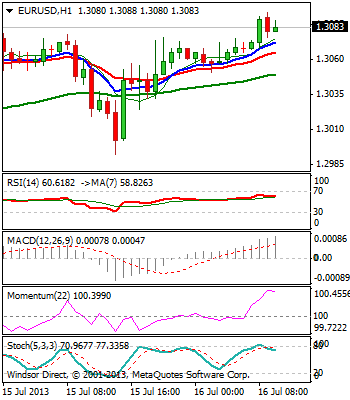

The Euro trades in a prolonged consolidation, holding in a sideways mode, with price action being entrenched within 1.3000/80 range. Hourly studies are still neutral, as the price attempts through the range tops, while 4-hour technicals maintain bullish tone and see scope for fresh strength that needs to clear initial barriers at 1.3121/45, to open key resistance at 1.3205. Double hanging man candle on the daily chart, however, keeps the risk of fresh weakness, with slide below key support levels at 1.3000/1.2980 that keep the downside protected for now, required to bring bears in play.

Res: 1.3100; 1.3121; 1.3145, 1.3205

Sup: 1.3050; 1.3000; 1.2980; 1.2926

GBPUSD

Cable’s hourly studies remain neutral, despite the price dented initial support and range floor at 1.5060, on a dip to 1.5026, as quick recovery above 1.5100, brought the price back to the range. From the other side, 4-hour chart maintain positive, with fresh strength, still being in play. Monday’s Doji candle shows indecision and sees potential for prolonged consolidation, with break of either 1.5026 or 1.5130, required to signal fresh direction.

Res: 1.5170; 1.5192; 1.5200; 1.5220

Sup: 1.5089; 1.5060; 1.5000; 1.4979

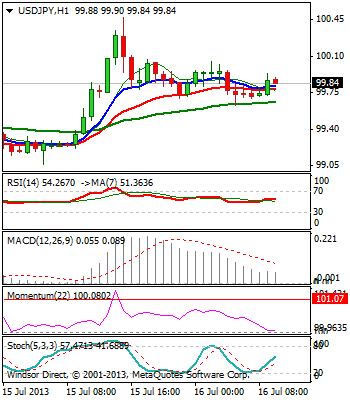

USDJPY

The pair extended short-term recovery off 98.22 low, as the price initially broke above 99.68, consolidation range top and more important psychological 100 barrier. Fresh rally reached 100.47 so far, with corrective pullback being contained at 99.68, previous low / 55DMA. Positively aligned hourly studies keep the upside favored, with sustained break above 100 hurdle, expected to resume recovery and open key 101.52 barrier, 08/07 high. Conversely, downside risk would increase on a violation of initial 99.68 support, while loss of 99.00 handle will be bearish and shift focus towards 98.22 low.

Res: 100.00; 100.47; 100.62; 101.00

Sup: 99.68; 99.34; 99.00; 98.87

AUDUSD

The Aussie remains extends recovery rally from 0.8997 low, as break above 0.9115 congestion top triggered fresh strength to important 0.9200 resistance zone. Freshly established bulls on hourly chart are supportive for further recovery, with 4-hour chart indicators heading north and building up bullish momentum. However, clear break above 0.9200 hurdle is seen as minimum requirement to open way towards key barriers at 0.9304 and 0.9343, 11/07 high and 26/27/07 tops / near 50% of 0.9664/0.8997 descend. Only break above the latter would be signaling more significant corrective action, as larger picture bears remain fully in play.

Res: 0.9200; 0.9232; 0.9252; 0.9304

Sup: 0.9145; 0.9115; 0.9085; 0.9034

Recommended Content

Editors’ Picks

EUR/USD holds positive ground above 1.0700, eyes on German CPI data

EUR/USD trades on a stronger note around 1.0710 during the early Monday. The weaker US Dollar below the 106.00 mark provides some support to the major pair. All eyes will be on the Federal Reserve monetary policy meeting on Wednesday, with no change in rate expected.

USD/JPY extends recovery after testing 155.00 on likely Japanese intervention

USD/JPY is recovering ground after crashing to 155.00 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

Gold tests critical daily support line, will it defend?

Gold price is seeing a negative start to a new week on Monday, having booked a weekly loss. Gold price bears the brunt of resurgent US Dollar (USD) demand and a risk-on market mood amid Japanese holiday-thinned market conditions.

XRP plunges to $0.50, wipes out recent gains as Ripple community debates ETHgate impact

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.