The Euro trades in near-term corrective phase, off 1.0530 higher low, with two-legged recovery posting fresh high at 1.0745 so far. The pair stays short of pivotal 1.08 zone, where sideways-moving 20SMA lies and close above here is required to confirm recovery. Today’s pullback could be seen as corrective action, ahead of fresh attempts higher, as freshly established near-term bulls are still in play and would allow dips to 1.0612, Fibonacci 61.8% retracement of 1.0530/1.0745 rally / hourly Ichimoku cloud base, where reversal should be ideally formed. Otherwise, initial signals of lower top formation at 1.0745 will be generated, with further easing and break below higher base at 1.0570, required to confirm reversal and expose key supports at 1.0530 and 1.0519.

Res: 1.0663; 1.0706; 1.0745; 1.0776

Sup: 1.0624; 1.0612; 1.0590; 1.0570

GBPUSD

Cable maintains positive near-term tone and extends three-day recovery from 1.4563, 13 Apr low, to 1.4878, retracing over 76.4% of the downleg from 1.4970 to 1.4563. Three positive daily closes in long green candles, signal reversal, as the price establishes above daily 20SMA and cracked broken bull-trendline off 1.4633, former low. Bullish near-term studies favor further recovery and retest of pivotal 1.4970/1.50 resistance zone, tops of former consolidation range, break of which to confirm reversal. Corrective easing faces initial support at 1.4800, former high, with extended dips to be ideally contained above 1.4758, Fibonacci 38.2% of 1.4563/1.4878 upleg. Otherwise, extended weakness and violation of 1.4698/84, 15 Apr trough / Fibonacci 61.8% retracement, would neutralize near-term bulls and signal an end of corrective phase.

Res: 1.4878; 1.4920; 1.4970; 1.5000

Sup: 1.4800; 1.4758; 1.4721; 1.4698

USDJPY

The pair remains at the back foot in the near-term, as yesterday’s repeated close in red and extension below daily cloud base at 118.92, to fresh low at 118.79, daily 20d lower Bollinger band, nearly fully retraced 118.70/120.83 upleg. With daily indicators breaking into negative territory and firm bearish tone on lower timeframes technicals, scope is seen for final push towards pivotal 118.31 support, low of 26 Mar, to complete 118.31/120.83 bull-phase and signal formation of daily failure swing, for further easing towards lower boundary of three-month 115.83/122.01 consolidation range. Corrective actions off 118.78, hourly double-bottom, should be ideally capped under 119.73, yesterday’s high and lower top of 120.83/118.78 descend.

Res: 119.42; 119.73; 120.10; 120.42

Sup: 119.22; 118.78; 118.70; 118.31

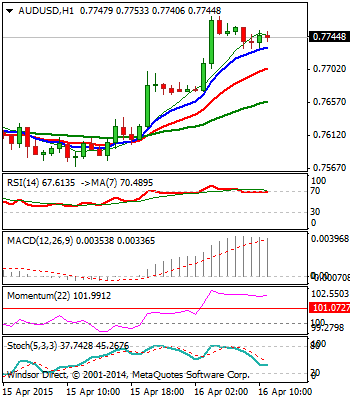

AUDUSD

The pair accelerates above pivotal 0.7736 barrier, 09 Apr high and top of near-term consolidation range, signaling near-term base formation. Two consecutive positive daily closes and today’s fresh acceleration through daily 20SMA that also penetrated daily cloud base and so far reached 0.7780 high, Fibonacci 61.8% of 0.7936/0.7531 downleg, sidelines immediate downside risk. Further rallies and daily close above 0.7782 barrier is required to signal formation of daily double-bottom, for stronger recovery. Bullish near-term studies support the notion, with corrective easing on overbought hourly technicals, expected to find support at 0.7690 zone, daily 20SMA / Fibonacci 38.2% of 0.7553/0.7780 upleg.

Res: 0.7780; 0.7841; 0.7882; 0.7911

Sup: 0.7730; 0.7690; 0.7667; 0.7640

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 as USD rebounds

EUR/USD lost its traction and retreated slightly below 1.0700 in the American session, erasing its daily gains in the process. Following a bearish opening, the US Dollar holds its ground and limits the pair's upside ahead of the Fed policy meeting later this week.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.