The Euro maintains firm bearish tone, as fresh weakness met initial target at 1.0660, on extension to 1.0642, seen so far. The pair eyes immediate target at psychological 1.06 support and 1.0519, 13 Apr low, seen on extension lower..

Key short-term support at 1.0461, low of 13 Mar 2013, is coming in focus, as Euro remains under strong pressure. Completion of Mar/Aug 1.0461/1.1712 corrective phase, is seen as likely short-term scenario.

Falling daily 10SMA / Tenkan-sen line, continue to maintain descend. The lines currently lay at 1.0760, with resistance being reinforced by 4-hour Ichimoku cloud base and expected to cap corrective attempts.

Alternatively, stronger correction could be expected on violation of 1.0828, 12 Nov lower top.

Res: 1.0670; 1.0690; 1.0760; 1.0828

Sup: 1.0600; 1.0560; 1.0500; 1.0461

GBPUSD

Near-term tone is weakening, as the price probes below initial supports at 1.5191, weekly Ichimoku cloud base and consolidation floor at 1.5172, also Fibonacci 38.2% of 1.5025/1.5262 correction.

Yesterday’s close in red, signals completion of reversal pattern, after recovery peaked at 1.5262, capped by daily Kijun-sen line and 50% of 1.5495/1.5025 descend, short of strong 1.53 resistance zone, multiple MA’s bear crosses and daily Ichimoku cloud base, breakpoint area.

Bearish daily studies favor lower top formation at current high, for return to 1.5025 and eventual attack at psychological 1.50 support.

Initial supports lay at 1.5105, former low of 27 Sep and 1.5085, cracked Fibonacci 61.8% retracement of 1.4563/1.5928, below which, to open way towards 1.5025 and 1.5000 targets.

Res: 1.5220; 1.5244; 1.5262; 1.5300

Sup: 1.5143; 1.5105; 1.5085; 1.5025

USDJPY

The pair remains well supported and rallies towards target at 123.59, 09 Nov peak, as recent recovery off yesterday’s post-gap low at 122.20, nearly fully retraced 123.59/122.21 correction.

Bulls prevail on all timeframes and favor final attack at 123.59, for resumption of larger uptrend that focuses 124.14, June 2007 high.

Meantime, consolidation ahead of 123.59 target could be expected, with rising daily 10SMA, currently at 122.70, expected to keep the downside protected.

Only break below yesterday’s low at 122.20, would sideline near-term bulls and signal stronger correction.

Res: 123.41; 123.59; 124.14; 124.50

Sup: 122.95; 122.70; 122.37; 122.20

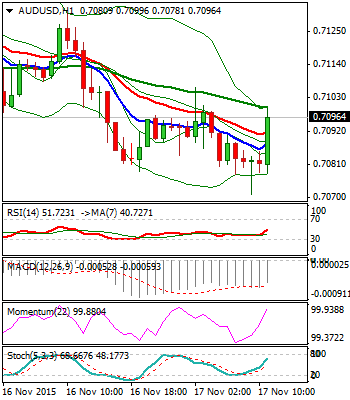

AUDUSD

The pair establishes below daily Ichimoku cloud base, following yesterday’s close in red and today’s fresh extension lower. Reversal from 0.7156 peak, reached Fibonacci 61.8% of 0.7014/0.7156 recovery, generating bearish signals for lower top confirmation and further acceleration lower.

Falling daily 20MA, currently at 0.7129, continues to maintain descend, with bearishly aligned daily studies, keeping downside pressured.

Expect corrective attempts to hold below daily 20SMA at 0.7129 and bear-trendline off 0.7380 peak, laying few ticks higher, for fresh attempts lower.

Alternatively, violation of the latter and break of 0.7156 top, would revive near-term bulls and shift focus towards next significant barrier at 0.7222, 04 Nov lower top.

Res: 0.7106; 0.7129; 0.7140; 0.7156

Sup: 0.7071; 0.7048; 0.7014; 0.6960

Normal 0 false false false EN-US X-NONE X-NONE /* Style Definitions */ table.MsoNormalTable {mso-style-name:"Table Normal"; mso-tstyle-rowband-size:0; mso-tstyle-colband-size:0; mso-style-noshow:yes; mso-style-priority:99; mso-style-qformat:yes; mso-style-parent:""; mso-padding-alt:0in 5.4pt 0in 5.4pt; mso-para-margin-top:0in; mso-para-margin-right:0in; mso-para-margin-bottom:10.0pt; mso-para-margin-left:0in; line-height:115%; mso-pagination:widow-orphan; font-size:11.0pt; font-family:"Calibri","sans-serif"; mso-ascii-font-family:Calibri; mso-ascii-theme-font:minor-latin; mso-fareast-font-family:"Times New Roman"; mso-fareast-theme-font:minor-fareast; mso-hansi-font-family:Calibri; mso-hansi-theme-font:minor-latin;}

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD: Extra gains in the pipeline above 0.6520

AUD/USD partially reversed Tuesday’s strong pullback and regained the 0.6500 barrier and beyond in response to the sharp post-FOMC pullback in the Greenback on Wednesday.

EUR/USD jitters post-Fed with NFP Friday over the horizon

EUR/USD cycled familiar territory on Wednesday after the US Federal Reserve held rates as many investors had expected. However, market participants were hoping for further signs of impending rate cuts from the US central bank.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Ethereum plunges outside key range briefly as US Dollar Index gains strength

Institutional whales appear to be dumping Ethereum after recent dip. Fed’s decision to leave rates unchanged appears to have helped ETH's price recover slightly. SEC Chair Gensler has misled Congress, considering recent revelations from Consensys suit, says Congressman McHenry.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.