The FED will be crossing their fingers for good data tonight to justify their tapering. It would also refuel speculation about interest rate rises next year...

What can we expect?

I suspect the ‘weather-effect’ we experienced over the past 2 NFP’s has thawed and for a positive jobs figure to appear. However we also have to consider if this has already been priced in by the bigger players. USDJPY has been gaining traction in the lead up to NFP and currently trading at 4-week highs, following a 5th consecutive bullish close. Any signs of even modest shortfall tomorrow could become a quick sell signal - buy the rumour, sell the fact!

I expect relatively subdued trading across the board as the markets await the NFP, with the fate of A$ lying firmly in the hands of the jobs data. If we see particularly good employment figures then I’d expect to see A$ target 0.917, 0.915. Below here it becomes more interesting as we are back within a long-term bearish channel and the corrective range seen between Dec-March.

Poor jobs figures should see A$ hold above 0.917-20 and on target to reach 0.9350, maybe as early as next week. It’s certainly enjoyed the lime light recently and there’s no immediate reason for it to have one ‘last hurrah’ for another leg higher. However whilst I am a longer-term A$ bear, I’m not afraid of the occasional baby-bull rally once in a while – which is exactly what this is in my opinion.

- USDCAD sits on 1.1 (my 'line in the sand) and I will seek bearish trades if NFP comes in below 136k.

- USDJPY also looks over extended so bearish setups will be considered below 103.80

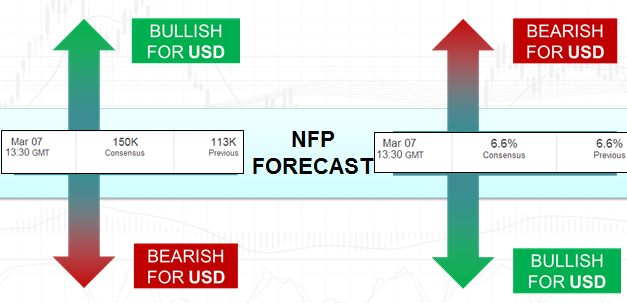

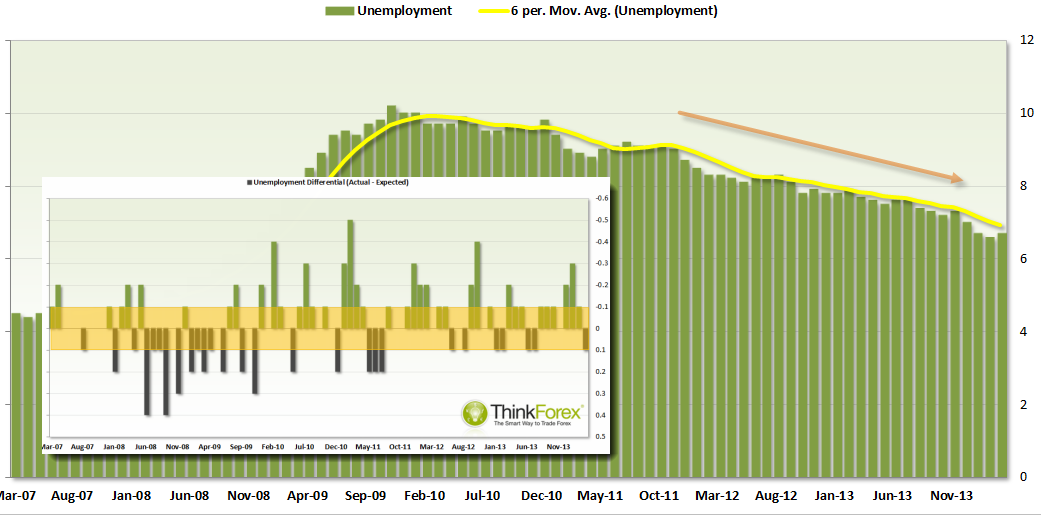

The differential between expected and consensus (inset) tends to be 0.1 out, so whilst unemployment of 6.7% or 6.5% will move the markets the effects should be limited, as the markets look at other data for a clearer picture.

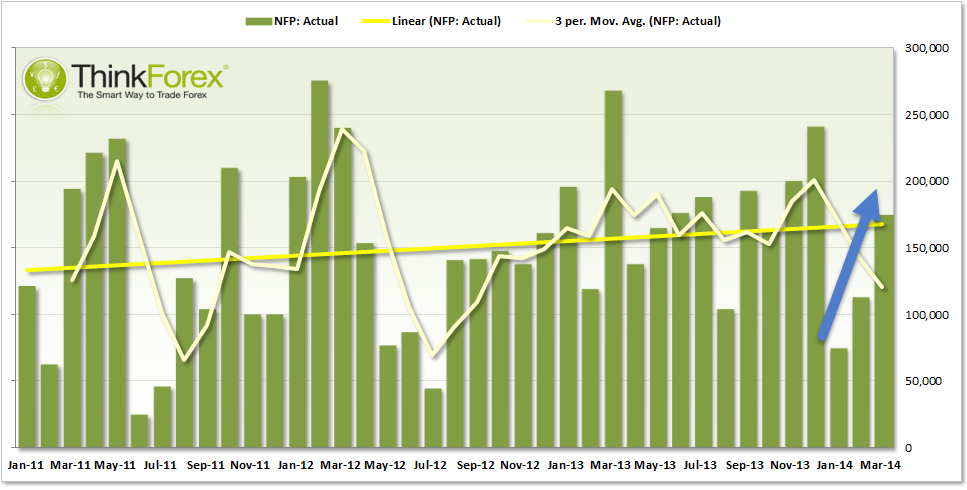

Since Jan we have seen 2 consecutive months of job creation following January's disastrous data. Last month was the first time this year we came in above expectations, but only just.

