The Australian dollar has continued to decline strongly and has recently reached a six week just above 0.76. This is a significant level and the AUD/USD will be looking for support from this level presently. To start this week it was consolidating just below the key 0.7850 level where it then met some resistance before falling sharply. Throughout last week the Australian dollar fell sharply from above 0.8150 down to a two week low below 0.7850 to close out last week. It did enjoy support from this key level for a few days late last week before giving way. In the week prior the Australian dollar enjoyed a solid week which culminated in a new three month high above 0.8150 before easing lower. The last few weeks has seen the Australian dollar on a roller-coaster ride moving from below 0.78 and up to near 0.82. A few weeks ago the Australian dollar surged higher however it ran into resistance right around 0.7950 and 0.80 before easing slightly and consolidating in a narrow range between 0.7850 and 0.79 to finish out the week.

Back in early March the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly back up to above 0.79. Throughout February the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that towards the end of February the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200.

Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

(Daily chart / 4 hourly chart below)

AUD/USD May 28 at 23:55 GMT 0.7657 H: 0.7761 L: 0.7617

AUD/USD Technical

During the early hours of the Asian trading session on Friday, the AUD/USD is trading in a very narrow range around 0.7650. Current range: trading right above 0.7650.

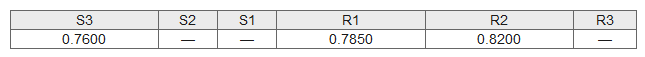

Further levels in both directions:

- Below: 0.7600.

- Above: 0.7850 and 0.8200.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.