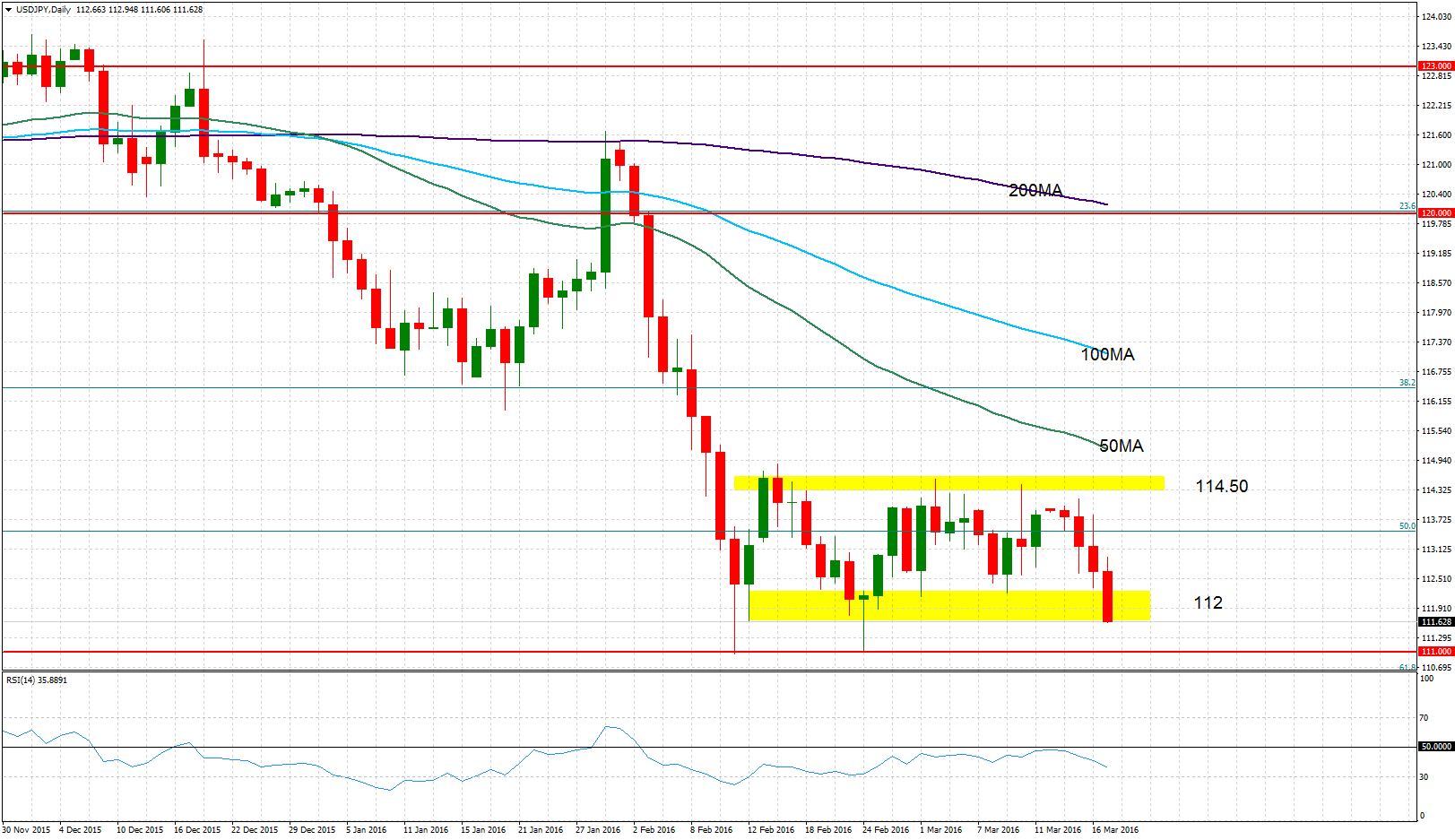

USDJPY maintains its neutral bias, trading in a broad range between 112.00 and 114.50 since mid-February.

Only a break above 115.96 (January 20 low) would shift the near-term bias to a more bullish one. Downside risk exists as indicated by the falling RSI. The indicator is also below 50 in bearish territory. Meanwhile, the negatively aligned moving averages also highlight a bearish outlook.

