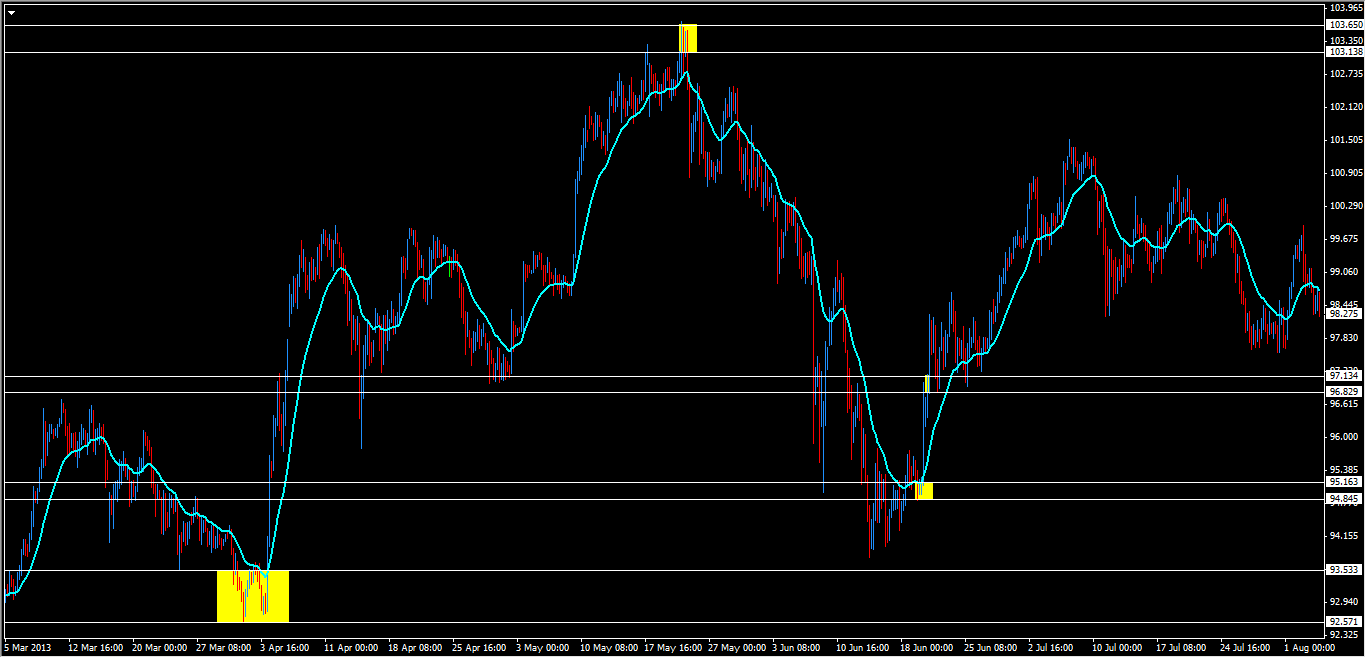

The table below includes updated supply/demand levels on the major currency pairs. The table is updated on a daily basis after the NY close. The levels will help trading decisions for intraday, swing and positions traders.

**RBR = Rally-base-rally

**RBD = Rally-base-drop

**DBD= Drop-base-drop

**DBR= Drop-base-rally

** Refer to footnote for further information on supply/demand analysis

Supply Demand Charts and Analysis

Below readers can graphically identify supply and demand areas registered in our daily supply/demand table above. A brief comment on the outlook has also been added.

1 - USD INDEX (watch LIVE chart)

The index is consolidating recent losses with room to move either side depending on market catalysts.

