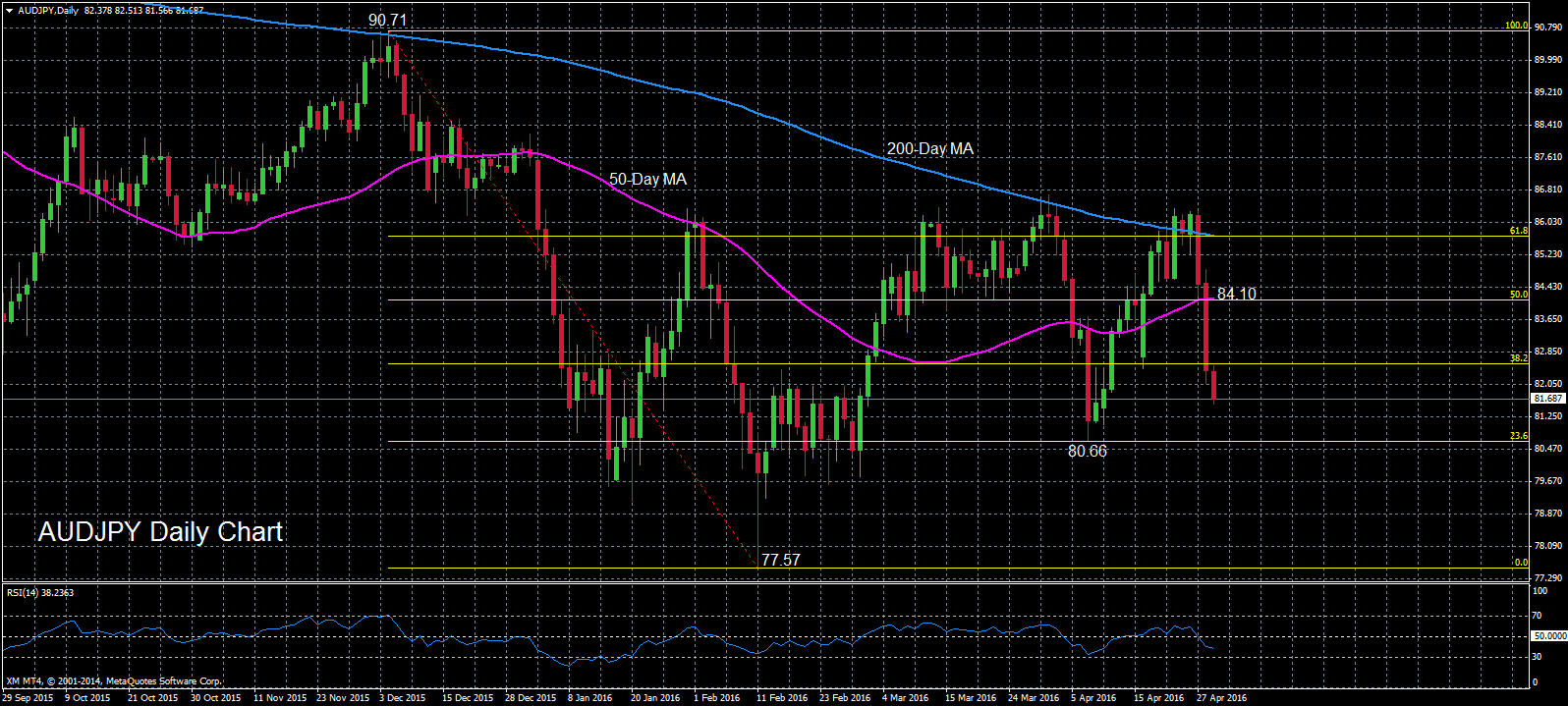

AUDJPY has fallen over 5% in the past three days with the current sell-off taking prices from above the 200-day moving average to sharply below the 50-day moving average. The near-term bias has turned from positive to negative. This is underlined by the downward sloping RSI, which has yet to approach oversold territory, indicating there is scope for further losses.

The nearest support is likely to come from the 23.6% Fibonacci retracement level of the downleg from 90.71 to 77.57. This is also the April 7 low of 80.66. A drop below this level would strengthen the bearish bias and threaten the February 11 low of 77.57.

In the medium-term, prices have been trading within a range since January and a rise back above the 50-day moving average, which also corresponds with the 50% Fibonacci level at around 84.10, would help sustain the neutral outlook.

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.