The USD index extended its consolidative moves through Monday. The activity come son the back of violated intraday supply level at 82.50 although the climb higher saw the contract disallowed from its next supply at 83.00/83.20 - as per the drop-base-drop from last April - ahead of next offers at 83.50/84.00. Intraday demand noted between 82.20/30 ahead of 81.50/82.00.

Pay attention to the index location. When it nears demand, unfilled buy orders will likely provide broad initial support to the USD, thus one may potentially increase the chances of a USD long play succeeding on such convergence. The same applies if playing USD short positions, with the odds further stacked in one's favour when the index faces supply.

Chart LIVE available at FXstreet.com

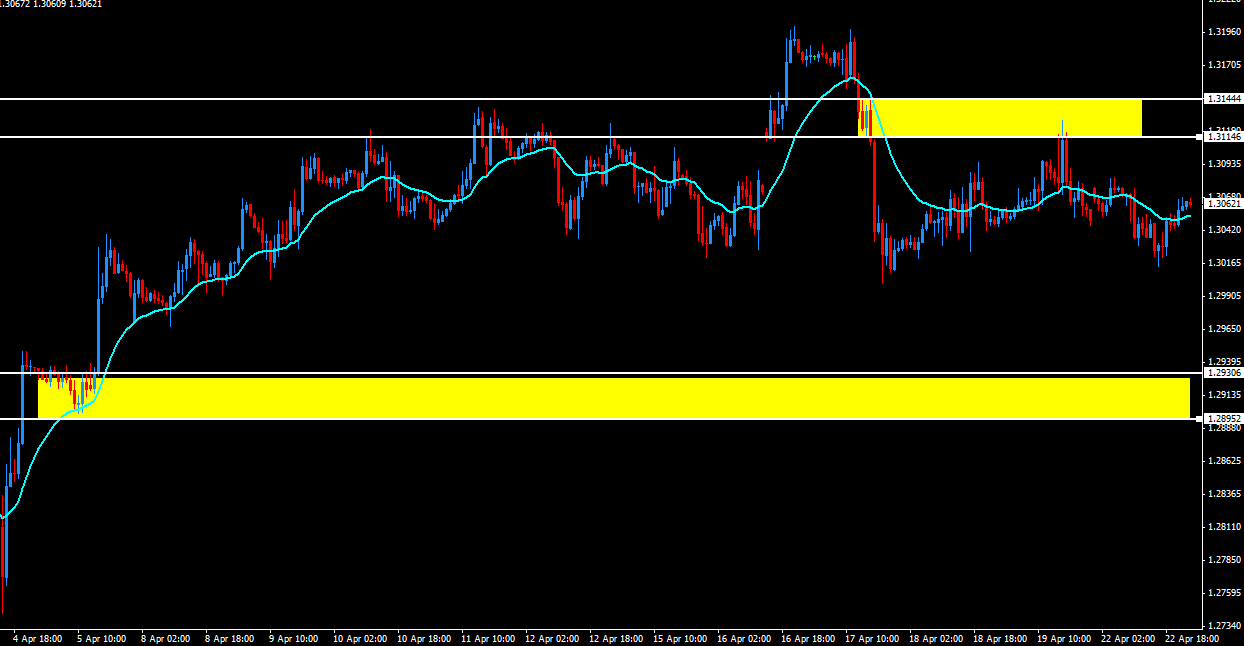

White lines drawn represent supply/demand levels

Below we identify the most relevant supply and demand levels as per obvious imbalances between buying and selling interest in the EUR/USD. These are areas where large institutions were active buyers and/or sellers in recent trading. Supply and demand identification is a critical tool to identify where the unfilled buy/sell orders may lie.

EUR/USD goes nowhere fast, 1.29/2930 or retest of 1.3120/40 next?

No new developments in the EUR/USD, with the supply level at 1.3120/40 -noted in several occasions in our daily report - still a sellers stronghold, while on the downside, any approach at 1.30 conventional/psychological support continues to push prices away. Should the level be broken, fresh demand lies below in the 1.2930/1.29 area, as per the April 5th drop-base-rally, a 'level on top of level', which strengthens the case to see an initial decent bounce off the level in case a test takes place in the next sessions ahead.

Supply and demand levels identified in the chart

Good luck!

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD remains above 1.0700 amid expectations of Fed refraining from further rate hikes

EUR/USD continues to gain ground on Thursday as the prevailing positive sentiment in the market provides support for risk-sensitive currencies like the Euro. This improved risk appetite could be attributed to dovish remarks from Federal Reserve Chairman Jerome Powell on Wednesday.

GBP/USD gains traction above 1.2500, Fed keeps rates steady

GBP/USD gains traction near 1.2535 during the early Thursday. The uptick of the major pair is supported by the sharp decline of the US Dollar after the US Federal Reserve left its interest rate unchanged.

Gold needs to reclaim $2,340 for a sustained recovery

Gold price is consolidating Wednesday’s rebound in Asian trading on Thursday, as buyers await more employment and wage inflation data from the United States for fresh trading impetus. Traders also digest the US Federal Reserve interest rate decision and Chair Jerome Powell's words delivered late Wednesday.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.