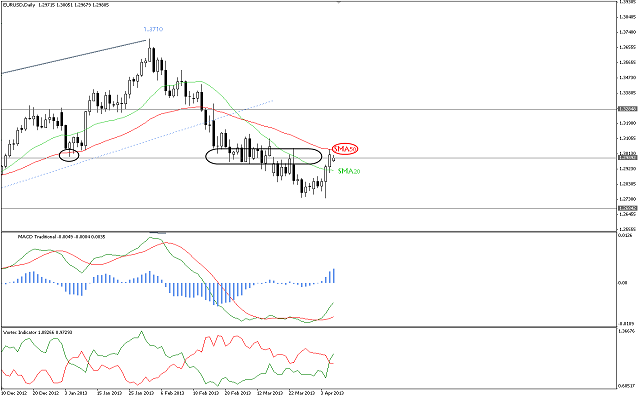

The pair has showed a strong rebound from 1.2750 zones and is currently hovering around very sensitive areas below SMA 50-valued at 1.3040- as seen on the provided daily chart. The positivity on technical indicators suggests further appreciation but we will not be bullish unless prices take out 1.3040.

The trading range for this week is among the key support at 1.2750 and key resistance at 1.3275.

The general trend over short term basis is to the downside targeting 1.2560 as far as areas of 1.3270 remains intact.

Support 1.2945 1.2905 1.2865 1.2800 1.2750

Resistance 1.3040 1.3085 1.3110 1.3140 1.3170

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 1.3040 targeting 1.3245 and stop-loss with four-hour closing below 1.2905 might be appropriate this week

GBP/USD

Cable has managed to breach the initial resistance level of 1.5260-turned into support- to confirm the rebound from 1.5020 zones as seen on the provided daily chart. The current upside recovery may continue supported by stability above SMA 20 and SMA 50 mainly targeting 1.5500 levels but 1.5180 should hold to keep the positivity on technical indicators unchanged.

The trading range for this week is among key support at 1.5130 and key resistance at 1.5555.

The general trend over short term basis is to the downside targeting 1.4225 as far as areas of 1.6875 remains intact.

Support 1.5300 1.5260 1.5180 1.5130 1.5020

Resistance 1.5370 1.5445 1.5500 1.5555 1.5625

Recommendation Based on the charts and explanations above, our opinion is buying the pair above 1.5295 targeting 1.5500 and stop-loss with four-hour closing below 1.5180 might be appropriate

USD/JPY

The violent upside actions seen during the previous week continued with the opening of this week and the pair has started the week with a gap while RSI 14 reflects extreme overbought case. Henceforth, we should stand aside today to see whether the gap will be covered over upcoming sessions or not. Of note, a break above 99.00 will weaken the psychological level of 100.00 and will expose 101.50 territories.

The trading range for this week is among key support at 95.50 and key resistance at 101.50.

The general trend over short term basis is to the upside targeting 100.00 as far as areas of 84.00 remain intact.

Support 98.30 97.60 97.00 96.70 95.50

Resistance 99.00 99.50 100.00 100.60 101.50

Recommendation Based on the charts and explanations above, our opinion is stayind aside until an actionable setup presents itself to pinpoint the next move.

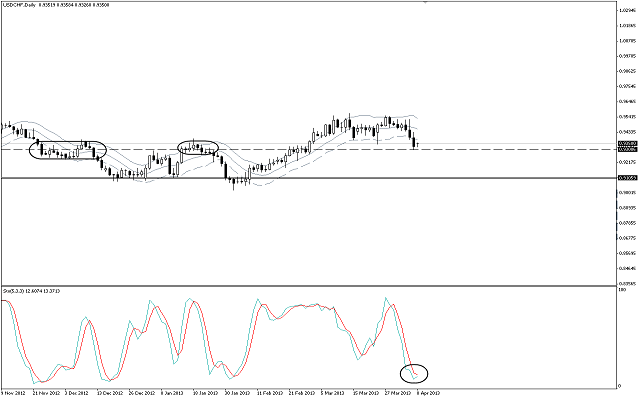

USD/CHF

The pair is currently hovering around very sensitive support zones- previous resistance- as seen on the provided daily chart. Stochastic shows a probability of drawing a positive overlap, while moving below the lower line of Keltner channel is seen as overbought sign. Hence, we should stand aside until the pair affirms the bearish pressures seen during the last week.

