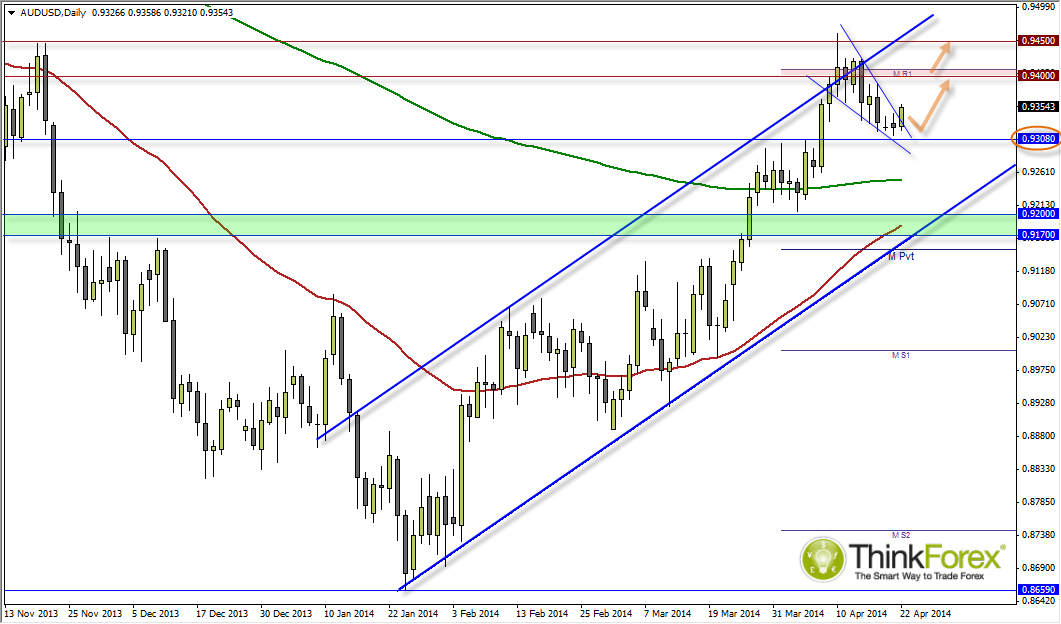

I suspect we have either finished (or very close to completing) the correction lower before we see a resumption of the bullish daily trend

Over the past few sessions we have seen a decline in volume, which would usually add weight to the declines being a retracement, but this was also over a holiday period so I would expect lower volume anyway. Putting that aside I am satisfied we have seen the swing low and for a resumption of the uptrend to resume.

Asia trading today saw an upside break of a bullish wedge, which projects an approximate target around the base at 0.945. We still have 6x trading days in the month remaining so 0.94 is just an initial target, with the base of the wedge trading around 0.945 at the tip of the Shooting Star Reversal.

COTS report show that 'Large Specs' are still Net long for a 2nd consecutive and increasing (as of Tuesday last week).

CPI y/y is forecast at 3.2%, above 2.7% last release. A number 3.1% or below should see the A$ stumble whereas a positive reading at 3.2% or above should see further A$ appreciation. We also have the CPI q/q forecast at 0.8% so if we see 0.8% or higher along with 3.2%+ y/y CPI then it should add fuel to the bullish fire.

Also interesting to note is the comments from Australian Government not being happy with RBA's neutral stance, stating the higher exchange rate is causing issues regarding the budgets and recovery.

Events to monitor

- CPI y/y and q/q

- HSBC Chinese Flash PMI

- US Housing and Employment data

- Interaction between RBA and Australian government over the A$ being 'above historical standard

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD stays near 1.0750 following Monday's indecisive action

EUR/USD continues to fluctuate in a tight channel at around 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold price turns red below $2,320 amid renewed US dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is Securities and Exchange Commission (SEC) filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.