Dollar regains cautiously ground

On Monday, rising tensions in Ukraine and ECB talk on further easing were a negative for the euro. At the same time, strong US retail sales were a positive for the dollar. The dollar gained some ground against the euro and the yen but the gains were fairly limited after all.

Overnight, US equities closed the session in positive territory, but sentiment remains fragile. Most Asian equity indices are in the red this morning. The (sluggish) rebound of the dollar keeps Japanese equities in positive territory. USD/JPY is hovering in a tight range just below 102. EUR/USD is also drifting sideways, just north of the 1.38 level. Core bond yields are off yesterday’s low and this is slightly supportive for the dollar.

Today, the calendar is interesting. In Europe, ZEW investor confidence is expected marginally higher at 51.5. We don’t expect a big impact of this indicator on the major USD cross rates. In the US, the empire manufacturing index, the CPI, the TIC capital flow data and the NAHB housing index will be published. Inflation is expected to rise from 1.4% Y/Y to 1.6% Y/Y. So, the issue of too low inflation for too long is far less of an issue in the US than in Europe. A higher than expected figure can be marginally supportive for the dollar.

However, activity data are probably more important at this stage. The Empire manufacturing and the NAHB housing index are both expected stronger in April. Improving activity data should be a positive for the dollar as the Fed is debating the timing of a first rate hike somewhere in the middle of next year. In this respect, we also keep an eye at the comments from several Fed governors who speak today. The news flow will probably be USD supportive today, but the guarded reaction of the dollar after the very strong US retail sales yesterday suggests that that further dollar gains are no done thing. On the euro side of the equation, the debate on more ECB easing and lingering uncertainty on Ukraine continue to cap the topside for the single currency.

Of late we advocated that it will be difficult for EUR/USD would have difficulties to rally sustainably beyond 1.40. This working hypothesis was under stress of late, but is still valid. In a short-term perspective, Friday’s EUR/USD chart shows a doji-like pattern. The 1.3906/67 area looks like a tough resistance. Caution remains warranted, but a guarded sell-on-upticks strategy can be reconsidered. USD/JPY is off the recent lows, but for this cross rate the picture remains even more fragile as long as global equities don’t find a more solid bottom.

EUR/GBP rebound running into resistance?

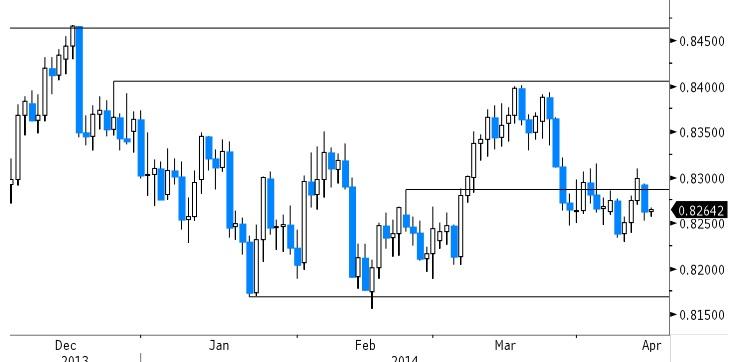

On Monday, non-UK factors drove trading in cable and EUR/GBP. The broader decline of the euro weighed also on EUR/GBP. However, as was the case for EUR/USD, the losses were subdued to moderate. EUR/GBP gradually drifted from the 0.8280 area to the 0.8255 area to close to session at 0.8262. Cable was initially under pressure, also due to the overall rebound of the dollar. The pair filled bids in the 1.67 area after the US retail sales. However, cable is much more resilient than EUR/USD and reversed the post-retail sales losses soon.

Overnight, the like-for-like BRC retails were much weaker than expected in march at -1.7% Y/Y. However, the drop in sales is probably due to an unfavorable Y/Y comparison due to the late timing of Easter. There is hardly any reaction in the major sterling crosses.

Today, the March UK PPI and CPI data will be published. A moderate decline in from 1.7% Y/Y to 1.6%Y/Y is expected, for both the headline and the core CPI. A (temporary) decline of inflation gives the BoE some breathing space in the process of preparing markets for less policy stimulation. However, if UK activity data remain strong, markets will probably look through a (temporary) decline of the inflation. So, we don’t expect today’s price data to change the broader (constructive) picture for sterling. Lingering uncertainty on Ukraine and the threat of more verbal ECB interventions will cap the topside of EUR/GBP.

Of late, the technical picture in the major sterling cross rates was mixed. Cable recently rebounded off the 1.6460 low and the 1.6823 cyclical top was almost reached last week. For now, this proves a too high hurdle, even as the dollar remains fragile across the board. We maintain our view that the top won’t be easy to break in a sustainable way, but broad dollar weakness might spoil the game. EUR/GBP drifted to the 0.8230 area early last week, but a real test of the 0.8200/0.8157 support area didn’t occur. The sterling momentum is constructive, but a break will probably be difficult as long as the euro remains well bid across the board. We keep a sell-on-upticks bias for EUR/GBP.

This non-exhaustive information is based on short-term forecasts for expected developments on the financial markets. KBC Bank cannot guarantee that these forecasts will materialize and cannot be held liable in any way for direct or consequential loss arising from any use of this document or its content. The document is not intended as personalized investment advice and does not constitute a recommendation to buy, sell or hold investments described herein. Although information has been obtained from and is based upon sources KBC believes to be reliable, KBC does not guarantee the accuracy of this information, which may be incomplete or condensed. All opinions and estimates constitute a KBC judgment as of the data of the report and are subject to change without notice.

Recommended Content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.