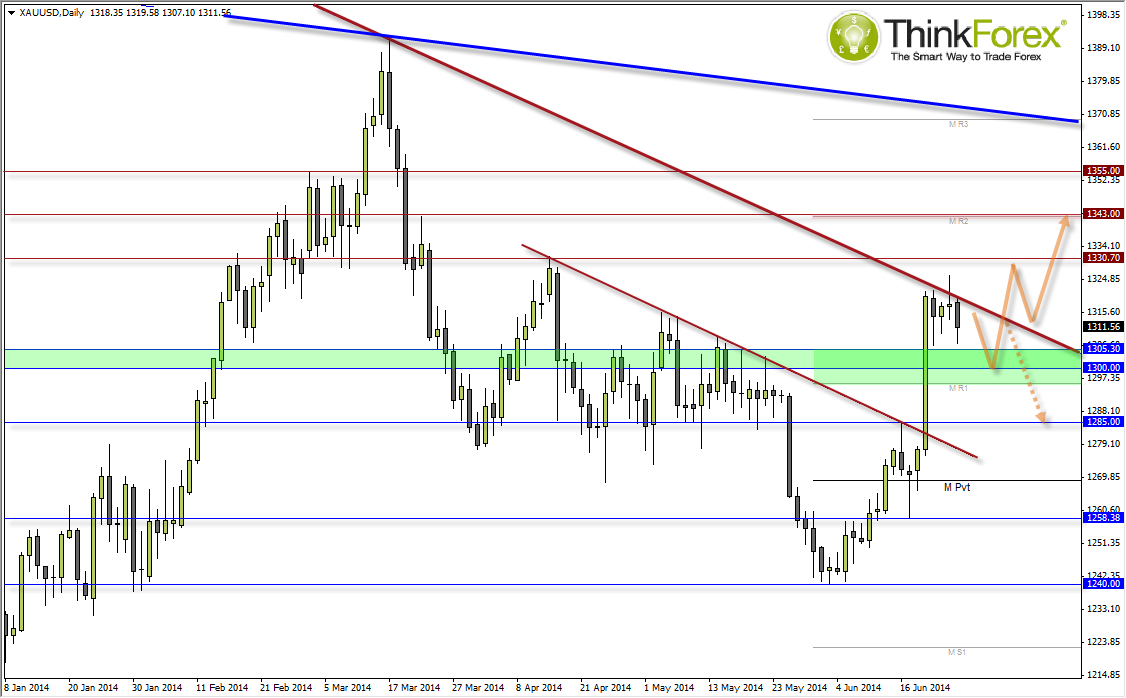

Gold has hesitated below $1330 and hovers around 11-week highs, awaiting further direction. The tight ranges offer potential breakout traders to 'set and forget'.

Gold hovers around current levels, finding resistance below the trendline from Sep '12. The $1240 low is a potential RS (Right Shoulder) of an inverted H&S pattern, however keep in mind these patterns can take a long time to complete and have a tendency to morph over time into more complex patterns. Therefor it is only a rough guide to potential future direction and price target (which incidentally would be around $1600 if we were to see direct gains from here).

An alternative scenario, and one I find more likely, is the weekly chart is going to continue to oscillate between $1180 and $1425 and 'coil' up into a complicated triangle until an eventual breakout occurs, north or south. One issue to consider is over the coming month/s I expect to be an avid USD bull which itself could make Gold heavier to help produce these complex patterns.

There is only one thing for certain right now - the weekly chart isn't trending.

Following yesterday's flight to safety' the markets favoured USD and Bonds, the fact that Gold has not budged from recent highs is a testament to its strength. But then this too is also a safe haven. If USD continues to remain strong amid tension in Iraq we may experience frustratingly choppy prices on Gold around the bearish trendline as investors put money into both USD and Gold.

In the event tensions are eased then we can expect Gold to respect the bearish trendline and gravitate towards $1300. A break below $1300 Targets $1285 and $1270.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.