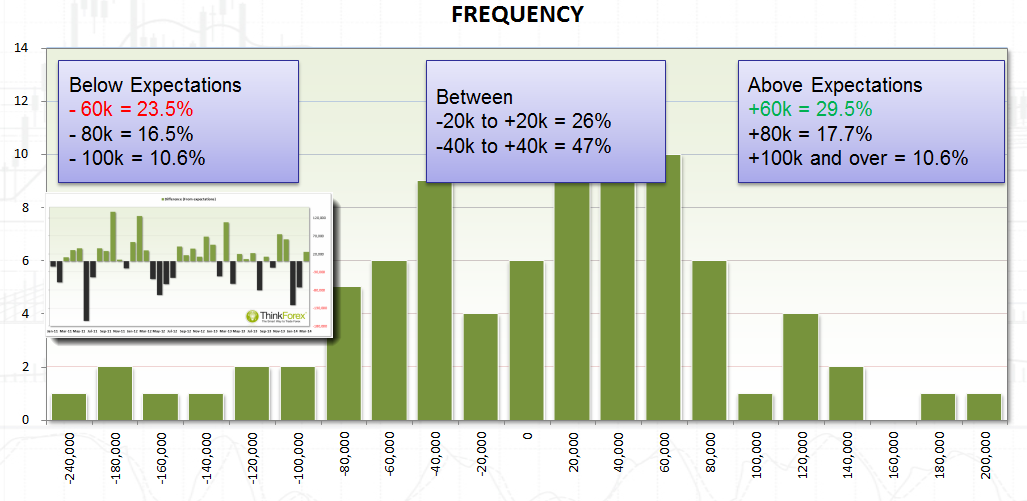

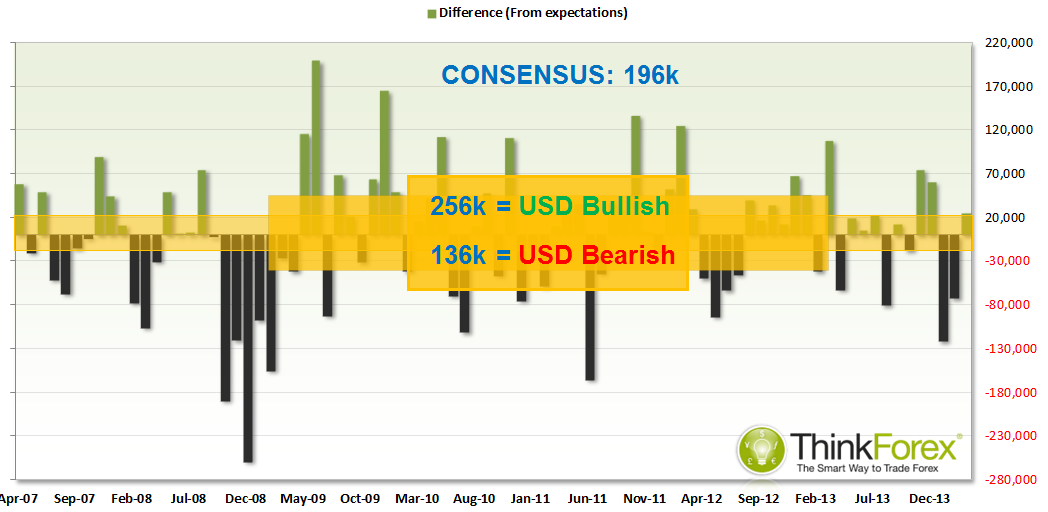

The frequency chart shows the differential between expected and consensus, with a positive number denoting above expectations and below falling short. Typically we come in +/- 40k around 47% of the time, so I am looking for differentials between +/- 60k for any sustained effects on the markets.

CFD and forex trading are leveraged products and can result in losses that exceed your deposits. They may not be suitable for everyone. Ensure you fully understand the risks. From time to time, City Index Limited’s (“we”, “our”) website may contain links to other sites and/or resources provided by third parties. These links and/or resources are provided for your information only and we have no control over the contents of those materials, and in no way endorse their content. Any analysis, opinion, commentary or research-based material on our website is for information and educational purposes only and is not, in any circumstances, intended to be an offer, recommendation or solicitation to buy or sell. You should always seek independent advice as to your suitability to speculate in any related markets and your ability to assume the associated risks, if you are at all unsure. No representation or warranty is made, express or implied, that the materials on our website are complete or accurate. We are not under any obligation to update any such material. As such, we (and/or our associated companies) will not be responsible or liable for any loss or damage incurred by you or any third party arising out of, or in connection with, any use of the information on our website (other than with regards to any duty or liability that we are unable to limit or exclude by law or under the applicable regulatory system) and any such liability is hereby expressly disclaimed

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.