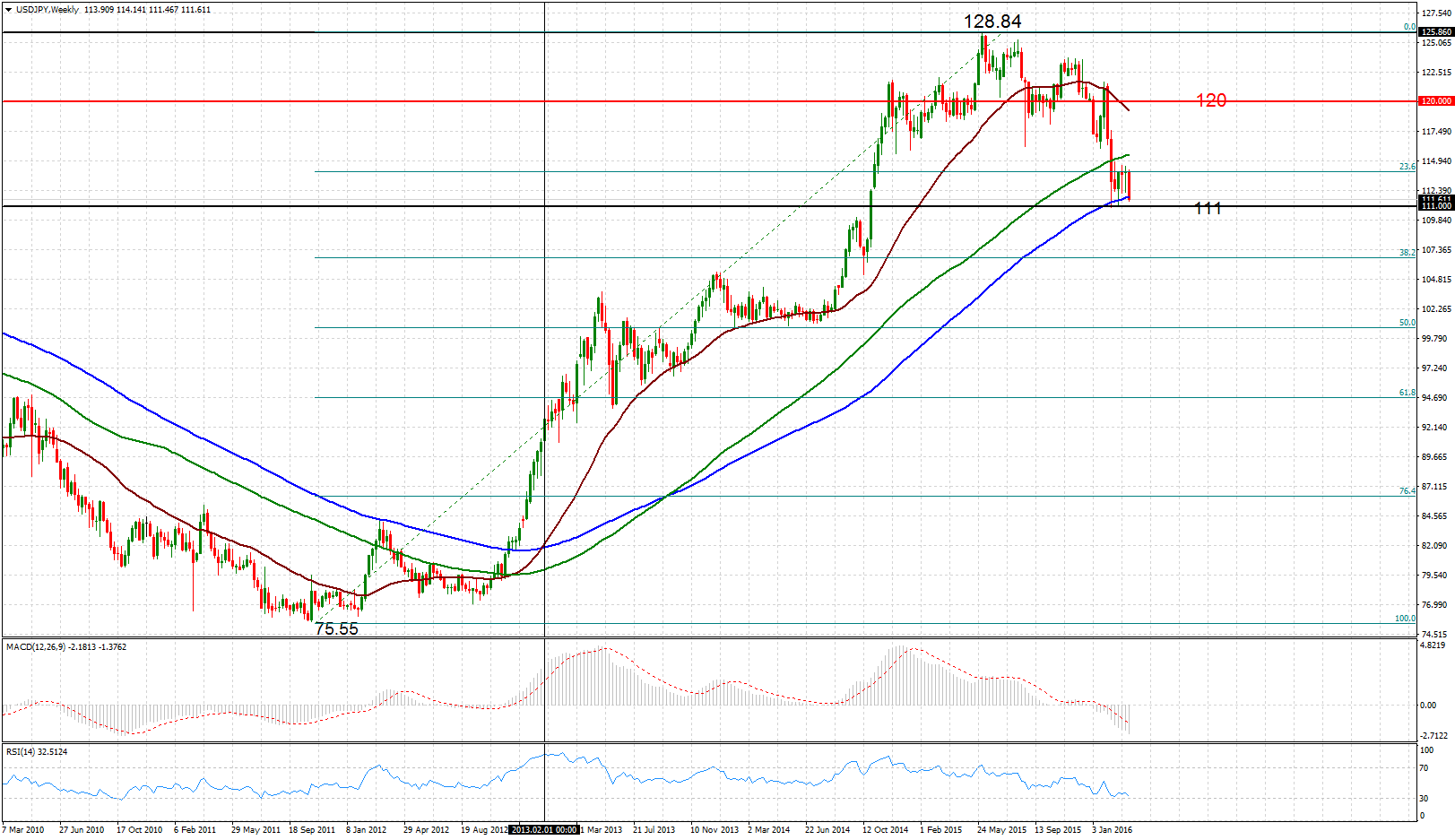

There is scope for prices to target the key 111.00 level, which is an important support level. A sustained break below this level would develop into a deeper correction of the long term uptrend that started from the end of 2011 when the market bottomed at 75.55 and rose to a 13-year high of 128.84 in mid-2015. The MACD in the long term chart is bearish and is below zero.

Daily Chart

Weekly Chart

Forex trading and trading in other leveraged products involves a significant level of risk and is not suitable for all investors.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700 as USD struggles ahead of data

EUR/USD is posting small gains above 1.0700 in the European session on Thursday. The pair remains underpinned by a sustained US Dollar weakness, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD stays firm above 1.2500 amid US Dollar weakness

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair's uptick is supported by a broadly weakness US Dollar on dovish Fed signals. A mixed market mood could cap the GBP/USD upside ahead of mid-tier US data.

Gold price trades with modest losses amid positive risk tone, downside seems limited

Gold price edges lower amid an uptick in the US bond yields, though the downside seems cushioned. A positive risk tone is seen as another factor undermining demand for the safe-haven precious metal.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.