Throughout most of last week the Australian dollar dropped sharply back through the support level at 0.8650 and 0.86 before finishing the week rallying higher and creeping back above the 0.8650 level. To start this new week it has rallied back above 0.8650 again before falling lower in recent hours. In the week prior the Australian dollar was able to rally higher and bounce off multi year lows around 0.8550 and in doing so has moved back within the previously well established trading range between 0.8650 and 0.88. Earlier last week the Australian dollar ran into the resistance level at 0.88 again which stood tall and sent prices lower again. A few weeks ago it fell sharply from above the resistance level at 0.88 back down to the support level of 0.8650 before crashing further to a new multi-year high near 0.8550. During the last couple of months the Australian dollar has done well to stop the bleeding and trade within this range after experiencing a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650 and a then eight month low in the process. The resistance level at 0.88 remains a factor and is continuing to place downwards pressure on price, however more recently all eyes have turned on to the support level at 0.8650 to see if the Australian dollar can hold on and stay within reach again.

Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

Abundant supply is driving commodity prices lower, but the good news is that Chinese demand for Australian resources will continue as its economy evolves, the Reserve Bank says. A dramatic increase in commodity exports from Australia and other countries has increased global supply, pushing commodity prices down, RBA head of economic analysis Alexandra Heath said. Her comments to the NSW Mining Industry and Suppliers Conference in Sydney on Friday came after the iron ore spot price this week fell to a fresh five year low of around $US70 per tonne. “Much of the fall in iron ore and coal prices we have seen over the past year or so is the result of increasing global supply, but recently there has also been some easing in demand associated with slower growth in Chinese steel production,” Dr Heath said. “The resulting fall in Australia’s terms of trade is expected to weigh on household income.” But while demand from China was slowing, it would continue to have a “huge appetite” for commodities of many kinds, she said. Dr Heath said China’s urbanisation process had some way further to run, meaning demand for commodities to build housing, infrastructure, utilities and public buildings.

(Daily chart / 4 hourly chart below)

AUD/USD November 24 at 21:45 GMT 0.8615 H: 0.8700 L: 0.8602

AUD/USD Technical

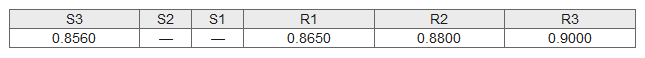

During the early hours of the Asian trading session on Tuesday, the AUD/USD is trying to rally a little higher off the 0.86 level after dropping sharply in the last 12 hours or so. Current range: trading right around 0.8615.

Further levels in both directions:

- Below: 0.8560.

- Above: 0.8650, 0.8800, and 0.9000.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.