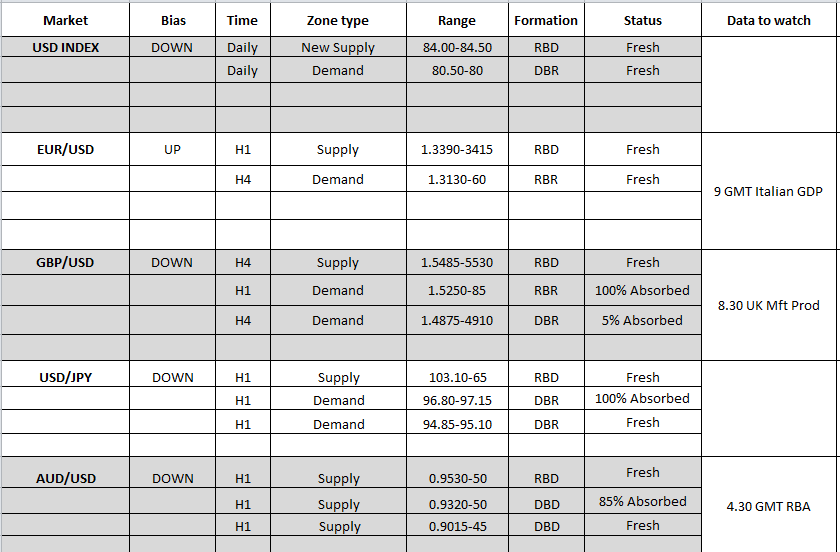

2 - EURO

Consolidation within context of a short term uptrend suggests risk is still for a test of 1.3390-1.3415 before sellers regain control.

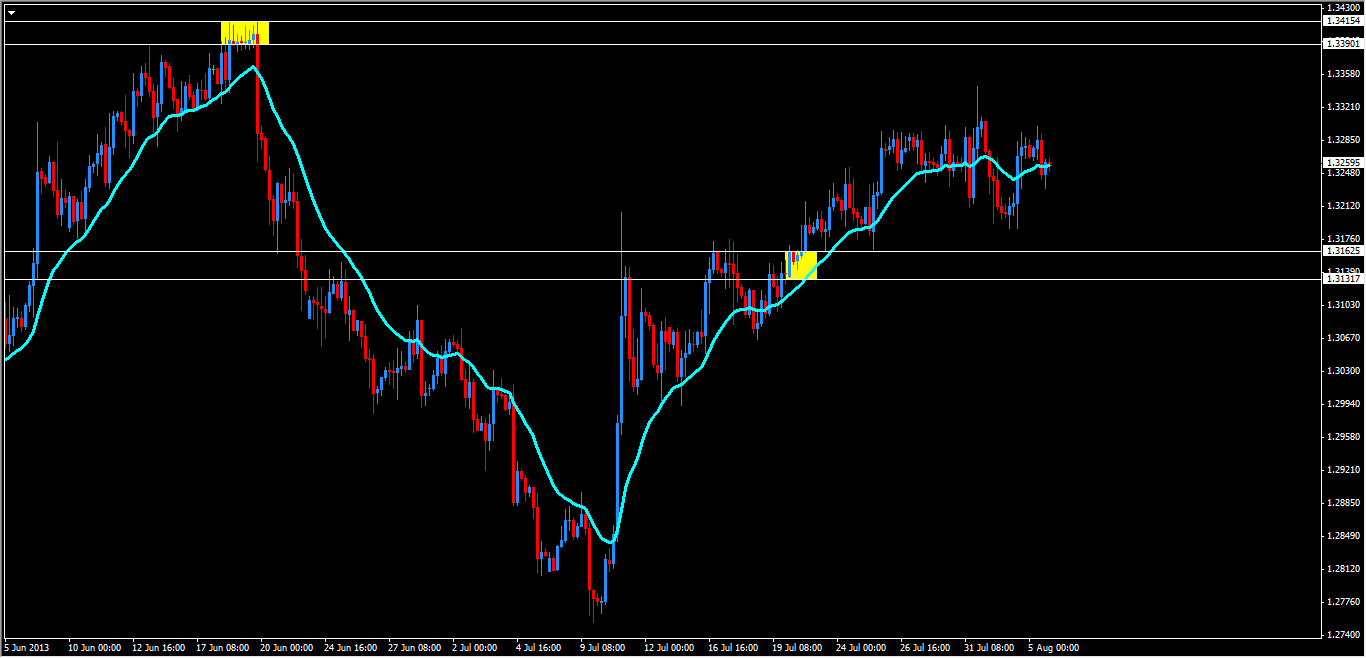

3 - BRITISH POUND

Pair has started to pick up steam again. Any potential upside resumption sees room to run until 1.5485-1.5530 while on the downside, any setback can also lead to fast falls.

