Near-term tone is positively aligned and sees the upside targets at 1.3000/1.3040 zone, round figure / 50%/61.8% retracement of 1.3153/1.2858 downleg in focus, as the price ticked higher, approaching initial 1.30 barrier. These levels are seen as turning points and sustained break would signal stronger recovery action in the near-term. Broken-bull-trendline off Nov 2012 low, now offer support and would keep afloat bulls, developing on lower timeframes charts. On the other side, overall picture remains negative, with downside risk towards 1.2786/50 targets, expected to remain in play, as long as 1.3153 lower top and breakpoint stays intact.

Res: 1.2977; 1.2993; 1.3000; 1.3040

Sup: 1.2930; 1.2900; 1.2882; 1.2858

GBPUSD

Cable regained strength in near-term action off 1.6159, yesterday’s correction low and cracked important 1.63 barrier. Bulls are coming in play on lower timeframes, which supports attempts through 1.63 hurdle, clear break of which is required to resume recovery rally off 1.6050, low of 10 Sep. However extension above 1.6340 is needed to fill the gap of 08 Sep and confirm recovery action, which will also neutralize bearish engulfing pattern, developing on the daily chart, which requires extension below yesterday’s low at 1.6159, to confirm reversal.

Res: 1.6309; 1.6338; 1.6416; 1.6463

Sup: 1.6247; 1.6210; 1.6184; 1.6159

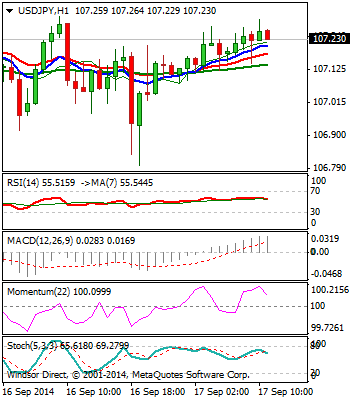

USDJPY

The pair remains positive and regains levels above 107, with near-term price action continuing to move in consolidative mode, off fresh high at 107.38. This keeps immediate focus at the initial target at 107.50, to signal an end of consolidative phase and open 108.28, Fibonacci 161.8% projection of the upleg from 100.81. Extended dips, are expected to hold above 106.50/35 support zone, to keep bulls intact, as the pair is looking for extension towards 108/110 zone in the near term.

Res: 107.38; 107.50; 108.00; 108.28

Sup: 106.79; 106.50; 106.35; 106.00

AUDUSD

The pair holds overall negative tone, with near-term corrective action off fresh low at 0.8982, accelerating after clearance of initial 0.9050 barrier. Hourly studies improved on a probe above 0.91 barrier and see room for further recovery action, as the rally cracked pivotal 0.9100/26, 50%/61.8% retracement of 0.9216/0.8982 zone. Sustained break above the latter to confirm hourly double-bottom formation, revive bulls on still weak 4-hour studies and spark further recovery, which would expose 200SMA at 0.9181. Alternatively, false break through 0.91 barrier, would re-focus 0.9050, now acting as support and risk return to the lows below 0.90 handle.

Res: 0.9110; 0.9126; 0.9160; 0.9181

Sup: 0.9059; 0.9050; 0.9000; 0.8980

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0750 to start the week

EUR/USD trades in positive territory above 1.0750 in the European session on Monday. The US Dollar struggles to find demand following Friday's disappointing labor market data and helps the pair hold its ground.

GBP/USD clings to small gains above 1.2550

Following Friday's volatile action, GBP/USD edges highs and trades in the green above 1.2550. Soft April jobs report from the US and the modest improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold price rebounds on downbeat NFP data, eyes on Fedspeak

Gold price (XAU/USD) snaps the two-day losing streak during the European session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Fed.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.