GOLD

Gold remains under pressure and sees further downside favored, after key short-term support at 1240, 03 June former base, was taken out. Fresh acceleration lower broke through the next targets at 1233, Fibonacci 138.2% expansion of the wave from 1322, 08 Aug lower top and 1231, Fibonacci 76.4% retracement of 1182/ 1392 ascend / 23 Jan low, to post new low at 1225. Corrective action is under way and so far stays short of pivotal 1240 barrier. Holding below the latter would keep bears intact, with formation of lower top expected to signal fresh weakness through 1225, towards the next targets at 1218/15, Fibonacci 161.8% expansion / 06 Jan low and psychological 1200 support expected to come in near-term focus, on a break lower.

Res: 1238; 1240; 1248; 1253

Sup: 1231; 1225; 1218; 1215

SILVER

Silver holds overall bearish tone and is consolidating fresh weakness which took out important supports at 18.62/59, 30/01 May lows, on the way towards key med-term support at 18.19, 28 June 2013 low. Denting bull-trendline, drawn off 18.19, at 18.72, signals completion of weekly bearish pennant pattern, which will be confirmed once the price loses 18.19 support. This confirms longer-term target at 8.48, low of Oct 2008, for full retracement of 8.48/49.77, 2008/2011 ascend. Bearish tone prevails on all key timeframes and sees the downside favored, with hesitation on approach to 18.19 support, expected on oversold daily studies.

Res: 18.70; 18.86; 19.00; 19.12

Sup: 18.50; 18.46; 18.19; 18.00

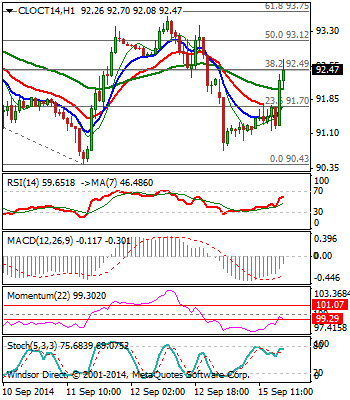

CRUDE OIL

Crude Oil enters near-tern consolidative phase after initial target at 91.18, Fibonacci 138.2% expansion of the wave from 103.37 lower top, was dented on extension to 90.43. Higher low was left at 90.74, which keeps hope of more significant corrective action in the near-term. This scenario, however, requires break above lower tops at 93.65 and 93.92, highs of 12 and 09 Sep, also zone of Fibonacci 61.8% of 98.98/90.43 to be confirmed. Otherwise, further weakness could be expected, as overall tone is negative, with precious week’s close in red, which supports further weakness towards 89.10, Fibonacci 161.8% expansion, next target.

Res: 93.65; 93.92; 94.97; 95.81

Sup: 90.74; 90.43; 90.00; 89.10

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.