In the last few days the Australia dollar is starting to feel some selling pressure from the 0.77 level as its eyes remain firmly focused on the long term support level at 0.76. To close out last week the AUD/USD fell sharply lower below 0.77 however it found solid support from the long term support level at 0.76. This level has provided solid support throughout most of this year and has now been called upon again in the last week again. Throughout last week the AUD/USD eased lower and was enjoying support from the key 0.77 level before giving way. A couple of weeks ago it surged higher from below 0.77 up to a three week high, however it ran straight into resistance at the key 0.7850 level, which has performed this role several times this year. A couple of weeks ago it also spent most of its time trading quite steady around the 0.7750 level whilst receiving solid support from 0.77.

Over the last month the resistance level at 0.7850 has played a major role and continues to place selling pressure down on the AUD/USD. Throughout this same period it has been enjoying rock solid support from the long term support level at 0.76 which has allowed it to rebound strongly back up to above 0.78 on more than one occasion. Throughout the second half of May the Australian dollar fall sharply from a four month high above 0.8150 down to the key support level at 0.76. This level has been a significant level for a couple of months and has propped the Australian dollar up on multiple occasions. This recent price action has been a significant reversal as it wasn’t so long ago, the AUD/USD was in a solid medium term up trend having broken through the key 0.7850 level and achieved the four month high above 0.8150.

For most of this year the Australian dollar has traded within a wide trading range between the support at 0.76 and resistance around 0.7850. Earlier this year in February that range was tighter with the support level higher at 0.77. Throughout this period it experienced reasonable swings back and forth between the two key levels with very few excursions beyond the levels. The key level presently remains 0.76 and it will be interesting to see how well the support at this level can hold up and stop the strong down trend the AUD/USD has experienced over the last few weeks. The 4 hour chart below shows how steady the recent decline has been but equally how significant the 0.76 level in being able to temporarily halt the decline.

(Daily chart / 4 hourly chart below)

AUD/USD July 2 at 00:20 GMT 0.7641 H: 0.7641 L: 0.7633

AUD/USD Technical

During the early hours of the Asian trading session on Thursday, the Australian dollar is easing back from the 0.77 level back towards the 0.76 after surging up to there in the last day or so. Current range: trading right below 0.7650.

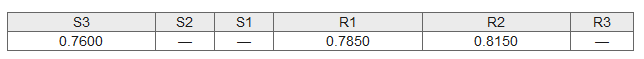

Further levels in both directions:

- Below: 0.7600.

- Above: 0.7850 and 0.8150.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.