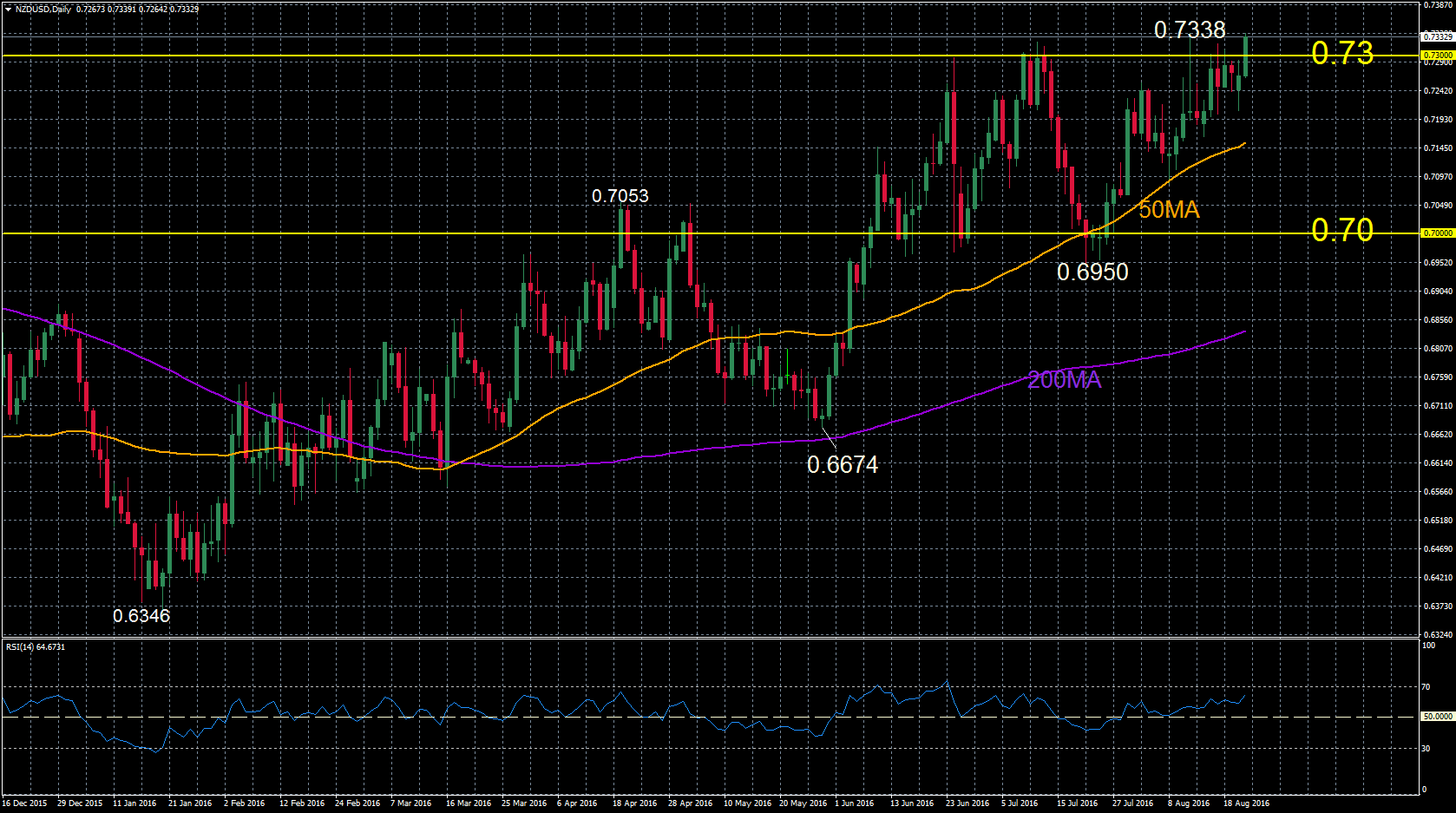

The technical picture for NZDUSD has been bullish since the pair rose from early 2016 lows of 0.6346 to the 0.73 area in August. The 50 and 200-day moving averages are giving a bullish signal and the RSI is in bullish territory above 50. The medium term picture shows the market was in a range between key psychological levels of 0.7000 and 0.7300.

Resistance at 0.7300 has been tested several times and today prices have broken above it again. Only a daily close above this level would indicate that the market is starting to move out of the medium term range to continue the uptrend.

If upside momentum is maintained and RSI keeps rising, then the market has a chance to attempt to make a new high and target the next resistance area around 0.7400. Immediate support is at 0.7150 (50-day moving average) and below this the 0.7000 level is major support. A drop below 0.7000 would start to change the overall bullish market structure and will weaken it.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD advances to near 1.0750 as risk appetite regains balance

EUR/USD extends its winning streak for the third successful day, trading around 1.0730 during the Asian session on Friday. The risk-sensitive currencies like the Euro gain ground as risk appetite regains balance ahead of US Nonfarm Payrolls.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2540 amid the softer US Dollar on Friday. The US Federal Reserve Chair Jerome Powell delivered a modest dovish message after the meeting on Wednesday, which weighs on the Greenback.

Gold lacks firm near-term direction, remains stuck in a range ahead of US NFP

Gold price struggles to gain any meaningful traction amid mixed fundamental cues. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support. Bets for a delayed Fed rate cut and a positive risk tone cap gains ahead of the US NFP.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.