EURUSD

The Euro cracked 200SMA barrier on yesterday’s probe above psychological 1.10 level and posted fresh recovery high at 1.1041. Long bullish daily candle and close above 1.10 handle, give bullish signal for possible repeated attempts above 200SMA.

Daily indicators are bullishly aligned and favor renewed attempts through 200 SMA hurdle, towards next significant barrier, descending daily Ichimoku cloud base at 1.1080. Extended rallies are expected to find strong resistance here and guard another pivot at 1.1122, Fibonacci 61.8% of 1.1494/1.0519 descend.

Corrective easing under 200SMA, which caps today’s action, broke bellow initial support at 1.0976, daily 55SMA and heads towards 1.0947, Fibonacci 38.2% of 1.0794/1.1041 upleg.

Overbought daily slow Stochastic may signal stronger pullback. Yesterday’s low at 1.0880, near Fibonacci 61.8% of 1.0794/1.1071, should contain extended dips, to keep intact pivotal 1.08 support zone.

Res: 1.1000; 1.1029; 1.1041; 1.1060

Sup: 1.0947; 1.0880; 1.0839; 1.0794

GBPUSD

Cable returned into full near-term bullish mode, on yesterday’s sharp bounce off 1.5000 handle, which fully retraced three-day 1.5154/1.4954 fall. The pair posted new high at 1.5188, which was cracked on today’s fresh upside attempts.

Yesterday’s long bullish daily candle gives strong bullish signal, as the pair left higher low at 1.4954 and resumes recovery from 1.4892, low of 02 Dec. Also, daily close above 1.5165, Fibonacci 61.8% of 1.5334/1.4892 downleg, supports further upside action.

Extension to strong1.5334 barrier, lower top of 19 Nov / daily Ichimoku cloud base, would be likely near-term scenario.

Immediate supports lay at 1.5127/03, daily 20SMA / Fibonacci 38.2% of 1.4954/1.5195 upleg.

Res: 1.5195; 1.5230; 1.5262; 1.5308

Sup: 1.5155; 1.5127; 1.5103; 1.5046

USDJPY

Yesterday’s sharp bearish acceleration left long red daily candle, which marks biggest daily loss since 01 Sep. Also, loss of pivotal 122.20 support zone, floor of former consolidation range, confirmed lower platform at 122.70 zone.

Daily studies are turning into bearish mode, as yesterday’s weakness probed below 200 and 55SMA supports.

The fall found temporary support at 121.06, above which, consolidation phase is expected to precede fresh leg lower.

Broken daily 30SMA at 122.55, is expected to cap extended rallies.

Renewed weakness will look for 121.06 retest, below which to open 120.89, 50% of 118.05/123.74 upleg and in extension, strong support at 120..22, Fibonacci 61.8% retracement / higher base of 23 Oct / 02 Nov.

Res: 122.20; 122.55; 122.80; 123.03

Sup: 121.26; 121.06; 120.89; 120.22

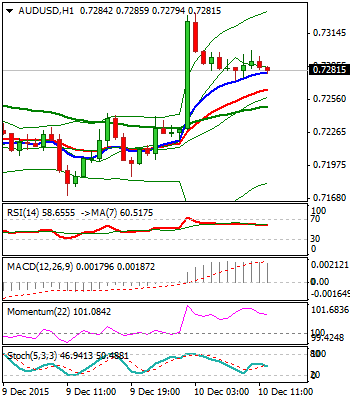

AUDUSD

Aussie regained traction, after strong pullback fro 0.7380 barrier was contained by daily Ichimoku cloud top. Subsequent bounce that left bullish daily candle with long tail yesterday, accelerated further today, on spike to 0.7332, which marks Fibonacci 76.4% of 0.7383/0.7170 pullback.

Near-term focus is turned higher for possible retest of 0.7380 pivotal resistance zone .

Meantime, corrective easing is expected to find support above 0.7250, mid-point of 0.7170/0.7332 rally / hourly Ichimoku cloud top.

Res: 0.7300; 0.7332; 0.7360; 0.7380

Sup: 0.7270; 0.7250; 0.7232; 0.7202

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds firm above 1.0700 ahead of German inflation data

EUR/USD trades on a firm footing above 1.0700 early Monday. The pair stays underpinned by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold price bulls move to the sidelines as focus shifts to the crucial FOMC policy meeting

Gold price (XAU/USD) struggles to capitalize on its modest gains registered over the past two trading days and edges lower on the first day of a new week, albeit the downside remains cushioned.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.