The trading range for this week is among key support at 0.9070 and key resistance at 0.9600.

The general trend over short term basis is to the downside stable at levels 0.9775 targeting 0.8860.

Support 0.9300 0.9245 0.9180 0.9125 0.9070

Resistance 0.9400 0.9465 0.9500 0.9530 0.9600

Recommendation Based on the charts and explanations above, our opinion is staying aside until an actionable setup presents itself to pinpoint the next move.

USD/CAD

The pair tried to breach 1.0200 but stabled below it keeping our bearish expectations valid till now, as we anticipate reaching the targets starting at 1.0120 then 1.0075. The downside effect of the harmonic pattern shown on graph is valid, as breaking 1.0140 levels will ease achieving the awaited targets.

The trading range for this week is among the key support at 1.0000 and key resistance at 1.0355.

The general trend over short term basis is to the upside with steady daily closing above 0.9800

targeting 1.0485

Support 1.0165 1.0120 1.0075 1.0055 1.0005

Resistance 1.0200 1.0290 1.0310 1.0355 1.0420

Recommendation Based on the charts and explanations above, our opinion is selling the pair below 1.0200 targeting 1.0140, 1.0100 then 1.0015 and stop-loss with four-hour closing above 1.0290 might be appropriate this week

AUD/USD

AUD/USD has broken pivotal levels between 1.0415 and 1.0385 and resided below them, activating the downside effect over the intraday basis. We now expect bearish objectives reaching 1.0230. The pair finds solid support at 1.0360; it is required to break that level to bolster our bearish expectations, which stand intact, unless if the pair breaches and holds ground above 1.0415.

* Trading range expected this week is between the key support at 1.0150 and the key resistance1.0560.

* Short-term trend is downside targeting 0.9400 if 1.0710 remains intact.

Support 1.0355 1.0300 1.0270 1.0225 1.0200

Resistance 1.0410 1.0440 1.0465 1.0500 1.0560

Recommendation Based on the above graph and analysis, we recommend selling the pair below 1.0365 targeting 1.0300, 1.0230 and 1.0150 and stop-loss by four-hour closing above 1.0410 this week.

NZD/USD

NZD/USD flip-flops around Linear Regression Indicators, received with a minor positivity from Stochastic, whereas the expected bearish direction is still standing. The main condition is that the pair settles below 0.8450 with objectives primarily kicking off at 0.8275. Note that breaking 0.8500 will confirm the pair's return into the ascending channel that was broken earlier.

* Trading range expected this week is between the key support at 0.8165 and the key resistance0.8620.

* Short-term trend is downside targeting 0.8845 if 0.8130 remains intact.

Support 0.8355 0.8310 0.8275 0.8225 0.8200

Resistance 0.8450 0.8480 0.8500 0.8535 0.8575

Recommendation Based on the above graph and analysis, we recommend selling the pair below 0.8400 targeting 0.8310 and 0.8225 and stop-loss by four-hour closing above 0.8500 this week.

Recommended Content

Editors’ Picks

AUD/USD retargets the 0.6600 barrier and above

AUD/USD extended its positive streak for the sixth session in a row at the beginning of the week, managing to retest the transitory 100-day SMA near 0.6580 on the back of the solid performance of the commodity complex.

EUR/USD keeps the bullish bias above 1.0700

EUR/USD rapidly set aside Friday’s decline and regained strong upside traction in response to the marked retracement in the Greenback following the still-unconfirmed FX intervention by the Japanese MoF.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Bitcoin price dips to $62K range despite growing international BTC validation via spot ETFs

Bitcoin (BTC) price closed down for four weeks in a row, based on the weekly chart, and could be on track for another red candle this week. The last time it did this was in the middle of the bear market when it fell by 42% within a span of nine weeks.

Japan intervention: Will it work?

Dear Japan Intervenes in the Yen for the first time since November 2022 Will it work? Have we seen a top in USDJPY? Let's go through the charts.