At the end of last week the dollar was well bid. Rising stocks and core bond yields after the positive headlines from the Ukraine conference in Geneva support the dollar. USD/JPY took the lead of the rebound, but the dollar also gained ground against the euro. This pattern more or less continued yesterday in the US. USD/JPY settled in the 102.50/70 area. EUR/USD dropped below the 1.38 mark yesterday.

Overnight, Asian equities are mostly in negative territory with China underperforming ahead of the China PMI tomorrow. The decline of the Asian/Japanese equities this morning is slowing the rebound of USD/JPY. At the same time EUR/USD is holding stable near the 1.38 big figure.

Today, there are few eco data on the calendar in Europe. Consumer confidence from the European Commission is the exception to the rule. A slight improvement is expected. We don’t expect this report to change the picture in EUR/USD in a profound way. In the US, the Richmond Fed and the existing homes sales are probably also only of intraday importance for USD trading. A good/better than expected Richmond Fed might be slightly supportive for the dollar.

Later this week, the calendar is moderately interesting. Currency traders will keep an eye at the EMU PMI’s. They will also continue to look out from comments from ECB Governors on (to low) inflation and on the valuation of the euro. Draghi is scheduled to speak on Thursday. If he says something on the issue, the market will take his hints into account. For USD/JPY, the performance of the equity markets is probably the most important driver short-term. After five consecutive trading days with a higher close in the S&P, the up-move might gradually run into resistance.

Of late, we advocated that it will be difficult for EUR/USD to rally sustainably beyond 1.40. This working hypothesis came under stress, but is still valid. The 1.3906/67 area looks like a tough resistance. To be honest, the negative impact of Ukraine on the euro was limited. Caution remains warranted, but a guarded sell-on-upticks strategy can be reconsidered. USD/JPY is off the recent low. For sustained further gains of the dollar (both against the euro and the yen), the US currency needs more interest rate support. In this respect, the recent core bond market movements weren’t dollar supportive. However, at the end of last week, there were cautious indications of US bond yields bottoming out.

Sterling remains well bid

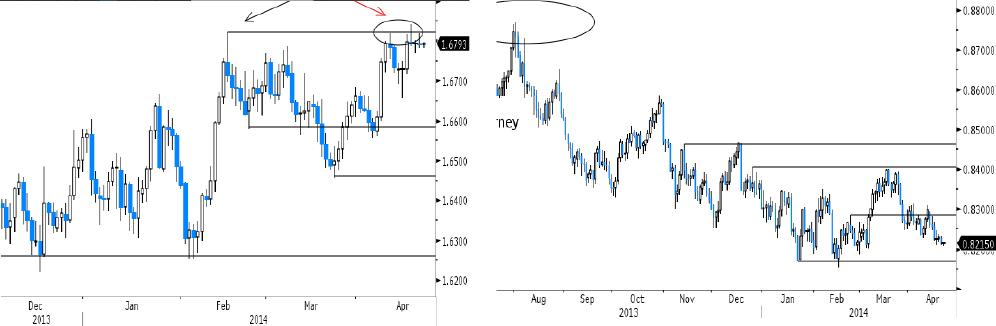

At the end of last week, sterling remained well bid after a good labour market report. Surprisingly, the euro was on the defensive, even as tensions on Ukraine (temporary?) faded. EUR/GBP settled in the lower half of the 0.8200 big figure. Cable held with reach of the recent top in the 1.68 area. The pattern of moderate downward pressure on the euro and cable holding stable continued yesterday in thin US trading.

Later today, there are no data on the agenda in the UK. In EMU, only consumer confidence might have some intra-day impact on the single currency, but the report is no game-changer. At the start of the session, the euro looks again on the defensive. So, for now, the recent gradual uptrend of sterling against the euro might stay in place. Cable resists the better bid for the dollar quite well and stays within reach of the 1.6842 top.

Of late, the technical picture in the major sterling cross rates was mixed. Cable recently rebounded off the 1.6460 low and the pair set a new minor cyclical top north of 1.6823. We maintain our view that a sustainable break the 1.6823/42 top won’t be easy. EUR/GBP was under (moderate) pressure at the end of last week and drifted lower in the 0.82 big figure. The sterling momentum is constructive, but a sustained break below the 0.8200/0.8157 support will be difficult without high profile news from the UK or Europe. We keep a sell-on-upticks bias for EUR/GBP.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD struggles to find direction, holds near 1.2550

GBP/USD stays under modest bearish pressure and trades near 1.2550 on Tuesday. The neutral risk mood, as reflected by the mixed action seen in US stocks, doesn't allow the pair to make a decisive move in either direction. The Bank of England will announce policy decisions on Thursday.

Gold rebounds to $2,320 as US yields edge lower

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.