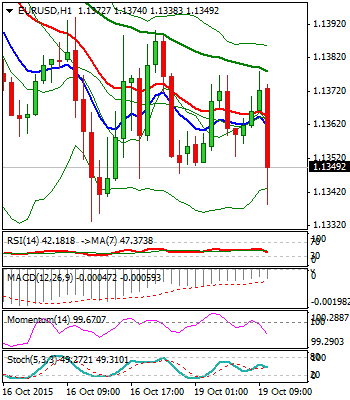

EURUSD

Near-term price action consolidates within 1.1331/1.1395 range, following two-day pullback from 1.1495, double upside rejection level. Pullback cracked pivotal 1.1355/42 support zone, broken former bull-channel top / 13 Oct higher low, but failed to close below and confirm break. Two days close in red and weekly Doji with long upper shadow, keep the downside under pressure. However, daily technicals are bullishly aligned, with rising 10SMA offering immediate support at 1.1342.

Slide below Friday’s low at 1.1331, would bring more negative signals, for extension towards psychological 1.13 support and 1.1270 breakpoint, daily 20 SMA / thin daily 1.1260/70 Ichimoku cloud.

On the other side, consolidation top at 1.1395, also Fibonacci 38.2% of 1.1494/1.1331 pullback, marks initial pivot, break of which would signal higher base formation and shift near-term focus higher.

Neutral near-term tone is expected while the price holds within 1.1331/95 consolidation.

Res: 1.1378; 1.1395; 1.1418; 1.1432

Sup: 1.1331; 1.1300; 1.1270; 1.1253

GBPUSD

Cable consolidates within daily Ichimoku cloud, following last week’s strong rally that accelerated from 1.5198 higher low and peaked at 1.5506, on brief probe above daily Ichimoku cloud top at 1.5490 and psychological 1.55 barrier.

Overall bulls favor fresh attack and final break above daily cloud top, for resumption of larger rally from 1.5105, towards initial target at 1.5526, Fibonacci 76.4% of 1.5656/1.5105 downleg and in extension to eye psychological 1.5600 level, ahead of key barrier at 1.5656, peak of 18 Sep.

The second consecutive weekly bullish close supports the scenario.

Near-term consolidation floor, supported by daily cloud base at 1.54 zone, is required to hold and prevent the pair from deeper pullback.

Res: 1.5506; 1.5526; 1.5561; 1.5597

Sup: 1.5464; 1.5425; 1.5404; 1.5389

USDJPY

Two-day recovery off 118.05, seven-week low, was capped by daily Kijun–sen line at 119.63, keeping intact pivotal 119.87 barrier, former triangle support, reinforced by daily 20SMA.

Overall picture remains bearish and is expected to look for fresh attempts lower, despite failure to confirm bearish break, after weekly close occurred above former range floor at 118.67.

Look for further consolidation under falling daily 20AMA, ahead of fresh attempts lower, as favored scenario.

Only firm break higher and daily close above 120 handle, would sideline downside risk.

Thin daily Ichimoku cloud remains key barrier at 120.32/70.

Res: 119.65; 120.00; 120.00; 120.32

Sup: 119.04; 118.89; 118.66; 118.24

AUDUSD

Aussie jumps above 0.73 barrier, supported by better than-expected Chinese data. The rally sidelines immediate downside risk, signaled by Friday’s close in red and today’s fresh bearish extension that so far found footstep at 0.7235.

Near-term technicals are gaining traction, while overall picture remains bullish and favors resumption of larger uptrend from 0.6935, on completion of 0.7380/0.7196 consolidation.

Fresh strength emerges again above falling daily Ichimoku cloud top, with regain of minimum 0.7335, Friday’s high and 0.7347, daily 100SMA, required to confirm recovery and re-focus recent top and breakpoint at 0.7380, 12 Oct high.

Alternative scenario requires break below today’s low at 0.7235, to expose 0.7196, correction low and weaken near-term structure on violation of the latter.

Res: 0.7335; 0.7347; 0.7361; 0.7380

Sup: 0.7263; 0.7235; 0.7196; 0.7157

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price stalls rebound below $2,330 as US Dollar recovers

Gold price is holding the rebound below $2,330 in Asian trading on Thursday, as the US Dollar recovers in sync with the USD/JPY pair and the US Treasury bond yields, in the aftermath of the Fed decision and the likely Japanese FX intervention.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.