Outlook:

Some of the corrective action we are seeing in the foreign exchange market may be due to traders dumping positons ahead of the month-end and perhaps also just in case G-20 does come up with something original. The G-20 meeting that began today in Shanghai is getting more attention than usual. The IMF and IFF have been out in force insisting “somebody should do something” about what could become a deflationary recession. Never mind that it’s a free market driving down the price of oil, an overhang of nonperforming loans driving down European bank stocks, and a partly free market driving capital out of China.

The IMF said “What to do about the increasing risks to the recovery is perhaps the single most important question before the finance chiefs in Shanghai. The G-20 must plan now and proactively identify policies that could be rolled out quickly, if downside risks materialize.” The IMF wants G-20 to devise a plan that will “coordinate demand support, using available fiscal space to boost public investment and complement structural reform.”

Oh, dear. This is not how governments work, having an emergency plan ready within “fiscal space” that is ready to go at a moment’s notice.

Exactly what plans would they be? The policies could include cutting tax rates, additional central bank stimulus, throwing money out of helicopters, maybe subsidizing various things (houses? Cars? College educations?), and big infrastructure projects. Some countries may be able to initiate such policy changes on a dime, but the US, for one, couldn’t implement a single one of them, nor could the UK or Germany, just to name a few. Most stimulative measures can’t be done at all under current legislative and budget conditions, let alone “be rolled out quickly.” And we thought Lagarde had grown into the job.

That pretty much leaves us with the only responsible party in the room that has some latitude—central banks. Overdependence on central banks is a given. We have been complaining about it for years. The most recent Economist magazine has a cover story titled “Running out of ammo?” Besides, TreasSec Lew denies there is a problem, or at least a problem of the magnitude that requires an emergency response. He said “markets should not expect a 'crisis response' in the absence of a crisis.”

That may sound flippant but Lew is right. We do not actually have a crisis. A problem, yes, but not a crisis. After all, major companies, banks and countries are not failing. Lehman was a crisis. Greece was a crisis. This time we just think the global slowdown could keep going and going and going until it stops altogether. Well, so what? Not to be snotty, but when the price of something falls to an extreme, at some point a vulture comes along and starts buying, setting off the rest of the crowd. This is true of oil, steel, government bonds, equities, beer and socks. In the process, some high-cost producers of oil, steel, beer and socks will go out of business. That opens up an opportunity for the low-cost producers to thrive and new producers to come on the scene, especially if they have some nice new technology that gives them an advantage.

What the Grand Poohbahs are saying is that they don’t like the process. They hate the idea of all those failures, not to mention the pace of natural recovery. It could be years! Well, yes. On the whole, recoveries do take years. This is not to say it wouldn’t be splendid to have tax reform and infrastructure spending in the US. We think those two items would do a pretty good job plumping up the US economy. The people supporting Trump think so, too. This raises the question of whether a properly designed stimulus program in the US would overcome the negative effects of a faltering China. Since China’s faltering is actually pretty mild in the grand scheme of things (6.5% is not “bad”), the answer is maybe yes. But this is not something that can come out of G-20. It can come out of a Congress.

You have to suspect the Grand Poobahs who want to change the way the financial markets work don’t actually know how financial markets work. They fail to see how many moving parts there are and how they fit together. The term ‘unintended consequences” might have been designed just for the folks who think they are qualified to re-design the financial system from the top down.

The NYT writes the financial world wants Plan B. “China, the world’s leading engine of economic growth in recent years, is struggling with heavy debts, a slowdown in manufacturing, stagnant exports and a flood of money leaving its borders. Countries that depend on selling oil and other resources are struggling under persistently low prices. The United States is facing a drag on growth as the strong dollar makes it cheaper for many consumers and companies to import goods instead of buying them from American businesses.”

Since we have had commodity producers on the ropes before and a too-strong dollar, for that matter, that pretty much leaves China as the one thing that is different this time. G-20 wants China and everyone else to refrain from sizeable one-time devaluations, but aside from the usual commitments along those lines, exactly what G-20 is supposed to do is a mystery. One unnamed Treasury official said that “the United States would push… to call on countries with broadly measured surpluses on trade and royalties to stimulate domestic spending, particularly by consumers.” Royalties? Maybe the term is supposed to include Japan with its foreign earnings as well as China with its trade surplus. Golly, if only the BoJ and MoF had thought of stimulating the consumer sector.

The one place G-20 might come to an agreement is pushing China to get it over with and devalue. Europe can be encouraged to boost public spending and the US could offer short-term emergency credit lines. This is what “some investors” want G-20 to do, according to the WSJ. But “There is little indication the G-20 will put additional policies on the table. Instead, some are slimming down their targets.” Mexico and Brazil are each cutting infrastructure spending.

Besides, China denies it wants or needs a devaluation. PBOC Gov Zhou, delivering the keynote speech at G-20 this morning (in English), said “China won’t use competitive devaluation to enhance export competitiveness. Currently, China’s overall exports remain strong.” Besides, “There is no basis for persistent [yuan] depreciation from the perspective of economic fundamentals.” Recent moves in capital flows are “largely normal” and the key to stemming outflows is to maintain a “healthy development” of the domestic economy. Zhou admits communications could be better (which doesn’t explain a one-month silence from the PBOC). He said “…it is particularly important to stabilise the market expectation on the [renminbi’s] exchange rate…. “as long as our economic fundamentals are sound . . . market expectation[s] will become more rational.”

