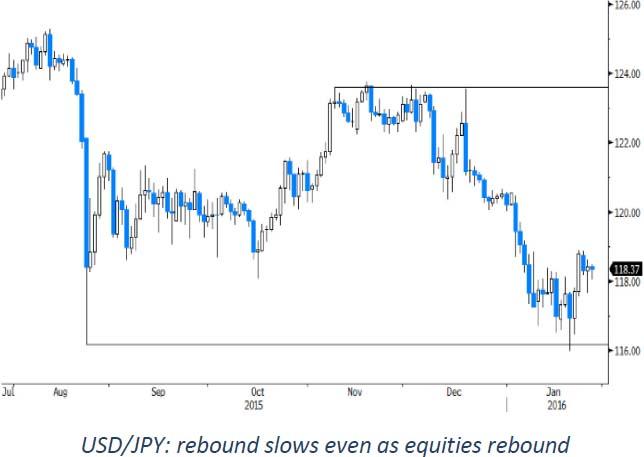

On Tuesday, the dollar held tight ranges against the euro and the yen. The US currency was under slight pressure early in the session as Chinese equities nosedived, but rebounded (temporarily) as European and US markets decoupled from China and as oil rebounded. In a broader perspective, the swings in USD/JPY and EUR/USD were again insignificant. The US eco data, consumer confidence and Richmond Fed manufacturing survey, were OK but largely ignored. EUR/USD closed the session at 1.0870 (from 1.0849 on Monday). USD/JPY closed at 118.42 (from 118.30).

This morning, Asian equities show a mixed picture. Non-Chinese indices mostly show decent gains, but China struggles to join the rebound from Europe and the US yesterday. Chinese industrial profits declined a bigger than expected -4.7% Y/Y in December. Regarding the yuan, the PBOC maintains its recent tactics. It fixed the yuan slightly stronger against the dollar. Despite the disappointing equity performance, the off shore yuan and the Hong Kong dollar are again regaining limited further ground. The PBOC is said to have asked some banks to suspend offshore yuan lending in order to limited short-selling of the currency.

The rebound of oil stalled late yesterday, but oil still preserves most of yesterday’s intraday gain. EUR/USD (1.0860) and USD/JPY (118.30) are still holding tight ranges ahead of the FOMC decision.

Today, there are few eco data in Europe. In the US, the mortgage applications and the new home sales will be published. However, just hours before the release of the FOMC policy statement, the impact of the data on (currency) trading will probably be limited. We expect the Fed to acknowledge to potential impact of the recent rise in market volatility. If the communiqué also refers to a further decline in inflation expectations, markets will see it as a sign of the Fed easing its policy stance and reducing the chances of next rate hike in the near future. For an in depth analysis see the fixed income part of this report. An open reference to a decline in inflation expectations might also be a short-term negative for the dollar. We don’t expect the Fed to openly amend its policy stance only one month after starting policy normalisation. If so, the damage for the dollar should be limited.

That said, in a day-to-day perspective we see risks of the dollar ceding some ground with the established ranges ahead and even after the Fed policy announcement. Equities and oil still can play a role, but we expect also wait-and-see behaviour in these markets ahead of the FOMC statement.

From a technical point of view, EUR/USD failed to regain important resistances at 1.1087 (breakdown) and 1.1124 (62% retracement from the October high). Earlier this month, EUR/USD failed also to sustain below 1.0796 support (07 Dec low). This area was again tested at the end of last week and early this week, but a break didn’t occur. Next support is at 1.0711/1.0650 (correction low: 76% retracement off 1.0524/1.1060) and at 1.0524. On the topside, 1.0985/1.1004 (reaction top) is a first reference. This level was left intact even as sentiment was outright risk-off before the ECB meeting. Next resistance comes in at 1.1060/1.1124 (15 Dec top: 62% retracement). We expect this resistance to be strong and difficult to break. After the ECB announcement, we look to sell EUR/USD on upticks for return action lower in the range. The picture for USD/JPY remains negative below 120, but the pair tries to build a bottom. Still, we think that a sustained return above 120 will be difficult.

Sterling turns back south

There were no data in the UK yesterday. Sterling was under pressure early in the session as (Chinese) equities and oil declined. However, European markets gradually disconnected from Asia. EUR/GBP touched an intraday top in the 0.7660/65 area early in Europe but soon started a gradual intraday downtrend. Markets kept an eye on the hearing before the Treasury committee on the BoE financial stability report. Monetary policy was not the main topic but BoE’s Carney repeated that conditions were not yet in place for a rate hike. He also elaborated on the risk of financing the UK current account deficit due to the uncertainty on the Brexit vote. The quotes had no big impact on sterling; The UK currency was still in the first place driven by the rebound in oil and equities. EUR/GBP closed the session at 0.7575 (from 0.7614). Cable rebounded to close at 1.4350 (from 1.4249).

Today, the nationwide house prices and the BBA loans for house purchases are on the agenda. We expect these data to be only of intraday significance for sterling trading. BoE’s Bailey and Shafik will speak. We doubt they will address monetary policy issues. So, we expect technical trading in the major sterling cross rates ahead of the FOMC decision. A soft market reaction to the FOMC decision might also be a slightly negative for sterling against the euro.

In a longer term perspective, uncertainty on Brexit and global negative risk sentiment are important drivers for sterling weakness. As long as these issues aren’t solved, a sustained sterling rebound is unlikely. The medium term technical picture of sterling against the euro remains negative as EUR/GBP broke above the 0.7493 Oct top. Next resistance stands at 0.7875. A return below 0.74 would be a first indication that sterling enters calmer waters.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 even as USD struggles ahead of data

EUR/USD has erased gains to trade flat near 1.0700 in the European session on Thursday. The pair comes under pressure even as the US Dollar struggles, in the aftermath of the Fed policy announcements and ahead of more US employment data.

GBP/USD turns south toward 1.2500, US data eyed

GBP/USD is consolidating the rebound above 1.2500 in European trading on Thursday. The pair struggles, despite the US Dollar weakness on dovish Fed signals. A mixed market mood caps the GBP/USD upside ahead of mid-tier US data.

Gold price pulls back as market sentiment improves

The Gold price is trading in the $2,310s on Thursday after retracing about three-tenths of a percent on reduced safe-haven demand. Market sentiment is overall positive as Asian stocks on balance closed higher and Oil prices hover at seven-week lows.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.