Interested in more FX key technical levels? Take a look at Swissquote's daily technical outlook.

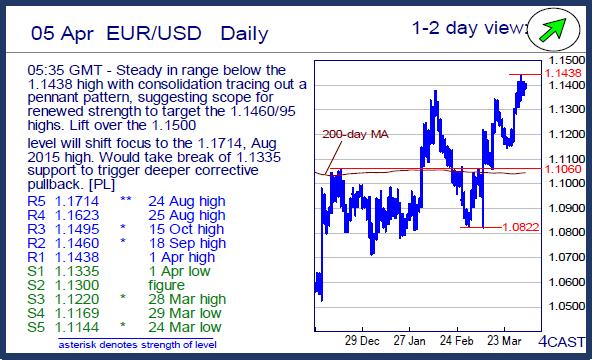

EUR/USD

Steady in range below the 1.1438 high with consolidation tracing out a pennant pattern, suggesting scope for renewed strength to target the 1.1460/95 highs. Lift over the 1.1500 level will shift focus to the 1.1714, Aug 2015 high. Would take break of 1.1335 support to trigger deeper corrective pullback. [PL]

USD/CHF

Steady in range above the .9556 low though the downside still not firm. Break will shift focus to the .9500 level then .9476, Oct low. Upside seen limited with resistance starting at .9626 then the recent lows at .9651/61 recent lows. Would need to regain the latter to fade downside pressure and get recovery underway. [PL]

USD/JPY

Further decline to break the 111.00 level expose the 110.67 low to retest. Below this will see risk for further decline to target the 110.00 level. Upside see the 112.00 level key and regaining this needed to fade downside pressure. [PL]

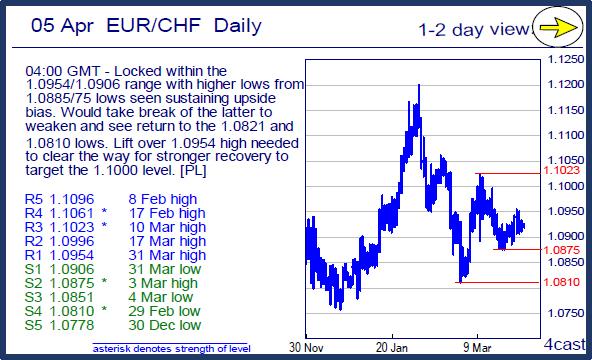

EUR/CHF

Locked within the 1.0954/1.0906 range with higher lows from 1.0885/75 lows seen sustaining upside bias. Would take break of the latter to weaken and see return to the 1.0821 and 1.0810 lows. Lift over 1.0954 high needed to clear the way for stronger recovery to target the 1.1000 level. [PL]

GBP/USD

View unchanged with Inside-range set last session hindering further decline towards the daily support line at 1.4155 with intraday trade to shift into consolidation. Resistance seen at 1.4322 and lift above latter will help to turn focus higher to 1.4372 then 1.4460. [W.T]

EUR/GBP

Paused at the .8020 high though the upside stays in focus and see scope to .8050, being measuring objective of a 10-mth bottom pattern seen in 2015. Recent highs at .7947/29 now reverts to support and setback needed to ease upside pressure and see room for stronger pullback to .7870 then .7831 low. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold price traders remain on the sidelines ahead of FOMC decision on Wednesday

Gold price remains confined in a narrow range as traders prefer to wait on the sidelines. Reduced Fed rate cut bets revive the USD demand and act as a headwind for the metal. Investors now await the FOMC decision and US macro data before placing directional bets.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.