The Australian dollar has seen its sharpest fall in over 12 months as it fell strongly every day last week from near 0.94 down to a six month low at 0.90 to start this week. The doldrums that have befallen the Euro and pound over the last couple of months have finally been caught by the Australian dollar. The long term key level at 0.90 will no doubt be monitored and be called upon to desperately provide some much needed support to the Australian dollar. It showed some positive signs to finish out a couple of weeks ago as it surged higher again bouncing off support below 0.93 and reaching a new four week high around 0.94 before falling sharply again. A few weeks ago it enjoyed a solid week moving up from below 0.9300 to a then three week high around 0.9370 before easing a little lower to finish the week. The Australian dollar reached a three week high just shy of 0.9480 at the end of July after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level.

The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

The Australian economy added 121,000 jobs in August, data from the Australia Bureau of Statistics (ABS) showed on Thursday, much higher than expectations of 12,000 jobs in a Reuters poll. The addition of 14,300 full-time jobs and 106,700 part-time jobs - the most in at least three decades - pushed the unemployment rate down to 6.1 percent, after hitting a 12-year high of 6.4 percent in July. Expectations were for a 6.3 percent reading. Following the data the Australian dollar gained over half a cent against the U.S. dollar, rising as high as $0.9216 after touching a five-month low of $0.9113 in the previous session. Against the New Zealand dollar it rose to 1.1222 from 1.1150. Australia's S&P/ASX 200 index was down 0.1 percent.

(Daily chart / 4 hourly chart below)

AUD/USD September 15 at 01:55 GMT 0.9009 H: 0.9036 L: 0.8999

AUD/USD Technical

During the early hours of the Asian trading session on Monday, the AUD/USD is drifting lower towards the key 0.90 level as it presently sits there waiting to see if the support will hold. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to near 0.95 again. Current range: trading right around 0.9000.

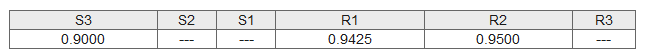

Further levels in both directions:

- Below: 0.9000.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

AUD/USD gains momentum above 0.6500 ahead of Australian Retail Sales data

AUD/USD trades in positive territory for six consecutive days around 0.6535 during the early Asian session on Monday. The upward momentum of the pair is bolstered by the hawkish stance from the Reserve Bank of Australia after the recent release of Consumer Price Index inflation data last week.

EUR/USD: Federal Reserve and Nonfarm Payrolls spell action this week

The EUR/USD pair temporarily reconquered the 1.0700 threshold last week, settling at around that round level. The US Dollar lost its appeal following discouraging United States macroeconomic data indicating tepid growth and persistent inflationary pressures.

Gold trades on a softer note below $2,350 on hotter-than-expected US inflation data

Gold price trades on a softer note near $2,335 on Monday during the early Asian session. The recent US economic data showed that US inflationary pressures staying firm, which has added further to market doubts about near-term US Federal Reserve rate cuts.

These cryptocurrencies could face selling pressure according to an analyst: STRK, ENA, OMNI, JUP, ONDO

Thor Hartvigsen, investor at Heartcore Capital and a crypto analyst has identified a list of cryptocurrencies that are expected to see a massive increase in their supply. Typically, an increase in selling pressure negatively impacts an asset’s price.

Week ahead: Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.