The Euro continues to gradually move lower on approach to initial targets at 1.2800, round figure support and more significant 1.2786, Fibonacci 61.8% of 1.2042/1.3992 ascend and higher base of Mar/July 2013 at 1.2754/44. Overall picture remains bearish and sees further downside favored, with extension below 1.2744, expected to open 1.2660, Nov 2012 low, the last significant obstacle on the way towards 1.2042, low of 2012. Lower timeframes studies show negative tone prevailing on 4-hour chart and consolidation above 1.28 handle, marked by neutral hourly technicals. Consolidation high at 1.2866, offers initial resistance zone, reinforced by bear-trendline, drawn off 1.2978, along with 1.2877, Fibonacci 38.2% of 1.2978/1.2815 downleg. More significant barrier lies above 61.8% retracement at 1.2928 lower platform, clearance of which to expose 1.30 breakpoint. Overextended daily studies, with RSI / MACD bullish divergence developing, suggest corrective action in the near-term.

Res: 1.2877; 1.2900; 1.2928; 1.2978

Sup: 1.2841; 1.2815; 1.2800; 1.2786

GBPUSD

Cable’s rally off 1.6284, 19 Sep corrective pullback’s low, lost traction on approach to 1.64 barrier, bringing near-term focus again at lower targets. Retest of 1.63, round-figure support and bull-trendline, drawn off 1.6050 low, sees increased risk of attack at 1.6284, with break lower to signal resumption of near-term descend from 1.6522 and expose 1.6231, Fibonacci 61.8% of 1.6050/1.6522 and 1.6159, 16 Sep higher low. On the other side, holding above the trendline support, would keep hopes of fresh attempts higher in play. Regain 1.64 handle is seen as minimum requirement to confirm bullish scenario.

Res: 1.6389; 1.6400; 1.6431; 1.6479

Sup: 1.6300; 1.6284; 1.6230; 1.6200

USDJPY

The pair trades in near-term consolidative mode, under fresh high at 109.42, posted last week. Near-term risk of further hesitation ahead of short-term targets at psychological 110 and 110.66, Aug 2008 peak increases, as hourly structure is weakening and consolidation floor at 108.57, was taken out. The notion is supported by yesterday’s Inside Day candle, which suggests a pause ahead of 110.00/110.66 targets. Fresh weakness could extend to 108/ 107.80, round-figure / Fibonacci 61.8% of 106.79/109.42 ascend, with strong support and breakpoint, lying at 107 zone.

Res: 108.57; 108.83; 109.00; 109.18

Sup: 108.23; 108.00; 107.80; 107.50

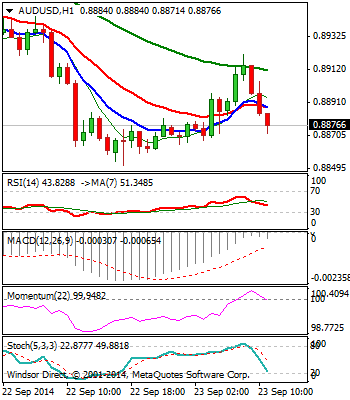

AUDUSD

The pair corrects higher after yesterday’s fresh weakness through 0.89 handle, reached new low at 0.8851, coming ticks away from initial target at 0.8846, Fibonacci 61.8% expansion of the wave from 0.9110 / 05 Aug 2013 low. Overall negative structure keeps the downside in focus, with near-term targets at 0.88, then 0.8783, Fibonacci 76.4% expansion and 0.8682, 100% expansion, ahead of key short-term support at 0.8658, 24 Jan 2014 low. Corrective actions should be ideally capped under 0.90 barrier, while only break here would signal stronger corrective action and delay immediate bears.

Res: 0.8921; 0.8950; 0.8990; 0.9011

Sup: 0.8846; 0.8819; 0.8800; 0.8783

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY rebounds above 156.00 after probable Japan's intervention-led crash

USD/JPY is staging a solid comeback above 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold prices skyrocketed as Powell’s words boosted the yellow metal

Gold prices rallied sharply above the $2,300 milestone on Wednesday after the Federal Reserve kept rates unchanged while announcing that it would diminish the pace of the balance sheet reduction.

Solana price dumps 21% on week as round three of FTX estate sale of SOL commences

Solana price is down almost 5% in the past 24 hours and over 20% in the last seven days. The dump comes as the broader crypto market contracts with Bitcoin price leading the pack as it slides below the $58,000 threshold to test the Bull Market Support Band Indicator.

The FOMC whipsaw and more Yen intervention in focus

Market participants clung to every word uttered by Chair Powell as risk assets whipped around in a frenetic fashion during the afternoon US trading session.