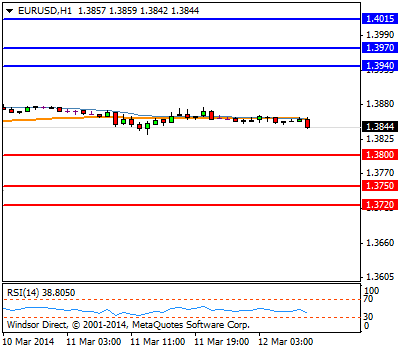

EURUSD

Lack of action again for the euro as we see another day of trading within a narrow 40 pip range. Previous Resistance and support levels still hold as they were not even tested during the last two sessions. We can currently safely say that EURUSD ended its upward trend on the 1 hour chart and now is stuck in a range between 1.3940 and 1.3800.

Res: 1.3940, 1.3970, 1.4015

Sup: 1.3800, 1.3750, 1.3720

GBPUSD

Sterling manages to continue the current downtrend on the 1 hour chart by breaking another support level at 1.6620. It achieved a new low at 1.6595. We have downward signals from the momentum indicators MACD and Momentum (22) plus prices are currently below exponential moving average 55 and the Ichimoku Cloud

Res: 1.6650, 1.6685, 1.6730,

Sup: 1.6580, 1.6540, 1.6580

USDJPY

We saw an almost 60 pip drop for the USDJPY during the previous and current session however it failed twice to break current support of 102.80. It currently trading close to that level and testing it for the third time. If it does manage to break it this will open the way for 102.25 & 101.70. However a rise above 103.75 will reverse our outlook

Res: 103.75, 104, 104.35

Sup: 102.80, 102.25, 101.70

GOLD

Strong upward action from Gold as we saw it break important resistance level 1354 and continue its rise to test 1362. This was the third attempt at breaking 1354, the previous two failed attempts happened on 6th and 3rd of this month. Because of this we will safely say that gold broke out of its range trading mode and we have an upward trend now on the 1 hour chart

Res: 1362, 1375, 1388

Sup: 1337, 1330, 1322,

Recommended Content

Editors’ Picks

USD/JPY briefly recaptures 160.00, then pulls back sharply

Having briefly recaptured 160.00, USD/JPY pulls back sharply toward 159.00 on potential Japanese FX intervention risks. The Yen tumbles amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD extends gains above 0.6550 on risk flows, hawkish RBA expectations

AUD/USD extends gains above 0.6550 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.