or bearish bias for USD then we should see an end to the current deadlock between AUD and USD.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.