After easing back over the last few days, the Australian dollar has fallen sharply in the last couple of days through the key 0.82 level and down to a new multi-year low just below 0.80. Over the last week or so the Australian dollar made numerous attempts at the resistance level at 0.82 only to be sent back often before finally finishing last week moving through this key level. In doing so it was able to reach a one month high near 0.83 before being sold back down again towards 0.82 as the resistance and selling activity above this level kicked in. For most of the last month over the Christmas / New Year period, the Australian dollar seemed to have been content with trading in a narrow range below the resistance at 0.82, which continues to remain a key level as it is presently provides resistance. It was only a week ago that the Australian dollar drifted lower to another new multi-year low near 0.8030. The Australian dollar experienced a disappointing November and December moving from resistance around 0.88 down to the new lows recently.

For a couple of months from September through to November, the Australian dollar did well to stop the bleeding and trade within a range between 0.8650 and 0.88 after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650. Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory.

It seems a long way away now but the Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

Australia’s central bank has kept its benchmark interest rate at a record low for 17 months — the longest period on hold in almost two decades — as the economy has gone from mining investment boom to bust. A growing group of economists say it’s time to cut again. The number anticipating a rate reduction in the first half of the year has grown to 11 of the 35 surveyed by Bloomberg News in Jan. 15-20, up from six out of 26 in December. They include three of Australia’s four major banks, the country’s largest investment bank and Deutsche Bank AG. Reserve Bank of Australia Governor Glenn Stevens, who will hold the year’s first policy meeting on Feb. 3, has been reluctant to reduce the overnight cash rate target from 2.5 percent where it has been since August 2013. “I don’t think we see many people at all saying ‘look, the cost of money is too high, or I can’t get money,’” he said in an interview with the Australian Financial Review published Dec. 12 — his most recent public comments.

(Daily chart / 4 hourly chart below)

AUD/USD January 22 at 22:05 GMT 0.8011 H: 0.8136 L: 0.7995

AUD/USD Technical

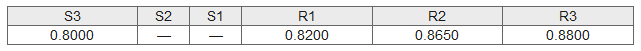

During the early hours of the Asian trading session on Friday, the AUD/USD is trading in a narrow range around 0.8020 after dropping sharply from back above the key 0.82 level down to a new multi-year low below 0.80. Current range: trading right above 0.8000 around 0.8020.

Further levels in both directions:

- Below: 0.8000.

- Above: 0.8200, 0.8650, and 0.8800.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold: Strength of $2,300 support is an encouraging sign for bulls

Gold price started last week under heavy bearish pressure and registered its largest one-day loss of the year on Monday. The pair managed to stage a rebound in the second half of the week but closed in negative territory.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.