- On the 3rd May, the euro overshoot on broad based US dollar-weakness/yen strength to 1.1616 where sellers were happy to absorb novice stop losses up to the ascendant channel upper line pictured below;

- Silent speculation is mounting that the upswing cycle is not yet over and the market could be faced with another episode of short squeezing above 1.16. I would be prepared for this knowing too well that headline grabbing targets in this pair are usually South not North;

- If that route is taken, renewed hedging measures would be required. The reason I've taken profit on some of the positions thought to serve as an hedge against my short leg, was the overshooting nature of the market and the clear price target;

- If I see a healthier surge higher- now that weak shorts are out of the way-, I would build up at least a 50% hedge;

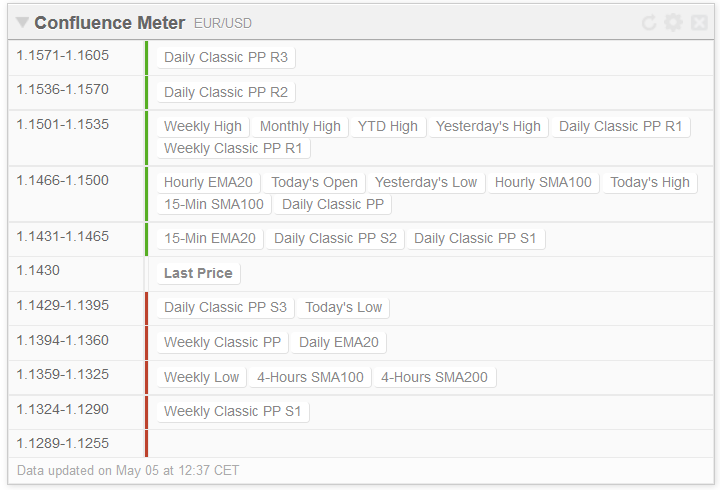

- Yesterday's failed attempt to place a more firm footing above 1.1500 makes sense if we notice how the area above that handle was -and still is- more crowded than the downside with technical indicators looming as obstacles;

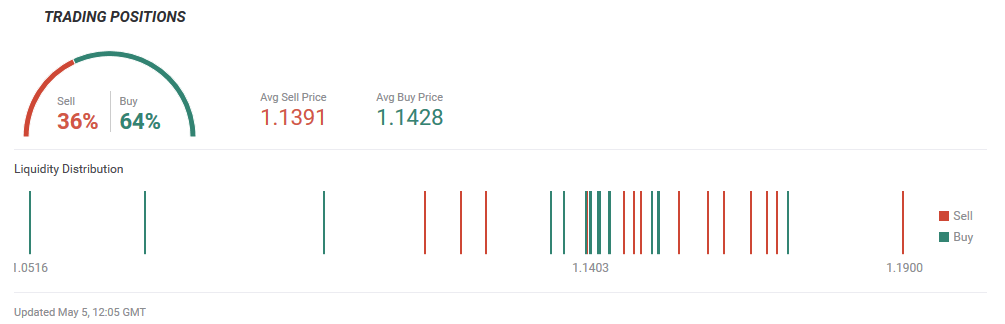

- From a traders positioning perspective, FXStreet's dedicated contributors have fresh buy orders clustered around 1.14 where price quotes at the moment of writing. Further falls are still very much possible if the buyers lose control of this pivotal area;

- With that said, further losses would meet my long limits at 1.1386 aiming at 1.1480, and below lower at 1.1200 for a default 50 pip;

- On the short side, 14 trades are open between 1.0559 and 1.1273, and new limits are awaiting at 1.1465 targeting 1.1380 and above at 1.1544 targeting 1.1500. As usual no fixed stop losses;

- As recently reported in my twitter feed @aulafx, from a 900 pip range in EURUSD in nominal terms, this model captured 4852 pips so far this year, on average that's 1213 pips per month. The maximum floating loss was about 26% when effective leverage hit a max of 7 to 1 during the euro spike towards 1.16.

The trading methodology reported in this analysis is based on a non-directional approach. It is meant to capture the most amount of pips from the constant price oscillations, either up or down. Each trade has a take profit of 50 pips, a stop loss of 500 pips. The size of each trade is regular, but trades can be stacked around key support and resistance zones, increasing the overall position size around certain price zones. The system can perform either in trending or range bound markets, but it suffers when there is an extreme unidirectional price advance. Buy and sell positions are taken with two separate real accounts.

To learn more about the method, you can watch these special webinar series:

Exploring the Coast Line of Foreign Exchange Land - Part I

Exploring the Coast Line of Foreign Exchange Land - Part II

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 ahead of US jobs report

EUR/USD stays in a consolidation phase above 1.0700 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.