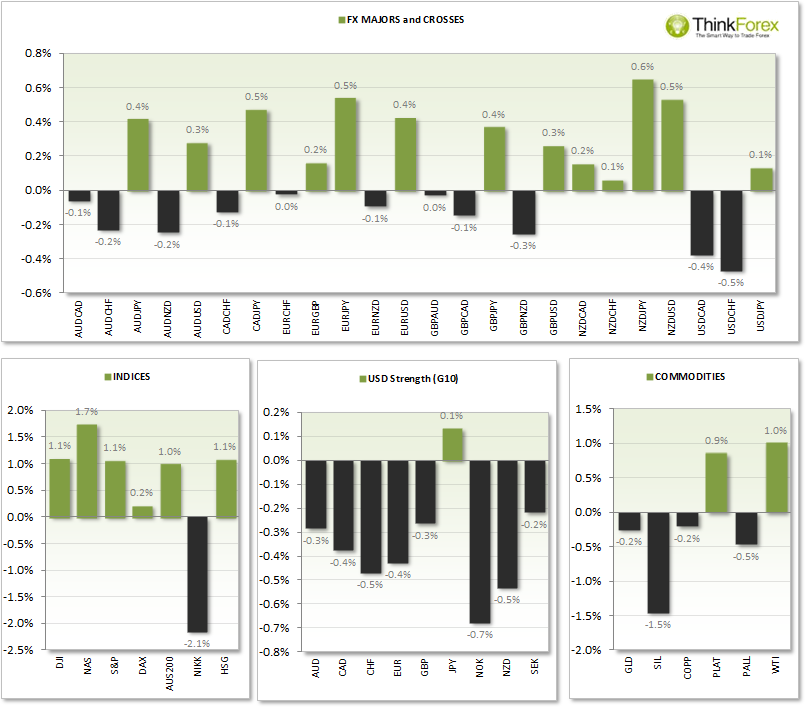

Following the Dovish comments from the FOMC minutes Dollar came the worst, seeing US Equities rally for a 2nd consecutive day

FOREX:

AUDUSD 0.940 capped as resistance and A$ awaits today's employment figures to see if it can hold on to 5-month highs; Currently trading just above daily pivot to suggest swing low in place for intraday traders

EURUSD Broke above 0.13825 resistance and seemingly back in line with the bullish trend

GBPUSD House sales rise to record high to see bullish momentum continue and now trading just shy of Feb highs

USDCAD Broke below 1.091 support; below 1.091 targets 1.080

USDCHF 3rd consecutive bearish close and at 2-week low

USDJPY Bullish Harami formed on Daily to suggest weakness to the bearish move; Currently trading above 102 early Asia

NZDUSD At 2.5yr high with increasingly bullish momentum

INDICES:

NASDAQ at 4-day high and closed at the high of the day to suggest continued gains

S&P Firmly rejected 1830 support and increasingly bullish

DJI Morning Star Reversal confirms swing low

COMMODITIES:

Gold Holds above $1300 and rallied following FOMC minutes; Closed with potential Hanging Man to suggest near-term weakness to bullish move; Also broke out of bearish wedge highlighted yesterday and retesting broken trendline

Silver back below $20 with potential bearish flag forming, or a basing pattern if we close convincingly above $20

WTI looks increasingly bullish after capitalising on USD weakens and target $104

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.