The Australian dollar enjoyed a solid week last week moving up from below 0.9300 to a three week high around 0.9370 before easing a little lower to finish the week. For the best part of the last few weeks the Australian dollar has traded close and around the 0.93 level after spending the preceding few weeks drifting lower from near 0.95. A couple of weeks ago it fell lower to below the 0.93 level level and down towards a two month low near 0.9220, before rallying well to return to the 0.93 level. Throughout July it generally slid lower from close to 0.95 down to its present trading levels around 0.93. It has done well of late to cling onto the 0.93 level after its sharp fall which saw it move from above 0.9400 down to a seven week low below 0.9240. Several weeks ago it was easing back below both the 0.9425 and 0.9400 levels with the former providing some resistance.

The Australian dollar reached a three week high just shy of 0.9480 a month ago after it enjoyed a solid period which saw it surge higher through the resistance level at 0.9425 to the three week around 0.9480, before easing back towards that level. The Australian dollar enjoyed a solid surge higher reaching a new eight month high above 0.95 at the end of June, only to return most of its gains in very quick time to finish out that week. Since the middle of June the Australian dollar has made repeated attempts to break through the resistance level around 0.9425, however despite its best efforts it was rejected every time as the key level continued to stand tall, even though it has allowed the small excursion to above 0.95. After the Australian dollar had enjoyed a solid surge in the first couple of weeks of June which returned it to the resistance level around 0.9425, it then fell sharply away from this level back to a one week low around 0.9330 before rallying higher yet again. Its recent surge higher to the resistance level around 0.9425 was after spending a couple of weeks at the end of May trading near and finding support at 0.9220. The 0.9220 level has repeatedly reinforced its significance as it is again likely to support price should the Australia dollar retreat further.

Throughout April and into May the Australian dollar drifted lower from resistance just below 0.95 after reaching a six month high in that area and down to the recent key level at 0.93 before falling lower. During this similar period the 0.93 level has become very significant as it has provided stiff resistance for some time. The Australian dollar appeared to be well settled around 0.93 which has illustrated the strong resurgence it has experienced throughout this year. For the best part of February and March the Australian dollar did very little other than continue to trade around the 0.90 level, although at the beginning of March it crept a little lower down to a three week low below 0.89. Towards the end of March however, the Australian dollar surged higher strongly moving to the resistance level at 0.93 before consolidating for a week or so.

The strongest demand at Australian bond auctions in a decade reflects yields in a sweet spot: more stable than those in the U.S. and higher than those in Europe. A sale of A$500 million ($470 million) in three-year debt this month drew bids for seven times that amount, the most since 2004, government data show. A A$200 million auction of four-year inflation-linked notes was similarly oversubscribed and today’s A$500 million offering of five-month bills went to just two buyers. Australian bonds are the world’s best performers during the past three months, including currency gains. Reserve Bank of Australia Governor Glenn Stevens has said he plans to keep interest rates on hold as he protects two decades of uninterrupted economic growth. In Europe, which is facing the threat of deflation, bond yields have plunged to records, curbing demand for the securities. Federal Reserve policy makers are considering raising interest rates, fueling speculation Treasury prices will fall.

(Daily chart / 4 hourly chart below)

AUD/USD August 31 at 23:50 GMT 0.9332 H: 0.9340 L: 0.9320

AUD/USD Technical

During the early hours of the Asian trading session on Monday, the AUD/USD is drifting a little lower from its three week high around 0.9370. The Australian dollar was in a free-fall for a lot of last year falling close to 20 cents and it has done very well to recover slightly to well above 0.95 again. Current range: trading right around 0.9330.

Further levels in both directions:

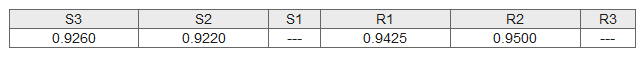

- Below: 0.9260, and 0.9220.

- Above: 0.9425 and 0.9500.

Recommended Content

Editors’ Picks

EUR/USD flirts with daily tops near 1.0730

The continuation of the selling pressure in the Greenback now lends further oxygen to the risk complex, encouraging EUR/USD to revisit the area of daily highs near 1.0730.

USD/JPY looks stable around 156.50 as suspicious intervention lingers

USD/JPY remains well on the defensive in the mid-156.00s albeit off daily lows, as market participants continue to digest the still-unconfirmed FX intervention by the Japanese MoF earlier in the Asian session.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.