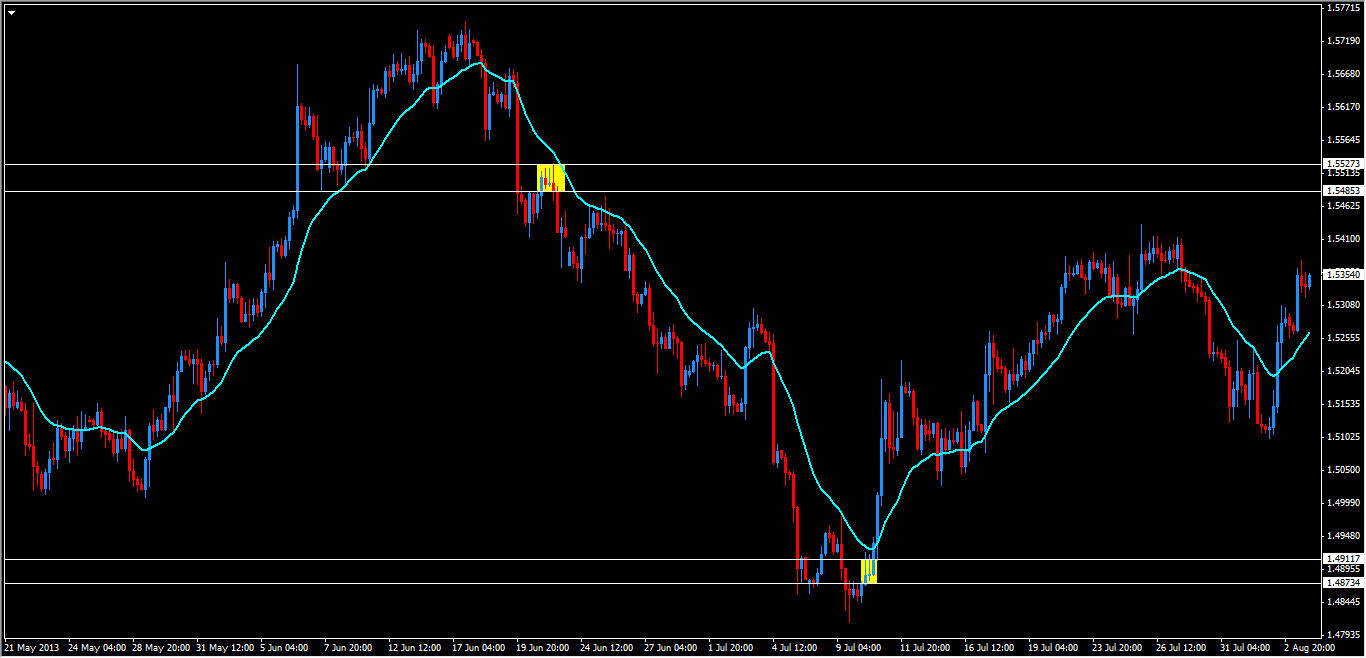

4 - JAPANESE YEN

There is a congestion area around 98.00 which needs to be clear for the Yen to continues its advance.

