Outlook:

No sooner did we get comments from Feds about falling inflation expectations (Bullard) than we got rising inflation itself. The US has now delivered higher growth than the eurozone as well as higher inflation. In fact, the inflation comparison is sobering. The Feb flash core CPI for the eurozone is 0.7% and for the US, a full percentage point higher, (core PCE prices up 1.7%).

We get a triple whammy this Friday on payrolls. Forecast have to include job losses from the energy sector and so the forecast range is wider than usual—130,000 to 190,000. But never mind. Unemployment is under 5% in the US, at least officially, while it’s double that in the eurozone. In which economy would you prefer to invest?

Sadly, tomorrow is Super Tuesday. Twelve states (and a territory), mostly in the South, run their primaries and the probability is high that the buffoon Trump will win them all and emerge as the Republican candidate. According to the NYT, the European press is having a field day denigrating the brainpower of the American voting public, and quite rightly. After all, the far end of the tail, where the ignorant and the bigots live, is a fat tail in the US. Every country has its ignoramus lout tail, but the US has 330 million people, so ours is simply bigger. And they are all, seemingly, voting.

But before judging the US (or the dollar) on political criteria, remember that the US also has a robust and resilient economic and political system. The president, even if it’s Trump, is not a dictator who can override the Constitution. Besides, at this point the Republican party—the party of Lincoln--would rather lose the election than be represented by Trump. And it’s early days, Super Tuesday or not. The main event is the convention in July in Cleveland. In any case, it’s not clear that those seeking yield give much weight to political matters, especially when the underlying system is good—and performing relatively well.

Besides, Europe has its own issues and they are deeper. Brexit looms. The ECB’s policy meeting on March 10 looms. And an interesting development is a new book by former BoE Gov Mervyn King, The End of Alchemy: Money, Banking and the Future of the Global Economy. Amazon will release it on March 21 but it is already being excerpted in The Telegraph. It looks like a real barn burner. King says, among other things, that the eurozone is doomed. The eurozone needs a fiscal union but will not be able to forge one, so that the future holds endless bailouts. The push by elites to form a transfer union is sowing “the seeds of division” and creating support for populist parties. “Further steps towards political union, where countries are forced to cede sovereignty and yield to Brussels diktats, could spark a public backlash.”

It will lead to not only an economic but [also] a political crisis. Monetary union has created a conflict between a centralised elite on the one hand, and the forces of democracy at the national level on the other. This is extraordinarily dangerous.” Golly, this is precisely what Bernard Connolly said in The Rotten Heart of Europe—in 1995.

The fallback in yields this morning notwithstanding, we can hope that the Fed will become sturdier on its pins. Most recently we had a comment from dove Brainard, a Board member, that the rising dollar has already delivered the equivalent of a rate rise of 0.75%. We’d like to see the underlying analysis for that. She also said spillovers from weaker foreign economies should make the Fed “very cautious” with its guidance on rates. This would make the policy path lower than expected. In other words, the Fed will heed weakness elsewhere and stay its hand for the good of the global economy.

Greenspan must be boiling mad. This is not what he would have thought or practiced, and at a guess, even Vice Chairman Fischer, who is most involved in the matter of “spillovers,” would say that the Fed has to do what its mandate calls for and not what is good for Germany or Japan. The question now is how much courage the Feds have. We get San Francisco Fed Williams on Wednesday. The regional Feds can say whatever they like without consulting the Board. We might get an interesting back-and-forth.

It’s a big data week, starting with the Chicago PMI this morning, the PMI manufacturing index tomorrow plus ISM and construction spending. Wednesday brings ADP and oil inventories. Thursday brings factory orders and ISM services. And Friday is payrolls.

