Strategy trade idea: Bullish September T-bond option spread

Treasuries have a history of comebacks

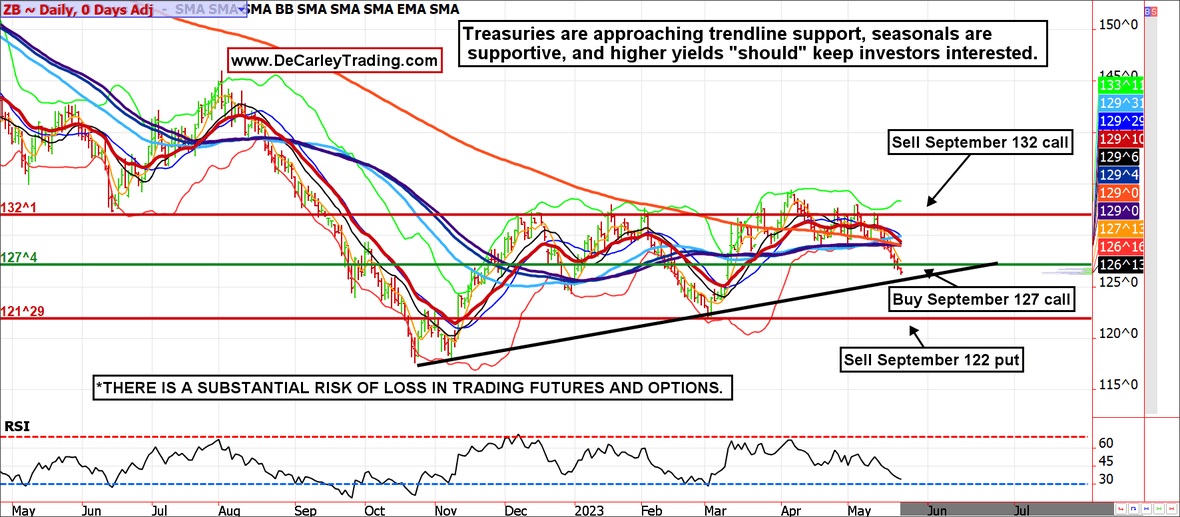

2022 was the worst year for Treasury investors since the late 1800s. Thus far, 2023 has been slightly better, but prices have yet to recover meaningfully. Debt default talks and higher stocks are keeping bond bulls on their back foot, but with trendline support coming into play and bullish seasonality, it seems like an opportune time to try to play the upside. After all, US yields are attractive relative to overseas securities with a lower inflation rate and lower default risk (hopefully). All of these things should keep the market from melting down.

We like using a bull call spread with a naked put in the September options. This allows traders to participate in the upside while leaving several points in breathing room on the downside. However, it does come with unlimited downside risk.

Alternative strategy

If you are looking for limited risk, the 127/132 vertical call spread can be bought for about $1500 (that represents the maximum risk before transaction costs). Another idea would be to buy the 10-year note 116 call for a little over $1,000. If you prefer futures, you could sell the Micro 10-year note (symbol 10Y) which trades in yield rather than price, or even buy the full-sized 10-year note future.

Bullish September 30-year bond spread

Buy September ZB 127 call.

Sell September ZB 132 call.

Sell September ZB 122 put.

Cost = This spread costs about 13 ticks or $203 plus transaction costs.

Margin = $3940.

Risk = Unlimited below 122.

Maximum Profit = $4,750, if held to expiration and the 30-year bond is above 132. However, a worthy profit target would be about $2,000/$2,500 in the coming months as opposed to holding all the way to expiration.

Expiration = August 25th.

DTE = 94.

Zaner360 symbols:

OZBU23 C127, OZBU23 C132, AND OZBU23 P122.

Author

Carley Garner

DeCarley Trading

Carley Garner is an experienced commodity broker with DeCarley Trading, a division of Zaner, in Las Vegas, Nevada. She is also the author of multiple books including, “Higher Probability Commodity Trading” and “A Trader's First Book on Commodities”.