The Euro pulls back from fresh high at 1.1712, levels last traded in Jan 2015. Yesterday’s strong rally left long daily bullish candle, marking strongest daily gains since Mar 18. Fresh easing, inspired by profit-taking, so far holds above psychological 1.15 support that marks the first trigger and sustained break here to open way for deeper pullback. The notion is signaled by overbought daily Stochastic that starts to point lower and could give stronger bearish signal, on reversal from overbought zone. Extension below 1.15 handle is expected to open next layers of strong supports: broken bear-trendline that connects Feb/May peaks at 1.1532/1.1465 and lies at 1.1390, ahead of 200SMA at 1.1328. Overextended daily studies support this scenario. Session low at 1.1524, marks initial support. On the upper side, initial resistance lies at 1.1620, Asian high, ahead of yesterday’s spike high at 1.1712.

Res: 1.1620; 1.1679; 1.1712; 1.1752

Sup: 1.1524; 1.1500; 1.1418; 1.1390

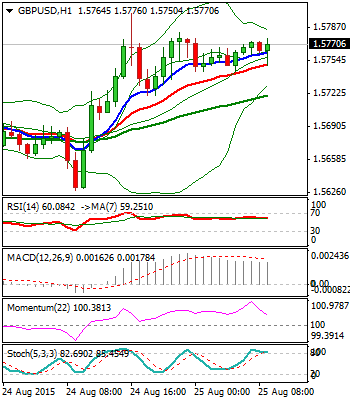

GBPUSD

Cable rallied yesterday and eventually closed above pivotal 1.57 zone, leaving long daily bullish candle and cracking the next target at 1.5801, 24 June former lower top. Bullish setup of daily studies, favors further upside and final push towards key 1.5928 barrier, high of 18 June, as yesterday’s rally probed above 76.4% Fibonacci retracement of 1.5928/1.5327 downleg. Narrow consolidation is under way and so far contained above 1.57 zone, now acting as pivotal support and being reinforced by rising daily Tenkan-sen line. Only sustained break below here would trigger stronger pullback. Such scenario is supported by overbought daily Stochastic that would give strong bearish signal, in case of reversal. Otherwise, expect fresh attempts higher after completion of near-term consolidation phase, while 1.57 support zone holds.

Res: 1.5776; 1.5801; 1.5829; 1.5908

Sup: 1.5744; 1.5720; 1.5680; 1.5628

USDJPY

The pair corrects after yesterday’s strong fall that posted fresh low at 116.13, last traded in mid-Jan, where bears were contained by 38.2% retracement of 100.81/125.84 rally. Recovery attempts probed briefly above psychological 120 barrier, with session range established between 118.24 and 120.09. Structure remains bearish overall and sees fresh weakness as favored scenario, however, stronger bounce, signaled by daily Stochastic reversing from oversold territory, cannot be ruled out. Session high at 120.09, marks initial barrier, ahead of 200SMA at 120.66, close above which to confirm stronger correction.

Res: 119.63; 120.09; 120.66; 121.00

Sup: 118.24; 117.78; 117.00; 116.13

AUDUSD

The pair consolidates within 0.7126 and 0.7231 range, after yesterday’s strong bearish acceleration spiked to fresh 6 ½ low at 0.7036, coming close to our next target at psychological 0.7000 level. Overall tone remains bearish and favors final break through 0.7000 pivot, with consolidative action being so far capped under daily Kijun-sen line at 0.7242 that marks the first upside pivot and should ideally hold, to keep intact yesterday’s high at 0.7310 and daily 10/20SMA’s bear-cross at 0.7326 that maintains downside pressure and marks next breakpoint.

Res: 0.7231; 0.7285; 0.7310; 0.7326

Sup: 0.7168; 0.7126; 0.7100; 0.7036

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.