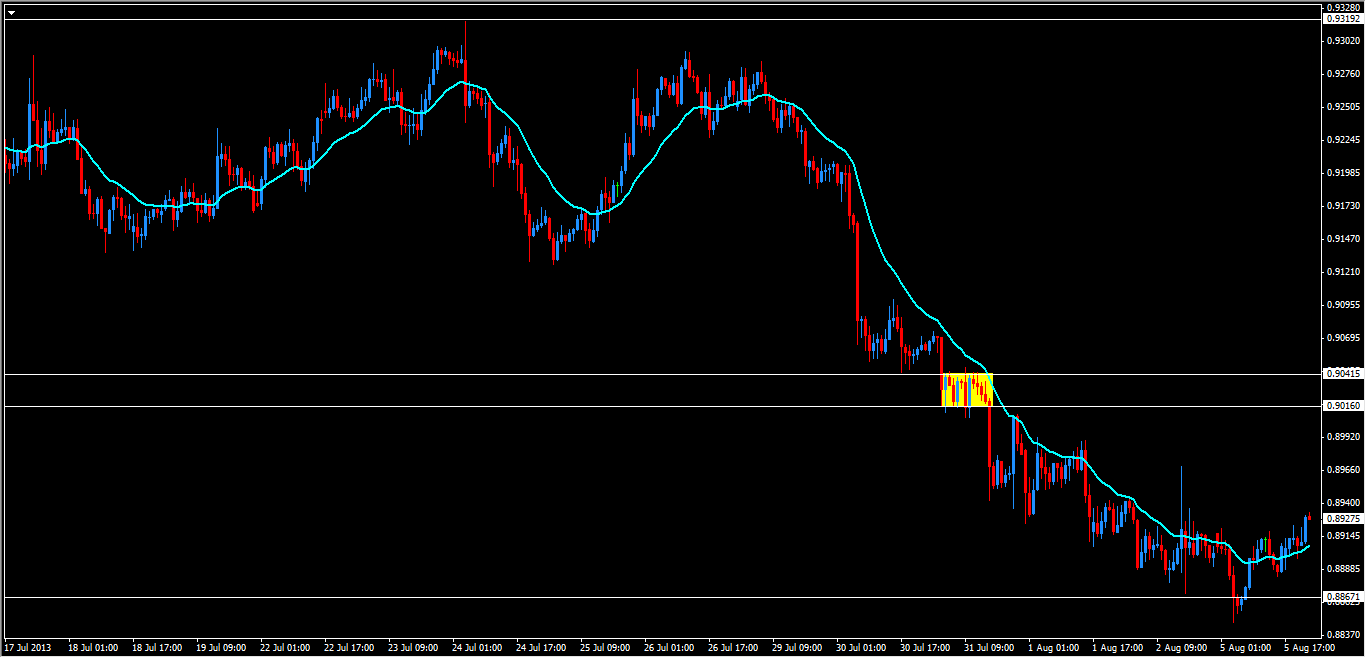

5 - AUSTRALIAN DOLLAR

The pair continues to be a clear sell on rallies.

Good luck everyone!

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

AUD/USD stalls ahead of Reserve Bank of Australia’s decision

The Australian Dollar registered minuscule gains compared to the US Dollar as traders braced for the Reserve Bank of Australia monetary policy meeting. A scarce economic docket in the United States and a bank holiday in the UK were the main drivers behind the “anemic” AUD/USD price action. The pair trades around 0.6624.

USD/JPY extends recovery above 154.00, focus on Fedspeak

The USD/JPY pair trades on a stronger note around 154.10 on Tuesday during the Asian trading hours. The recovery of the pair is supported by the modest rebound of US Dollar to 105.10 after bouncing off three-week lows.

Gold rises as US job slowdown dampens Treasury yields

Gold price rallied close to 1% on Monday, late in the North American session, bolstered by an improvement in risk appetite due to increased bets that the US Federal Reserve might begin to ease policy sooner than foreseen. The XAU/USD trades at around $2,320 after bouncing off daily lows of $2,291.

Ethereum traders show uncertainty following huge whale sale, Robinhood Crypto Wells notice

Ethereum holdings on centralized exchanges continue to decline despite recent whale sales. With Robinhood Crypto as the latest recipient of the SEC's Wells notice, Ethereum spot ETFs look more unlikely.

RBA expected to leave key interest rate on hold as inflation lingers

Interest rate in Australia will likely stay unchanged at 4.35%. Reserve Bank of Australia Governor Michele Bullock to keep her options open. Australian Dollar bullish case to be supported by a hawkish RBA.