EURUSD

Yesterday’s strong bearish acceleration, seen after false attempt above daily 20SMA, ended day in long red candle and closed below pivotal daily 200SMA support at 1.1175. Fresh extension lower, on today’s trading, cracked daily 100SMA at 1.1143, the last significant obstacle en-route towards key support and short-term base lows at 1.1100/1.1085. Break here is needed to confirm an end of month-long congestion, entrenched between 1.1085 and 1.1458, confirmed by monthly long-legged Doji candle.

Near-term bears may be delayed for correction on oversold conditions. Former pivot, 200SMA, now acts is immediate resistance at 1.1175, which lies near Fibonacci 38.2% of 1.1259/1.1133 fall, with extended rallies, expected to hold below 1.1211, Fibonacci 61.8% retracement, which guards 20SMA pivot at 1.1232.

Res: 1.1180; 1.1211; 1.1232; 1.1260

Sup: 1.1133; 1.1105; 1.1086; 1.1020

GBPUSD

Cable approached psychological 1.5100 support, on yesterday’s fresh acceleration lower that left red daily candle with long upper shadow, signaling strong selling interest. Firm bullish tone favors final attack at 1.5085 target, Fibonacci 61.8% retracement of Apr/June1.4563/1.5928 rally, violation of which would expose psychological 1.50 support. The notion is supported by 10/200SMA’s death cross and formation of 20/200SMA’s death cross at 1.5327.

Near-term price action consolidates above fresh lows at 1.5105, with narrow consolidation seen so far, ahead of fresh push lower. Only extended rallies above 1.5265, falling daily 10SMA / broken bull-trendline, drawn off 1.4563, low of 13 Apr, would sideline immediate downside threats.

Res: 1.5165; 1.5212; 1.5265; 1.5327

Sup: 1.5105; 1.5085; 1.5000; 1.4975

USDJPY

Fresh strength from 119.23, low of 29 Sep, where triangle support contained dips, improves near-term structure. Return above daily 20SMA at 120.08 and attempts at triangle’s upper boundary, currently at 120.30, turned near-term focus higher, for renewed attempts higher. Break higher to open thin daily Ichimoku cloud (120.52/120.70) and 200SMA at 120.93. Break above these barriers is required near-term bullish structure for final attempt at 121.30, short-term congestion ceiling.

Alternatively, loss of 20SMA handle and return to triangle support line, currently at 119.40, would weaken near-term structure.

Res: 120.33; 120.52; 120.70; 120.93

Sup: 120.00; 119.75; 119.40; 119.23

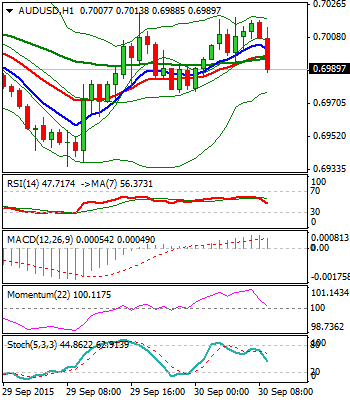

AUDUSD

The pair formed double-bottom at 0.6935 and accelerated today above initial barrier and former consolidation top at 0.7040. Fresh strength probes above pivotal daily 20SMA at 0.7052, also near Fibonacci 38.2% of 0.7278/0.6935 fall, with sustained break here, needed to give bullish signal for further recovery.

Rally penetrated into 4-hour Ichimoku cloud, top of which marks next barrier at 0.7107, also the mid-point of 0.7878/0.6935 fall, with next pivotal barrier laying at 0.7147, Fibonacci 61.8% retracement.

Daily close above 20SMA, is required to confirm correction.

Res: 0.7107; 0.7147; 0.7205; 0.7248

Sup: 0.7040; 0.7020; 0.6996; 0.6977

The information contained in this document was obtained from sources believed to be reliable, but its accuracy or completeness cannot be guaranteed. Any opinions expressed herein are in good faith, but are subject to change without notice. No liability accepted whatsoever for any direct or consequential loss arising from the use of this document.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.