Outlook:

We get Q2 GDP at 8:30 am ET today. The Bloomberg consensus estimate is 2.5% while seekingalpha has 2.9%. A lot depends on the revision to Q1, originally reported as a negative but possibly +0.2% in today’s revision. The percentage gain is simple arithmetic—the higher Q1, the lower the Q2 gain in percentage terms. One thing everyone agrees on—it’s the consumer that is driving GDP, not industrial production or the business sector. Consumer spending is now about 70% of GDP and healthy consumer spending plus residential investment will be strong, offsetting the drag from the energy sector and trade. We also get revisions back to 2012 that will try to tame seasonal adjustments that could be at fault for the lousy first quarter results two years in a row.

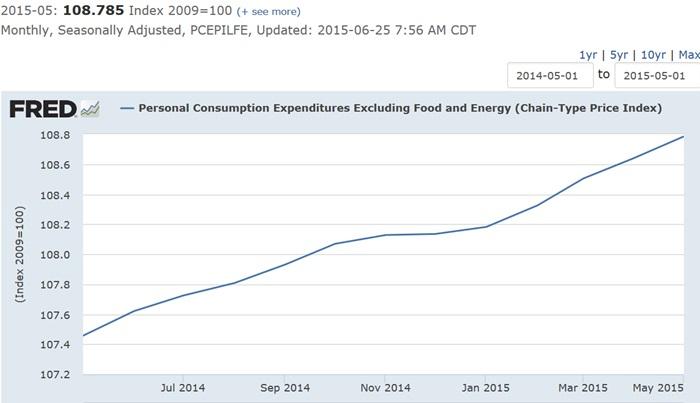

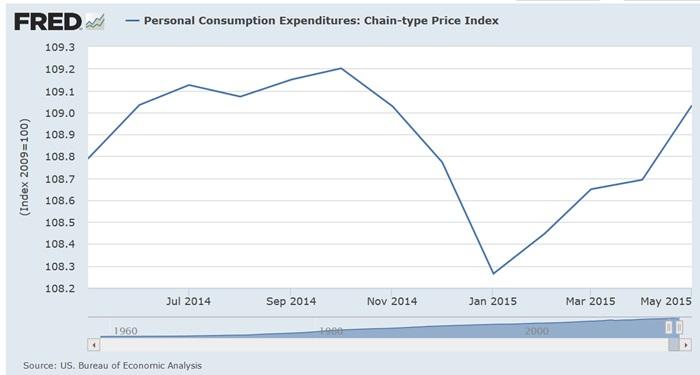

Finally, let’s not forget the core PCE deflator, which was 0.8% in Q1 and is expected substantially high-er for Q2 today. A quick look at the St. Louis Fed (FRED) chart is discouraging—it looks nothing like the CPI data (which points downward). A few weeks ago the Cleveland Fed reported its “median” CPI was up 2.3% y/y over the Jan-June period, when the Commerce Dept has 0.1% for the same period. Meanwhile, the Fed prefers the Commerce Dept’s personal consumption expenditures price index. That, too, shows a rise (second chart).

So which inflation measure is the most accurate? Well, it doesn’t really matter. The Fed has chosen PCE and we are stuck with it. To be fair, the Fed continues to say it is “reasonably certain” inflation will rise toward the 2% target. The problem is that the data is so messy, everyone pretty much gives up trying to name the inflation rate, abdicating responsibility to the Fed. Clearly the bond market is not worried about inflation. If it were, yields would be higher. Maybe the shock we need to worry about is not illiquidity, but a surprise jump in inflation that will suddenly put the Fed behind the curve. Just a thought.

GDP and revisions could give us some fodder for the FX market, although we mustn’t count on it. Over long periods of time, the country with the higher GDP gets a higher currency, but the correlation has a long lag and doesn’t always apply when other factors override. Besides, savvy folks see Friday’s Employment Cost Index and personal income as more direct and specific.

What about China? Periodically, stories about China dominate the headlines and lead markets. Think copper, or Monday’s 8% drop in the Shanghai. Late yesterday the FT published a story on the ripple effects of the Chinese equity market meltdown. Is that why oil prices fell this week? Here is a splendid perspective:

“This is overdone. China’s stock market performance has rarely had much, if any, correlation with the country’s real economy, let alone that of the rest of the world. Barely 20 years old and poorly regulated, the stock market still has more in common with the gambling casinos of Macau than with global ex-changes in western capitals such as New York, London or Tokyo. Nor are foreign investors much ex-posed to Chinese equities. Because of tight quotas, only a tiny proportion of China’s stock market — about 3 per cent — is owned by foreigners. That should make what is happening in China’s financial markets akin to an explosion in a far off cave.”

And only 7% of urban Chinese have money in the stock market. They are still in the money. “The mar-ket more than doubled in the 18 months before it peaked in mid-June. Only the latest of latecomers have seen their investments slide.” So what is the ripple effect? First is loss of confidence in Chinese technocrat governance. Intervention was badly done and didn’t work. This leads to doubts about the supposed trend toward more market mechanisms and less government control. Finally, some banks and brokers could be at risk of failing, which would impact growth. “If another point or two were shaved off growth, it could send very real tremors around the globe. Since 2008, China has been the motor of the world. The travails of its stock market add to evidence that this motor is spluttering.”

Hmm, this leads us to wonder which century we are in. The 20th century was “the American century” and the 21st century was, arguably, going to be “the Chinese century.” We always doubted that on the grounds that personal liberty is the proverbial cat out of the bag. The FT has a report from Beijing that defines the conflict perfectly: at today’s daily briefing, the China Securities Regulatory Commission warned the press that “We have a requirement concerning speculative reports. They must first be con-firmed by the CSRC in order to prevent the spread of false information and market disturbance.” The FT says “The warning was a reminder that as a ‘national team’ comprised of largely state-owned entities struggles to shore up China’s stock market, the government is orchestrating an equally important cheer-leading campaign involving a broad array of state media outlets.”

In the classic commie manner, the CSRC speaks of “capitalist roaders and other bad elements” maliciously seeking to “dump” shares. A UK academic told the FT “The political system in place in China is still essentially Leninist in its structure, organisation, thinking and instincts. The stock market is required to serve the people and the party and the party alone represents the people. So if the market goes the wrong way or ‘misbehaves’, it is unpatriotic and should be corrected. Anyone who drives or helps the market ‘misbehave’ is a traitor.”

Yikes! Speculation is good only when it drives prices up. When it drives prices down, it’s unpatriotic. This is not the Chinese century. It’s your grandfather’s communism.

We see the dollar continuing on a ragged uptrend today, but watch out for position-paring tomorrow.

Note to Readers: We will not publish any reports the week of Aug 3-7. Cape Cod beckons.

This morning FX briefing is an information service, not a trading system. All trade recommendations are included in the afternoon report.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.