For almost the last week the Australian dollar has continued to decline and has recently reached a one month low just above 0.77, To start this week it was consolidating just below the key 0.7850 level where it then met some resistance. Throughout last week the Australian dollar fell sharply from above 0.8150 down to a two week low below 0.7850 to close out last week. It did enjoy support from this key level for a few days late last week before giving way. In the week prior the Australian dollar enjoyed a solid week which culminated in a new three month high above 0.8150 before easing lower. The last few weeks has seen the Australian dollar on a roller-coaster ride moving from below 0.78 and up to near 0.82. A few weeks ago the Australian dollar surged higher however it ran into resistance right around 0.7950 and 0.80 before easing slightly and consolidating in a narrow range between 0.7850 and 0.79 to finish out the week.

Back in early March the Australian dollar made a statement and broke down strongly through the key 0.77 level which then provided significant resistance for the following few days. It was also able to enjoy some short term support around 0.7550 which propped it up and allowed it to rally strongly back up to above 0.79. Throughout February the Australian dollar made repeated attempts to move up strongly to the resistance level at 0.7850 however it was rejected every time and sent back easing lower, which is why this level remains significant presently. Just prior to that towards the end of February the Australian dollar moved through the resistance at 0.7850 to reach a new four week high around 0.7900. In the second half of January, the Australian dollar fell very sharply and break lower from the trading range that had been established roughly between 0.8050 and 0.8200.

Back in mid-January it made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing that week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. Over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently. For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650.

(Daily chart / 4 hourly chart below)

AUD/USD May 26 at 23:55 GMT 0.7743 H: 0.7744 L: 0.7727

AUD/USD Technical

During the early hours of the Asian trading session on Wednesday, the AUD/USD is trading in a very narrow range just below 0.7750. Current range: trading right below 0.7750.

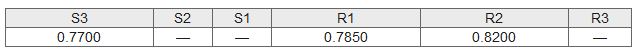

Further levels in both directions:

- Below: 0.7700.

- Above: 0.7850 and 0.8200.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.