EUR/USD Daily

With most players closing their book for the Year 2015, intraday trade remains tight, exposing little interest to create fresh positions with support seen at 1.0899 ahead of 1.0870. On the upside, strong resistance is seen at 1.0993. Happy and Healthy Year 2016 to All. [W.T]

USD/CHF Daily

With the Year 2015 coming to an end , bulls are reluctant to push higher as players squared off their positions and now settling prices back to consolidation. A break of wider and stronger 0.9786-0.9990 band will trigger clearer signals. [W.T]

USD/JPY Daily

With the Year 2015 ending and most of Fareast on holiday or partial working day, intraday trades remain tight in consolidation and current rebound seen as correcting the broader downmove from 123.56 high and should see selling appearing towards 120.73/98 resistances. Happy and Healthy New Year 2016 to All. [W.T]

EUR/CHF Daily

Spurred by the negative implication of High-wave candle set on Tuesday, prices staged a strong reversal to 1.0778 low last session and trades are now reverting to consolidation . Happy and Healthy New Year 2016 to All. [W.T]

GBP/USD Daily

With most players closing their books for the Year 2015 and the appearance of a Doji-session last session, further decline stalled with intraday trade drifting into tight consolidation. A Happy and Healthy New Year 2016 to All. [W.T]

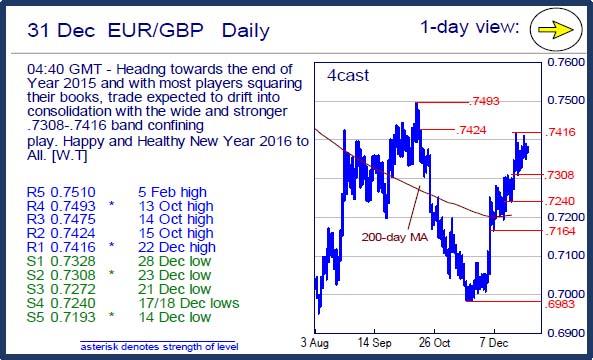

EUR/GBP Daily

Headng towards the end of Year 2015 and with most players squaring their books, trade expected to drift into consolidation with the wide and stronger .7308-.7416 band confining play. Happy and Healthy New Year 2016 to All. [W.T]

This publication has been prepared by Danske Bank for information purposes only. It is not an offer or solicitation of any offer to purchase or sell any financial instrument. Whilst reasonable care has been taken to ensure that its contents are not untrue or misleading, no representation is made as to its accuracy or completeness and no liability is accepted for any loss arising from reliance on it. Danske Bank, its affiliates or staff, may perform services for, solicit business from, hold long or short positions in, or otherwise be interested in the investments (including derivatives), of any issuer mentioned herein. Danske Bank's research analysts are not permitted to invest in securities under coverage in their research sector.

This publication is not intended for private customers in the UK or any person in the US. Danske Bank A/S is regulated by the FSA for the conduct of designated investment business in the UK and is a member of the London Stock Exchange.

Copyright () Danske Bank A/S. All rights reserved. This publication is protected by copyright and may not be reproduced in whole or in part without permission.

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0750 ahead of Eurozone PMI, PPI data

EUR/USD trades in positive territory for the fourth consecutive day near 1.0765 during the early Monday. The softer US Dollar provides some support to the major pair. Traders await the HCOB Purchasing Managers’ Index (PMI) data from Germany and the Eurozone, along with the Eurozone PPI.

GBP/USD rises to near 1.2550 due to dovish sentiment surrounding Fed

GBP/USD continues its winning streak for the fourth consecutive day, trading around 1.2550 during the Asian trading hours on Monday. The appreciation of the pair could be attributed to the recalibrated expectations for the Fed's interest rate cuts in 2024 following the release of lower-than-expected US jobs data.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.