Overall leverage in the Chinese economy is “relatively high” and the government is keeping a close eye on it. But China has the tools to limit risk. Growth may be slower than in the past, but it is more sustainable now. “The fundamentals of the Chinese economy remain strong.”

Bottom line, G-20 may want a Chinese devaluation but can’t force China to do it. G-20 may want more fiscal stimulus in Europe but runs into the brick wall of the German balanced budget commitment. G-20 wants the US to offer emergency swap lines to emerging markets suffering from low commodity prices. It’s not clear US citizens should take the sovereign risk, but they didn’t know about the $900 billion in swap lines used during the 2008-09 crisis, either, so perhaps ignorance is bliss.

Whatever G-20 delivers or fails to deliver, we have real economic data to contend with. It looks like European inflation is falling back again, given the information so far from Spain and Germany. We get eurozone flash CPI on Monday, with the probability pretty high it will boost expectations of aggressive action by the ECB on March 10. That could kill the tiny euro corrective bounce in one fell swoop.

Before then, we get the US revision of GDP this morning. Q4 will likely be revised down from 0.7% to 0.4%, according to Market News, but might be considered offset by seemingly better outcomes in Q1, at least so far. The Atlanta Fed GDPNow index has a reading of 2.5% annualized in Q1. Maybe Q4 will look stale and irrelevant.

In addition, today we get Jan personal income and consumption, plus the core PCE deflator. This might be a tad higher at 1.5%, which seems paltry but would be the highest since Oct 2014. And as numerous studies have shown for several years now, core PCE consistently undercounts inflation.

It’s critical to note that Bullard’s switch from hawk to dove, based on falling inflation expectations, in not a cause for panic. The WSJ says the drop may be misleading because it’s driven by falling oil and gasoline prices. “…. contrary to theory, oil prices do affect long-term expectations. The daily correlation between oil prices and the market’s expected inflation rate in five to 10 years’ time is 30%,” according to JP Morgan analyst Feroli. It’s not random noise. “We are talking about a pretty strong relationship that can only be rationalized…with some very extreme (arguably bizarre) stories about what oil tells us about the 2020-25 inflation outlook.” We are going to take this Byzantine sentence as verification of our thesis that consumers and markets are misjudging inflation (yes, we do have inflation!) and the Fed is wrong to dismiss these price effects.

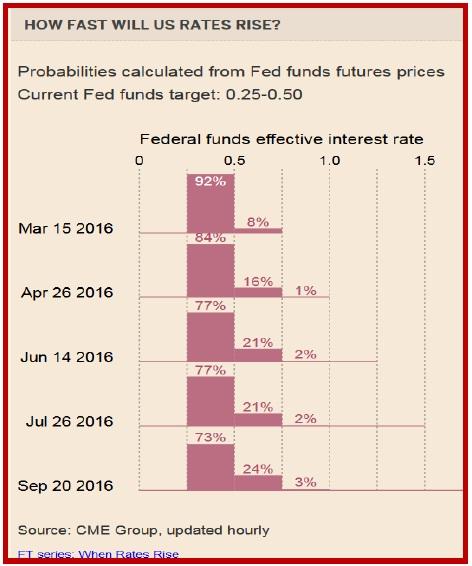

But the bond market is as stubborn as a mule. It is fixated on the idea the Fed is fearful and on hold indefinitely. See the FT’s Fed funds futures chart. Almost nobody expects we will get to 1% by September. What will it take to change these minds? At a guess, only a tirade from an important person like Yellen (“Yes! The US does have inflation! Look at this and this and this!”). But that’s not going to happen.

We imagine the dollar is going to resume its rise next week but not because anyone thinks the Fed is feeling activist, but rather because the rest of the world offers little but gloom.

| Current | Signal | Signal | Signal | |||

| Currency | Spot | Position | Strength | Date | Rate | Gain/Loss |

| USD/JPY | 113.08 | SHORT USD | WEAK | 02/04/16 | 117.57 | 3.82% |

| GBP/USD | 1.3995 | SHORT GBP | STRONG | 02/17/16 | 1.4349 | 2.47% |

| EUR/USD | 1.1014 | SHORT EURO | WEAK | 02/23/16 | 1.1011 | -0.03% |

| EUR/JPY | 124.54 | SHORT EURO | WEAK | 02/11/16 | 126.19 | 1.31% |

| EUR/GBP | 0.7869 | LONG EURO | WEAK | 10/23/15 | 0.7194 | 9.38% |

| USD/CHF | 0.9922 | SHORT USD | STRONG | 01/04/16 | 0.9979 | 0.57% |

| USD/CAD | 1.3521 | SHORT USD | WEAK | 02/01/16 | 1.4031 | 3.63% |

| NZD/USD | 0.6748 | LONG NZD | WEAK | 02/02/16 | 0.6486 | 4.04% |

| AUD/USD | 0.7213 | LONG AUD | STRONG | 01/25/16 | 0.6980 | 3.34% |

| AUD/JPY | 81.56 | SHORT AUD | WEAK | 02/11/16 | 78.47 | -3.94% |

| USD/MXN | 18.0812 | SHORT USD | WEAK | 02/23/16 | 16.1208 | 0.22% |

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD edges lower to near 1.0750 after hawkish remarks from a Fed official

EUR/USD extends its losses for the second successive session, trading around 1.0750 during the Asian session on Wednesday. The US Dollar gains ground due to the expectations of the Federal Reserve’s prolonging higher interest rates.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.