EURUSD

The Euro bounced after posting fresh low at 1.0615 yesterday, on profit-taking action that peaked at 1.0717. Falling daily 10SMA, reinforced by falling daily Tenkan-sen, which maintains downmove for the past month, capped so far the rally at 1.0717.

This barrier should ideally keep the upside protected, however, extension higher cannot be ruled out, as hourly studies turned positive.

Overall picture remains firmly bearish and favors fresh action lower, on completion of current consolidation.

Next significant barriers lay at 1.0760, hourly double top and 4-hour Ichimoku cloud base and 1.0800/28, Fibonacci 38.2% of 1.1094/1.0615 / 12 Nov low and mark the upside breakpoint

Res: 1.0717; 1.0760; 1.0800; 1.0828

Sup: 1.0666; 1.0629; 1.0615; 1.0600

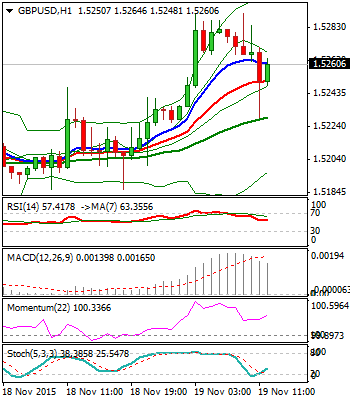

GBPUSD

Cable probes above four-day 1.5262/1.5153 congestion, following two-day rally from 1.5153, 17 Nov range low, where higher low is forming, after false break below strong weekly Ichimoku cloud support at 1.5191.

Cracking descending daily 20SMA / Kijun-sen line at 1.5267, could be seen as initial bullish signal, though, gains so far stay below psychological 1.5300 barrier.

The notion is supported by near-term studies, which gained bullish tone.

On the other side, daily technicals remain bearishly aligned, with the pair facing strong resistance zone above 1.53 barrier, which consist of sideways-moving daily 30SMA and 200SMA at 1.5306 and 1.5339, respectively.

Sustained break here is needed to confirm bearish resumption and neutralize existing risk of recovery stall.

Res: 1.5291; 1.5306; 1.5340; 1.5370

Sup: 1.5248; 1.5226; 1.5206; 1.5185

USDJPY

The pair pulls back in corrective action, after marginally higher high was posted at 123.74. Probe below initial support and former consolidation floor at 123.17, Fibonacci 38.2% of 122.20/123.74, generated initial signal of deeper pullback, which so far hit support at 123.08, rising daily 10SMA.

Strong support lies at 123 zone, defined by 10SMA and 4-hour Ichimoku cloud top and should ideally contain dips, to prevent deeper pullback.

However, near-term studies are weakening and cannot rule out further correction.

Extended corrective action, also signaled by daily RSI / slow Stochastic, reversing from overbought territory, should not exceed key near-term support at 122.20, 16 Nov higher low.

Res: 123.36; 123.74; 124.14; 124.50

Sup: 123.08; 122.90; 122.79; 122.56

AUDUSD

The pair rallies above near-term 0.7156/0.7067 consolidation, after strong barriers of falling daily 20SMA and trendline resistance at 0.7125, were taken out.

Today’s fresh strength, follows yesterday’s indecision, shaped in Doji with long tail, commences the third wave of recovery from 0.7014, low of 10 Nov. Daily close above 0.7156, former range top and Fibonacci 38.2% of 0.7380/0.7014 downleg, is seen as minimum requirement to confirm bullish resumption. The notion is supported by probe above the top of thin daily cloud top, which twists higher.

Next important barriers lay at 0.7210/22, Fibonacci 100% expansion / 04 Nov lower top.

Daily indicators are heading north and gaining bullish momentum for fresh upside extension.

Broken daily 20SMA / bear-trendline, now offer strong support, guarding 0.7067 higher low and downside breakpoint.

Res: 0.7177; 0.7197; 0.7210; 0.7222

Sup: 0.7151; 0.7125; 0.7067; 0.7048

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.