It is widely anticipated that we will see a 4th consecutive rate rise tomorrow from RBNZ to see the cash rate at 3.5%. The question is how much is already priced in.

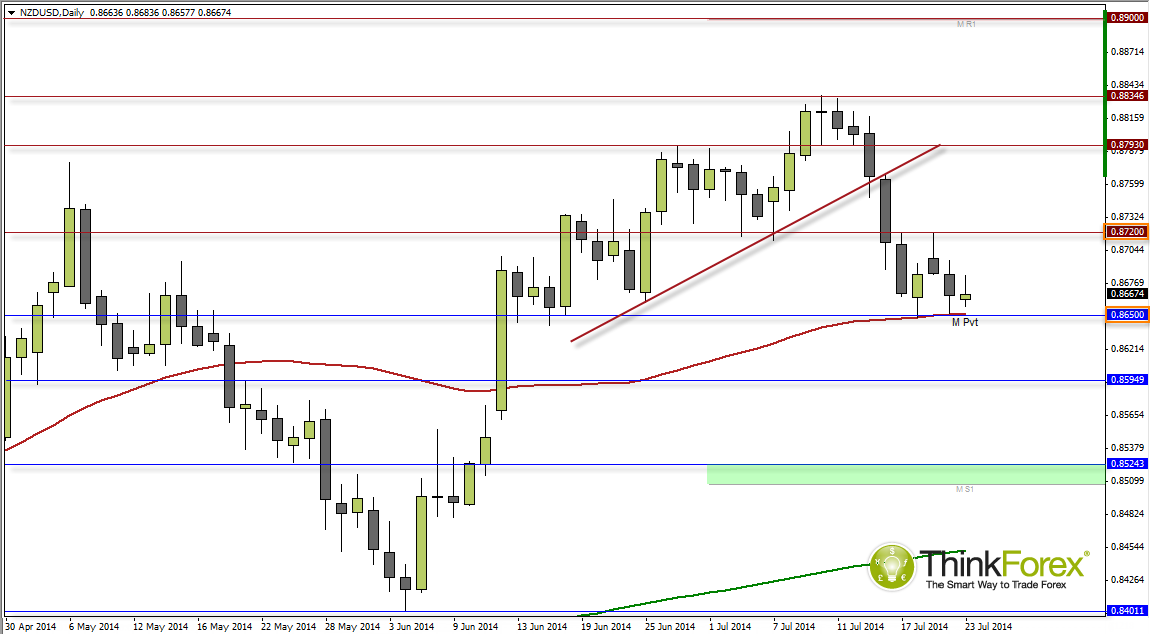

After breaking to 3-year highs, the Kiwi Dollar lacked new any dedicating to keep the bullish momentum going.

Traders would remember Graeme Wheeler's talk of intervention if an "overvalued New Zealand Dollar" was accompanied by poor fundamental data coming out. So it should not come as too much of a surprise to have seen the Kiwi Dollar sell-off with the arrival of lower dairy prices and soft inflation data, as the Kiwi Dollar perched nervously at the 3-year highs. However immediately after it was dealt another blow as the world learnt of Malaysian Air Flight MH17, resulting in carry trades being closed with the obligatory flight to safety.

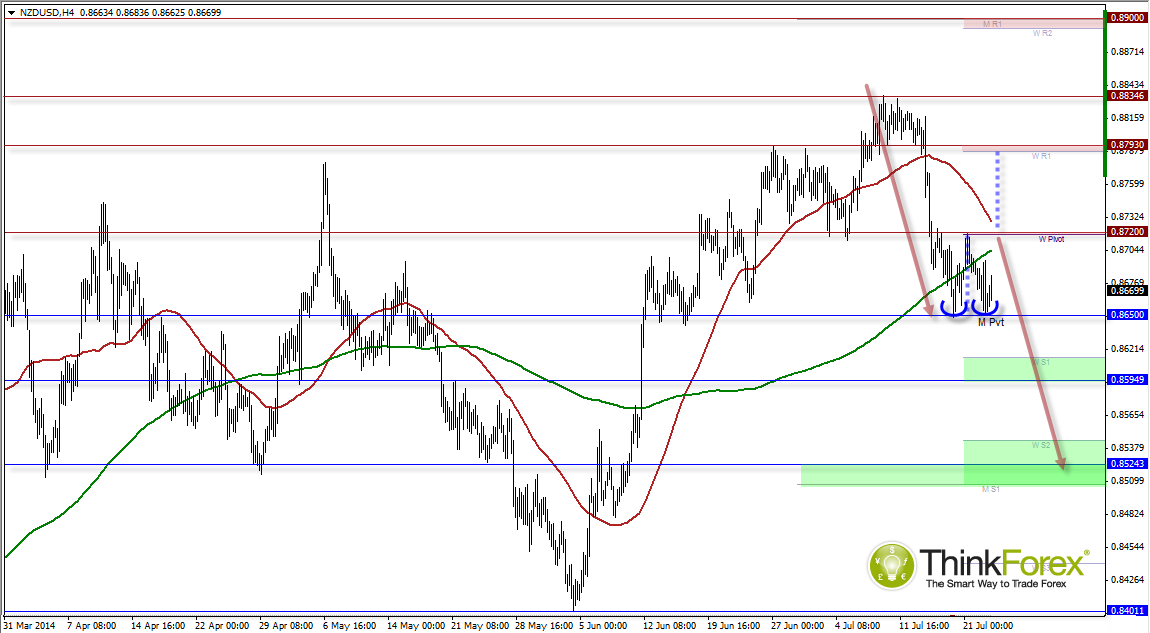

In just 3-days, Kiwi bears had undone 20 days of bullish gains before finding support at 0.865. The speed of the decline compared to the low volatility seen at the highs makes me suspect we may see a further low, before these highs are tested again.

However with the rate indecision tomorrow we can at least expect some modest gains as day-traders take advantage, assuming of course we do see a rate hike.

Increased by 25bps to 3.5%

We can expect modest gains as day traders attempt to take 'easy picking' but the focus will be on the following rate statement. For the bulls to expect anything more substantial we need to see hawkish comments from Wheeler. But due to the soft inflation data and lower dairy prices, I see this as an outside chance. In which case I expect 0.879 to cap as resistance.

Rate remains fixed at 3.25%

Whilst this is an outside chance (unlikely) it could provide a more tradable opportunity with extra legs. Below you can see the potential for a bearish continuation pattern which would target 0.852. However for this to be reached we would require a rate to remain fixed, a dovish statement, and for geo-political concerns to remain high (or increase).

I expect we will continue to range trade between 0.865 and 0.872 until tomorrow's rate decision. We are currently midway between this 70-pip range and price action leave potential for either a bullish reversal (double bottom) or bearish continuation (bear flag/pennant) to be confirmed either side of these key levels.

A break above 0.872 confirms a double bottom (bullish reversal) to target 0.879

A break below confirms a bearish flag/pennant to target 0.852 lows.

However it will be the rate decision and dovishness / hawkishness of the following statement which will proide the likelihood of the targets getting hit sooner, or later.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.