EURUSD

The Euro trades in a tight range, entrenched within daily 100SMA and daily cloud that marks initial range. The lower boundary was cracked but no clear break seen so far, to confirm downside resumption and open next support at 1.0992, daily cloud base. However, near-term structure remains negative and sees further weakness favored. Bearish resumption through initial 100SMA and cloud base, to face week’s low at 1.0952, with short-term support at 1.0818, low of 27 May, expected to come in focus on further acceleration lower. Conversely, daily close above Ichimoku cloud top, would ease immediate downside risk, while return above falling daily 10SMA at 1.1167, would provide relief and focus daily 20SMA breakpoint at 1.1232. Lower volumes are expected due to US holiday, with uncertainty ahead of Sunday’s Greek referendum, requiring caution.

Res: 1.1140; 1.1167; 1.1193; 1.1232

Sup: 1.1039; 1.1016, 1.0992; 1.0952

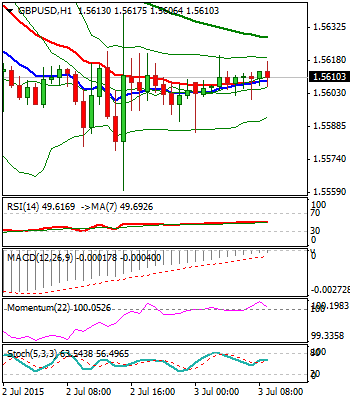

GBPUSD

Cable ended yesterday’s trading in long-legged Doji, signaling hesitation on approach to 1.5548, 50% of 1.5168/1.5928 rally / daily Kijun-sen line, as yesterday’s dip was contained at 1.5560. This confirms 1.5548/60 as strong near-term support zone. Prolonged consolidation is expected, as near-term studies are in neutral/negative mode, while daily studies hold bullish tone but conflicting daily MA’s suggest no clear direction. Loss of 1.5548 handle would soften near-term tone for further correction and expose next strong support zone and breakpoints at 1.5454, daily 55/200SMA’s Golden cross and daily Ichimoku cloud top at 1.5442. Daily 20SMA caps at 1.5657, with daily close above, required to sideline downside risk.

Res: 1.5638; 1.5657; 1.5700; 1.5729

Sup: 1.5586; 1.5560; 1.5548; 1.5500

USDJPY

The pair consolidates around 123 handle, following yesterday’s recovery rejection at 123.70 and pullback, triggered by disappointing US jobs data. The move is for now seen as corrective action, with 123 support zone required to hold, for fresh attempts higher. Near-term technicals are in neutral mode, while daily studies are mixed and contracting 20d Bollingers, suggest extended consolidation. As yesterday’s probe above descending daily 20SMA, was seen as false break, this now marks initial barrier at 123.33, with close above, required to signal fresh rallies. Extension above yesterday’s high at 123.70 to confirm and expose pivotal 124.36/42 tops. Otherwise, expect further easing and renewed pressure at pivotal 122 support, on sustained break of 123 handle.

Res: 123.33; 123.70; 124.00; 124.36

Sup: 122.79; 122.34; 122.00; 121.82

AUDUSD

The pair remains under pressure, with overnight’s fresh acceleration lower from session’s high at0.7647, eventually cracking former week’s low at 0.7584, posted after Monday’s gap-lower open. Firm bearish tone is seen on all timeframes and sees scope for final push towards key 0.7531 support, 02 Apr low, to confirm completion of 0.7531/0.8161 corrective phase and signal resumption of broader downtrend. Session peak at 0.7647, offers initial resistance, ahead of falling daily 10SMA at 0.7677 and pivotal daily 20SMA at 0.7710. Only close above here would sideline near-term bears.

Res: 0.7647; 0.7677; 0.7710; 0.7740

Sup: 0.7565; 0.7531; 0.7500; 0.7450

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY crashes nearly 450 pips to 155.50 on likely Japanese intervention

Having briefly recaptured 160.00, USD/JPY came under intense selling to test 155.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.