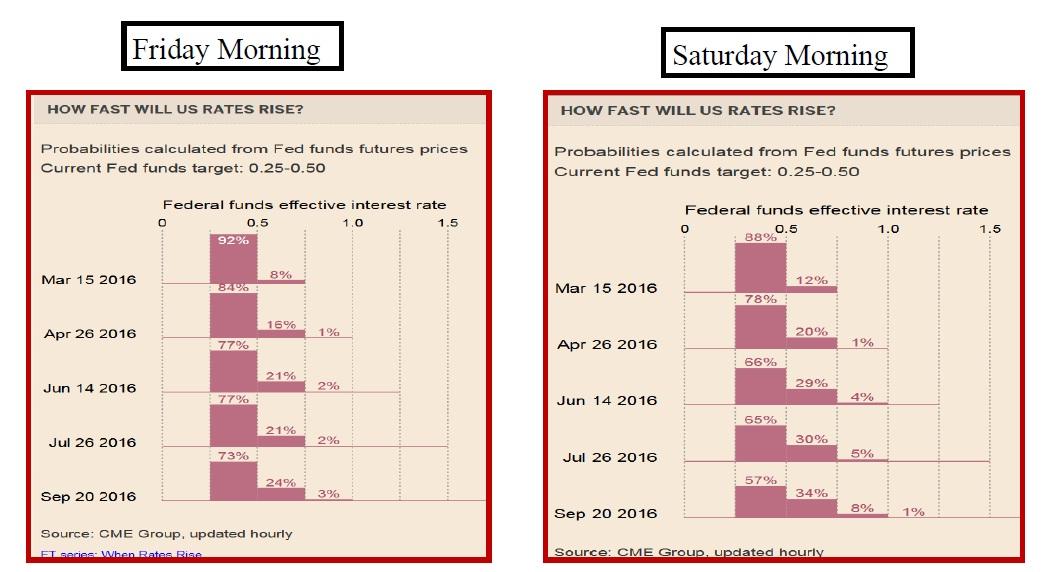

At a guess, it will take really awful data to halt the dollar‘s momentum now. See the Fed funds futures charts from the FT on the next page. Fed funds are a bad forecaster but we have to watch it, anyway.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 112.94 | SHORT USD | WEAK | 02/04/16 | 117.57 | 3.94% |

| GBP/USD | 1.3851 | SHORT GBP | STRONG | 02/17/16 | 1.4349 | 3.47% |

| EUR/USD | 1.0898 | SHORT EURO | STRONG | 02/23/16 | 1.1011 | 1.03% |

| EUR/JPY | 123.08 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 2.46% |

| EUR/GBP | 0.7867 | LONG EURO | STRONG | 10/23/15 | 0.7194 | 9.36% |

| USD/CHF | 1.0009 | SHORT USD | STRONG | 01/04/16 | 0.9979 | -0.30% |

| USD/CAD | 1.3569 | SHORT USD | WEAK | 02/01/16 | 1.4031 | 3.29% |

| AUD/USD | 0.6606 | LONG AUD | WEAK | 01/25/16 | 0.6980 | -5.36% |

| AUD/JPY | 80.71 | SHORT AUD | WEAK | 02/11/16 | 78.47 | -2.85% |

| USD/MXN | 18.2520 | SHORT USD | WEAK | 02/23/16 | 16.1208 | -0.72% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD drops toward 0.6500 after dismal Aussie Retail Sales, mixed China's PMIs

AUD/USD is extending losses toward 0.6500, hit by an unexpected drop in the Australian Retail Sales for March while China's NBS April PMI data came in mixed. Upbeat China's Caixin Manufacturing PMI data failed to lift the Aussie Dollar amid a softer risk tone and the US Dollar rebound.

USD/JPY holds rebound to 157.00 after Monday's suspected intervention-led crash

USD/JPY is trading close to 157.00, staging a solid rebound in the Asian session on Tuesday. The pair reverses a part of heavy losses incurred on Monday after the Japanese Yen rallied hard on probable FX market intervention by Japan's authorities. Poor Japan's jobs and Retail Sales data weigh on the Yen.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

BNB price risks a 10% drop as Binance founder and ex-CEO Changpeng Zhao eyes Tuesday sentencing

Binance Coin price is dumping, with the one-day chart showing a defined downtrend. While the broader market continues to bleed, things could get worse for BNB price ahead of Binance executive Changpeng Zhao sentencing on Tuesday, April 30.

FX market still on intervention watch

Asian foreign exchange traders will be particularly attentive to any signs of Japanese intervention on Tuesday, following reports of Tokyo's involvement in the market on Monday. This intervention action propelled the yen upward from its 34-year low of 160 per dollar, setting off shockwaves of volatility.