Since breaking the trendline from the 2012 highs and at its highest level since April,Gold has now stalled. Is there potential for a 'fakeout'?

Whilst Gold had risen on the back of Geo-political tension within Iraq, it has failed to keep up momentum and now awaits further direction. Also the fact it is failing to continue to take advantage of a weaker USD does raise questions to its ability to continue the bullish run from the $1240 lows.

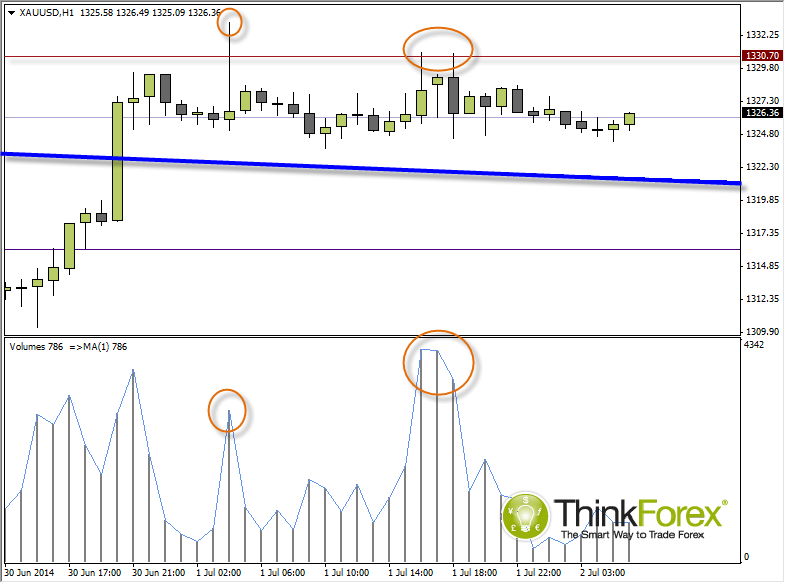

Yesterday produced a Bearish Pinbar (Similar to Shooting Star but smaller body) and failed to close above $1331 resistance to suggest a hesitancy to break higher, for now at least.

We do have potential to pull back to the broken trendline but we also need to allow for some market noise around this level before seeking bullish setups above the broken trendline.

A break below the trendline could see intraday targets around $1305 and of course $1300 - until we get beneath here then I'll not become too excited in the bear camp.

Further suggestion of a retracement come from the intraday volume where we can see higher-volume spikes with narrow-bodies candles (with high wicks) to suggest 'offloading' of long positions.

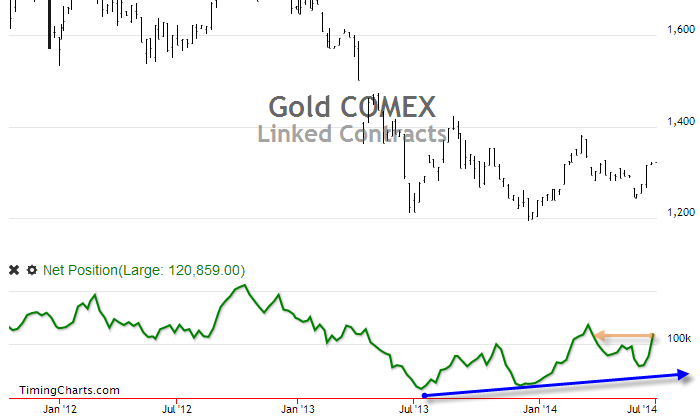

Whilst I suspect a retracement, on a medium-term I suspect we'll see further gains looking at the COTS data, as large traders have increased their Net Long exposure which is the highest in 3-month.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.