The Euro maintains strong bullish sentiment, regained on yesterday’s softer-than-expected tone of Fed Chair Janet Yellen comments. Strong rally left long bullish daily candle yesterday, with fresh bullish resumption in early European trading, approaching key short-term barriers at 1.1341/74 (peaks of 17 Mar / 11 Feb).

Sustained break above these barriers will be very bullish and could trigger extension towards 1.17 zone (the upper boundary of weekly chart’s consolidation between 1.0461 and 1.1712.

Daily MA’s turned into full bullish mode on yesterday’s rally, with extended RSI / Slow Stochastic, showing room for stretch to initial target 1.1341.

Consolidation should be anticipated before bulls resume, with initial support at 1.1281 (daily low) and rising daily 10SMA underpinning the action at 1.1235 and expected to hold extended dips.

Res: 1.1341; 1.1374; 1.1400; 1.1430

Sup: 1.1300; 1.1281; 1.1235; 1.1218

GBPUSD

Cable extends bulls for the third consecutive day and establishes above 1.44 barrier (Fibo 76.4% of 1.4512/1.4056 downleg), following yesterday’s acceleration that broke into daily Ichimoku cloud and closed well above clouds base.

Firm bullish tone of daily studies favors further upside, with immediate barrier at 1.4487 (upper 20d Bollinger Band), ahead of key resistance at 1.4512 (18Mar peak). Sustained break above 1.4512 is needed to confirm an end of congestion, entrenched between 1.4050 and 1.4512 and signal resumption of broader recovery from 1.3834 (low of 29 Feb), towards next significant barrier at 1.4557 (daily Ichimoku cloud top).

Caution on daily Slow Stochastic, which is entering overbought zone and may signal hesitation on approach to key 1.4512 barrier.

Psychological 1.4400 level offers immediate support, followed by session low at 1.4366, with extended dips expected to find support above 1.4300 (rising daily 10SMA).

Res: 1.4449; 1.4487; 1.4512; 1.4557

Sup: 1.4400; 1.4366; 1.4300; 1.4270

USDJPY

The pair remains under strong pressure and resumes descend from yesterday’s high at 113.79, where dollar’s seven-day rally stalled.

Strong bearish signal was generated by yesterday’s long red daily candle, with long upper shadow. Today’s bearish extension so far tested psychological 112 support, with focus at 111.85 (Fibo 61.8% of 110.65/113.79 recovery), break of which to confirm reversal.

Near-term risk is shifting again towards critical 111 support zone (briefly cracked on extension to 110.65), after upside attempts towards the upper boundary of short-term congestion, lost traction.

Daily Tenkan-sen and Kijun-sen lines turned into bearish setup, together with daily 10, 20 & 30SMA’s which are back to full bearish mode, supporting overall bearish structure for repeated attack at 111 support zone.

Daily 20SMA capped today’s action, marking initial resistance at 112.80, ahead of 113.10 (Fibo 61.8% of 113.79/112.00 downleg), which is expected to cap extended corrective rallies.

Res: 112.42; 112.80; 113.10; 113.45

Sup : 112.00; 111.85; 111.00; 110.65

AUDUSD

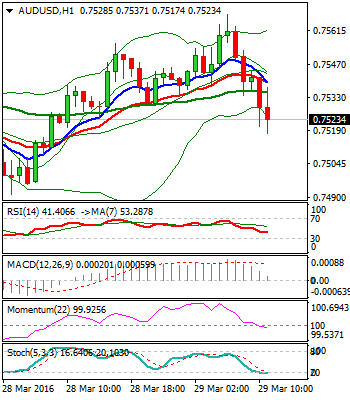

Aussie probes above former high of 18 Mar at 0.7678, on the third consecutive day of bullish acceleration from 0.7475 (24 Mar correction bottom), where higher low was left.

Extended wave C that commenced from 0.6972 (09 Feb trough), is looking for test of its 176.4% Fibo expansion at 0.7711, with extension to 0.7810 (FE 200%), not ruled out.

Firm bullish structure of daily technicals supports further upside action, with daily close above 0.7678 (former top), needed to confirm bullish resumption.

Rising daily 10SMA offers initial support at 0.7583 and should ideally contain corrective dips, to keep intact pivotal supports at 0.7526 (20SMA and 0.7475 (24 Mar higher low).

Res: 0.7696; 0.7711; 0.7750; 0.7810

Sup: 0.7613; 0.7583; 0.7526; 0.7475

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.