Rates

Friday, global core bonds traded in a thin sideways range of no more than about 20 ticks for the Bund and 9/32 for the T-Note future with virtually unchanged closure for the Bund and modest, but technically insignificant gains for the T-Note futures by the end of the US session. The eco calendar was empty apart from EMU consumer confidence, which was better than expected.

The only other noticeable event was the ECB announcement that banks will pay back a very high €18.9B in 3-year LTRO loans. It’s the third week in a row that repayments top €10B and it might start affecting eonia (slightly). In US equity trading, after the S&P set (just) a new all-time high, selling kicked in and the failed test resulted in modest (S&P) to moderate (NASDAQ-) daily losses.

Volumes were very high, which might sometimes be highly relevant when a test of the highs failed, but ahead of the weekend and with triple witching expiries, we don’t draw too many conclusions of the intra-day turnaround. It raises importance of equity trading this week though.

Today, the market calendar is more enticing with the focus on the PMI’s in the euro zone. In the US, the eco calendar contains only the less important Markit manufacturing PMI. ECB’s Liikanen en Linde are scheduled to speak together with Fed’s Stein, who already spoke on Friday though.

In February, the euro zone PMI’s showed a mixed picture. The manufacturing PMI weakened slightly, from 54.0 to 53.2, while the services PMI rose to its highest level since May 2011. For March, the consensus is looking for a limited drop in the manufacturing PMI, from 53.2 to 53.0, which if confirmed would be the second consecutive decline. We believe however that the risks are for a stronger outcome, following a weakening in the previous month. The services PMI, on the contrary, is forecast to have stabilized at 52.6. For the services PMI, we see risks for a downward surprise as domestic demand will probably remain restrained, weighing on the services sector.

US Fed talk was interesting, but couldn’t really bring excitement. Governor Kocherlakota defended his dissent with arguments he used in the past (threshold of 5.5% unemployment rate & inflation of 2.25%) Governor Bullard did elaborate on Yellen’s comment that rates could be increased some 6 months after the end of QE, which would bring us to spring 2015, clearly ahead of what markets expected pre- FOMC. Bullard downplayed the quote and said he thought Yellen was simply saying something governors were hearing from financial markets.

Bullard also said that the individual rate projections (and their mean/average) were not meant as the primary way in which the FOMC would convey info about the likely path of interest rates. He said the statement was the device that the FOMC used to express its opinion on the likely rate path. Governor Fisher, a hawk, didn’t want to put a time frame on rate-rise path. He downplayed to some extend the upward shift in the projected interest rate path, by saying the change in forecasts by Fed officials was made prior to the meeting and somehow this was read as a massive shift, suggesting like Bullard that it is the statement that finally conveys the FOMC views. He sees some exhibition of market risk and thus we think he (and maybe others) will have be pleased by the market reaction.

Overnight, most Asian equity markets trade positive. Chinese manufacturing PMI disappointed (see headlines), while the yuan is stronger . Apparently, not enough to keep Chinese equities down. In the same vein, there are more tensions on Ukraine (see headlines). ECB’s Constancio sounded quite dovish (see headlines). US Treasuries are slightly down, while the dollar is marginally stronger. This suggests a slightly lower opening of the Bund.

Today, the eco calendar is thin, but EMU PMI business confidence has the potential to move bonds, if it would deviate substantially from consensus. Pity enough, we see mixed risks compared to consensus (see above) which doesn’t allow us to give much guidance for the market reaction. Geopolitics is a wildcard, but we are inclined to see these risks as secondary for markets unless they spiral out of control. .

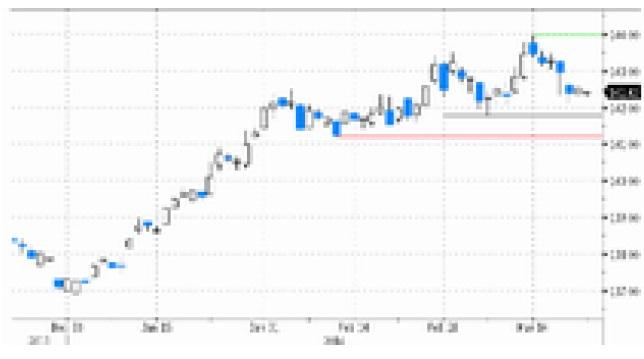

Technically, the US Note future tested the downside of the 123-15+/125-06+ channel and the 10-yr yield the upside of the 2.6-2.8% range. We believe that following the FOMC statement, US eco data will become very important, but this week the eco calendar is still light and mainly devoted to housing data , durable orders and consumer confidence. Maybe not important enough for markets to break out of the current range. A break below/above these technical levels paves the way for a return to 121-08+/3%. For the Bund, the picture is more nuanced as the possibility of more monetary easing by the ECB remains and technical key levels are further away (Bund 141.81 support). As we see US eco data to rebound, but only clearly visible in next month’s releases, and after the FOMC message last week, we favour the downside (higher yields), but time may not be ripe.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

AUD/USD eases toward 0.6500 after mixed Australian trade data

AUD/USD is seeing some fresh selling interest in the Asian session on Thursday, following the release of mixed Australian trade data. The pair has stalled its recovery mode, as the US Dollar attempts a bounce after the Fed-led sell-off.

USD/JPY holds rebound near 156.00 after probable Japan's intervention-led crash

USD/JPY consolidates the rebound near 156.00, having lost nearly 450 pips in some minutes after the Japanese Yen rallied hard on another suspected Japan FX market intervention in the late American session on Wednesday.

Gold price struggles for a firm intraday direction, hover above $2,300

Gold price fails to lure buyers amid a fresh leg up in the US bond yields, modest USD uptick. A positive risk tone also contributes to capping the upside for the safe-haven precious metal. Traders, however, might prefer to wait for the US NFP report before placing aggressive bets.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Fed meeting: The hawkish pivot that never was, and the massive surge in the Yen

The Fed’s latest meeting is over, and the tone was more dovish than expected, but that is because the rate hike hype in the US was over-egged, and rate cut hopes had been pared back too far in recent weeks.