During the last few month the Australian dollar has done well to stop the bleeding and trade within a wide range roughly between 0.8650 and 0.88. Prior to that it had experienced a sharp decline throughout September which saw it move from close to 0.94 down to below 0.8650 and an eight month low in the process. Despite the current resistance at 0.88, it was able to move through to a two week high above 0.8900 a few weeks ago before recently falling sharply below 0.87 again. The resistance level at 0.88 remains a factor and is continuing to place downwards pressure on price, however more recently all eyes have turned on to the support level at 0.8650 to see if the Australian dollar can remain above it. Several weeks ago the Australian dollar found some much needed support at 0.8950 and rallied back up to just shy of the key 0.90 level before resuming its decline. The long term key level at 0.90 was called upon to desperately provide some much needed support to the Australian dollar, which it did a little a few weeks ago, however it has more recently provided resistance.

Back at the beginning of September the Australian dollar showed some positive signs as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 however that all now seems a distant memory. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95.

After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year.

Not even super-low interest rates are tempting consumers and businesses out of spending hibernation in Australia. Business confidence was flat in the September quarter, according to figures from the National Australia Bank last Thursday. Forward orders eased, suggesting sluggish domestic demand, and while business conditions did rise, most of the gains came from a surprise jump in July which had since eased off, the report said. NAB chief economist Alan Oster said expectations of any significant rebound in domestic demand were premature. “Both consumers and business remain cautious about spending, despite encouragement from very low interest rates, which is unsurprising given slower rates of income growth,” he said. “Consequently, corporate leverage ratios are low and household savings rates remain high, although there have been signs of improvement more recently.” On the plus side, strong residential construction, boosted by low interest rates and strong investor demand, including foreign investors, would have flow-on effects to the rest of the economy, Mr Oster said. Recent falls in the Australian dollar would also help export competitiveness, but could have a negative impact for some businesses, he said.

(Daily chart / 4 hourly chart below)

AUD/USD October 28 at 01:00 GMT 0.8811 H: 0.8812 L: 0.8795

AUD/USD Technical

During the early hours of the Asian trading session on Tuesday, the AUD/USD is slowly climbing higher back above the key resistance level at 0.8800 again after finishing last week meeting significant resistance there. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to near 0.95 again earlier this year. Current range: trading right around 0.8810.

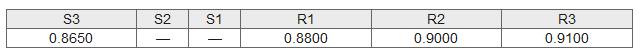

Further levels in both directions:

- Below: 0.8650.

- Above: 0.8800, 0.9000, and 0.9100.

Recommended Content

Editors’ Picks

USD/JPY crashes toward 156.00, Japanese intervention in play?

Having briefly recaptured 160.00, USD/JPY came under intense selling and sank toward 156.00 on what seems like a Japanese FX intervention underway. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Holiday-thinned trading exaggerates the USD/JPY price action.

AUD/USD rallies toward 0.6600 on risk flows, hawkish RBA expectations

AUD/USD extends gains toward 0.6600 in the Asian session on Monday. The Aussie pair is underpinned by increased bets of an RBA rate hike at its May policy meeting after the previous week's hot Australian CPI data. Risk flows also power the pair's upside.

Gold stays weak below $2,350 amid risk-on mood, firmer USD

Gold price trades on a softer note below $2,350 early Monday. The recent US economic data showed that US inflationary pressures stayed firm, supporting the US Dollar at the expense of Gold price. The upbeat mood also adds to the weight on the bright metal.

Ethereum fees drops to lowest level since October, ETH sustains above $3,200

Ethereum’s high transaction fees has been a sticky issue for the blockchain in the past. This led to Layer 2 chains and scaling solutions developing alternatives for users looking to transact at a lower cost.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.