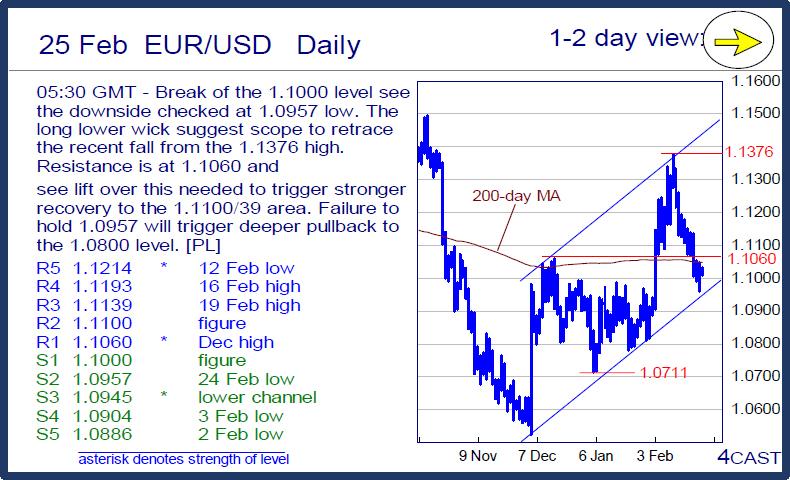

EUR/USD Daily

Break of the 1.1000 level see the downside checked at 1.0957 low. The long lower wick suggest scope to retrace the recent fall from the 1.1376 high. Resistance is at 1.1060 and see lift over this needed to trigger stronger recovery to the 1.1100/39 area. Failure to hold 1.0957 will trigger deeper pullback to the 1.0800 level. [PL]

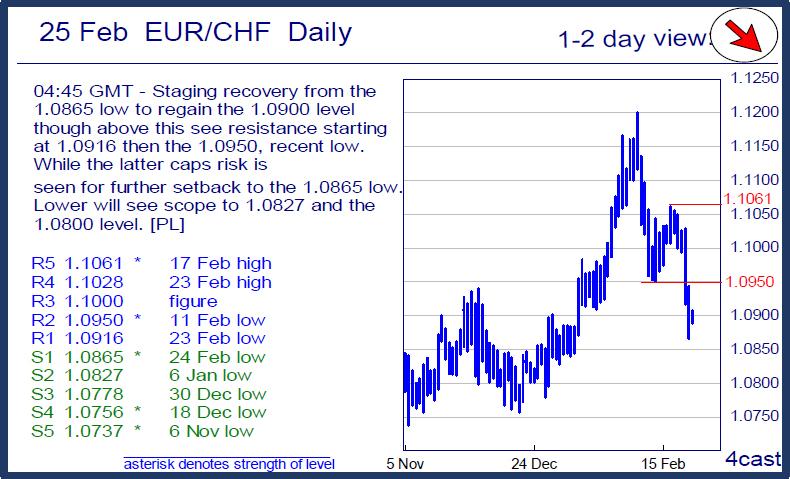

EUR/CHF Daily

Staging recovery from the 1.0865 low to regain the 1.0900 level though above this see resistance starting at 1.0916 then the 1.0950, recent low. While the latter caps risk is seen for further setback to the 1.0865 low. Lower will see scope to 1.0827 and the 1.0800 level. [PL]

USD/CHF Daily

Follow-through below the .9900 level to break the .9876 support triggers a top pattern at the 1.0004 high and see deeper setback to reach .9853 low. Below this will see return to the .9800 level then the 200-day MA at .9762. Upside see resistance now at .9918 and .9953 protecting the 1.0004 high. [PL]

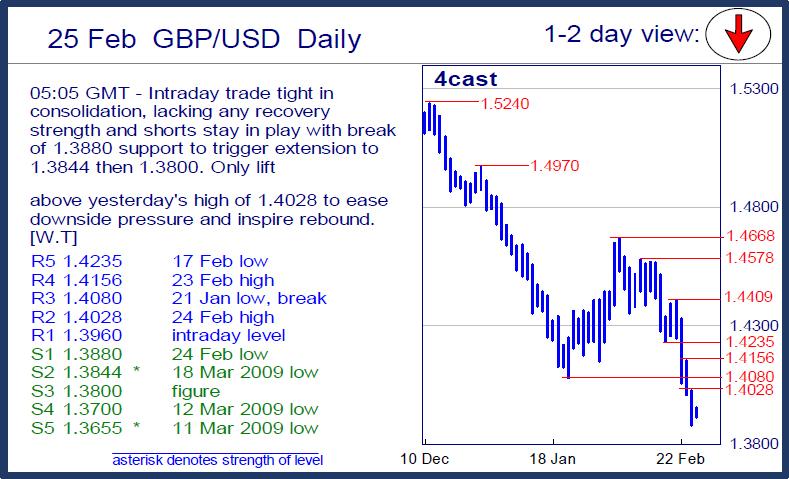

GBP/USD Daily

Intraday trade tight in consolidation, lacking any recovery strength and shorts stay in play with break of 1.3880 support to trigger extension to 1.3844 then 1.3800. Only lift above yesterday's high of 1.4028 to ease downside pressure and inspire rebound. [W.T]

USD/JPY Daily

Regaining the 112.00 level seen extending bounce from the 111.04 low and see scope to target 112.80 next. Beyond this will see stronger recovery to the 113.38/60 area and 114.00 level. Support now at the 112.00 level and 111.50 now protecting the 110.99 low. [PL]

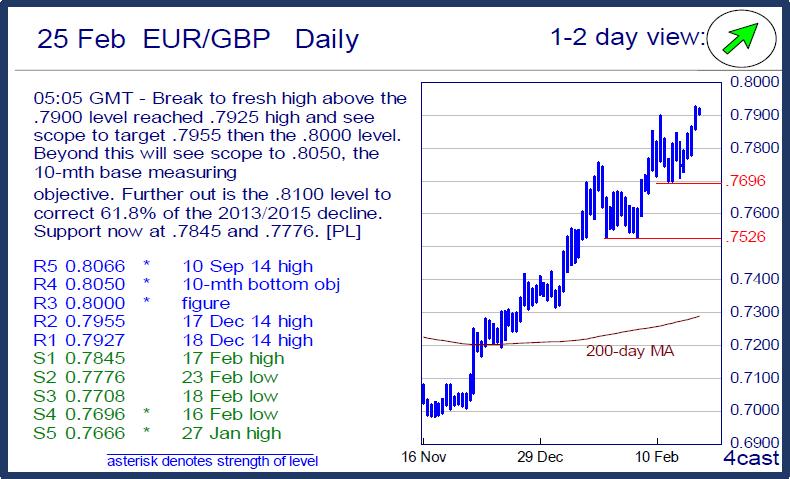

EUR/GBP Daily

Break to fresh high above the .7900 level reached .7925 high and see scope to target .7955 then the .8000 level. Beyond this will see scope to .8050, the 10-mth base measuring objective. Further out is the .8100 level to correct 61.8% of the 2013/2015 decline. Support now at .7845 and .7776. [PL]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.