Theobroma Cacao is native to the South American continent. It’s a finicky tree, sensitive to too much or too little water and will grow only within 20 degrees either side of the equator – a band known as the Cacao/Coffee Belt. T. Cacao made its way to Africa by way of an enterprising Ghanaian agriculturalist, Tetteh Quarshie. (By the way, raw beans are called cacao which are used to produce cocoa). Once the Dutch discovered how to separate cocoa solids from the oils, it became less expensive and a fabulous hit in Europe. This was still during the time of sailing ships, and because of colonial control it was far less costly to ship from colonial Ghana and Côte d'Ivoire. As time went on, Ghana and Côte d'Ivoire became the global source for cacao. Today, Ghana and Côte d'Ivoire satisfies the lion’s share of global demand, around 70% to 75%. For the most part, the price has been stable. Some price spikes occurred during periods of political instability e.g., during the 2011 civil war in Côte d'Ivoire, while a more recent one occurred for several reasons. Côte d'Ivoire shares long and porous borders with Liberia and Guinea - two of the countries affected by the Ebola epidemic. Furthermore, production is declining while demand is increasing.

It takes three to five years for the tree to mature and produce pods and the tree must be pollenated by a specific type of midge fly. Peak production occurs around its tenth year and declines from that point. There are two harvests a year: the main crop and midcrop. Government subsidies for fertilizer, pesticides, cultivation and replacement trees have not been evenly distributed for a variety of reasons. Official data suggest record crops seemingly every year, but the numbers are debatable. A change in climate is shortening the rainy season and extending the dry season. Conditions are not optimal for Theobroma Cacao in West Africa.

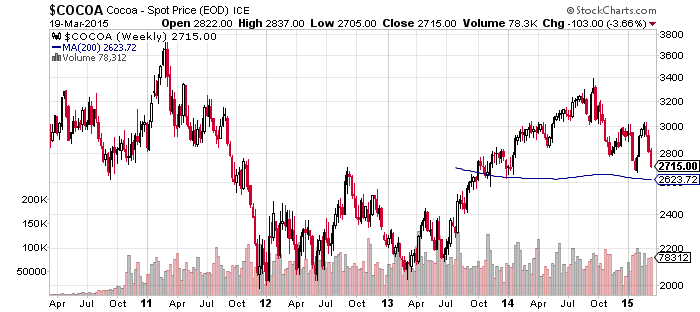

First, note the weekly price history of cocoa over from 2010 until the present:

The standout record high was due to the 2010 - 2011 Ivorian Civil War, after which the price stabilized and fluctuated between $2200 and $2700 a metric ton.

This year’s main crop harvest, just now ending, suffered a high number of rejected beans because of high levels of free fatty acids: “The European Union has set a ceiling for FFAs in cocoa beans of 1.75 percent oleic acid equivalent. However, trucks arriving at the ports of Abidjan and San Pedro contained beans with levels up to 4 percent... ...some exporters now believe estimates showing robust arrivals recently may have been wrong..."I think there's been a lot of double counting these last two weeks due to the high number of trucks that were rejected due to bean quality..."These trucks drove around looking to unload at different operators and that surely artificially inflated the estimated volumes the past two weeks," an exporter in San Pedro said.” (Reuters Africa 13-2-2015)

Cocoa has retraced its recent gains because of slowing growth in China and Europe. However, the threat of Ebola is waning, sitting about where it was in early 2014, but at a time of stronger global growth. Its relative price strength is approaching oversold; it’s sharply below its moving average and nearly at the lower Bollinger Band. The important things to keep in mind are that supply and demand dynamic is changing and accurate accounting is sometimes lacking.

Cacao thrives all along the equator, but not in large enough quantities to compete with Côte d'Ivoire, nor Ghana. The sum total of the 18 largest producers combined is still second to the combined total production of Côte d'Ivoire and Ghana.

Lastly we have the absence of any supply threat from ‘artificial cocoa’. The Theobroma Cacao genome is one of the most complicated on the planet. A recent sequencing identified 28,798 protein-coding genes compared with the 23,000 identified protein-coding genes identified in the human genome. Lastly, because of the genome’s structure, it’s difficult to “re-engineer”. In a nutshell: you won’t see genetically engineered cacao anytime soon.

In the process of making chocolate, cocoa liquor is separated from cocoa butter, and later in the process recombined with different proportions of cocoa liquor, cocoa butter, milk solids and sugar in order to make the different types of chocolate with which we’re familiar. Some of the larger confectionery manufacturers have lobbied for substituting hydrogenated oils in place of cocoa butter and while still being allowed to label it as “real chocolate”. EU and US agencies have been steadfast in their resistance to this lobbying. Cocoa, both solids and butter have a wide variety of applications besides the confectionery industry. The solids are a widely used food additive and the butter has applications in the cosmetics industry. Since the Second World War, the US has listed cocoa as a “strategic” commodity.

So to sum up, if you’re looking to capitalize on a commodity with strong global demand and limited global supply, why run with the herd? The more profitable sweet crude isn’t oil. It’s cacao.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY recovers toward 157.00 following suspected intervention

USD/JPY recovers ground and trades above 156.50 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, the Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.